Costs, carbon footprint, and environmental impacts of lithium

Jan 1, 2024 · Strong growth in lithium-ion battery (LIB) demand requires a robust understanding of both costs and environmental impacts across the value-chain. Recent announcements of LIB

Lithium Ion Battery Market is Slated to be Worth

Mar 1, 2023 · The lithium ion battery market size is projected to surpass around USD 307.8 billion by 2032 and it is poised to reach at a CAGR of 18.3% from

Lithium Ion Battery Market is Slated to be Worth

Mar 1, 2023 · Pune, Feb. 28, 2023 (GLOBE NEWSWIRE) -- The global lithium ion battery market size was valued at US$ 59.8 Billion in 2022 and is projected to

Advancements and challenges in lithium-ion and lithium

Apr 25, 2025 · Lithium-ion (LI) and lithium-polymer (LiPo) batteries are pivotal in modern energy storage, offering high energy density, adaptability, and reliability. This manuscript explores the

China Already Makes as Many Batteries as the Entire World

Apr 19, 2024 · BloombergNEF estimates that lithium-ion battery demand across EVs and stationary storage came in at around 950 gigawatt hours last year. Global battery

Global Lithium-Ion (Li-ion) Batteries Market to Reach $92.3 Billion

Oct 13, 2022 · - In the changed post COVID-19 business landscape, the global market for Lithium-Ion (Li-ion) Batteries estimated at US$38.6 Billion in the year 2020, is projected to reach a

A critical discussion of the current availability of lithium and

May 14, 2024 · Aqueous zinc batteries are currently being explored as potential alternatives to non-aqueous lithium-ion batteries. In this comment, the authors highlight zinc''s global supply

Global Lithium-ion Battery Market Report 2021: A $34.1

May 6, 2021 · The global lithium-ion battery market reached a value of US$ 34.1 Billion in 2020. Looking forward, the global lithium-ion battery market to exhibit strong growth during the next

E-bike Battery Pack Market is Expected to Reach a Valuation

Mar 24, 2022 · E-bike Battery Pack Market is Expected to Reach a Valuation of USD 18.3 Billion by 2030: Straits Research A Rise in Demand for Eco-Friendly E-Bikes to Expand the E-bike

Energy consumption of current and future production of lithium

Sep 28, 2023 · New research by Florian Degen and colleagues evaluates the energy consumption of current and future production of lithium-ion and post-lithium-ion batteries.

Battery Pack Assembly Line Market Research Report 2033

According to our latest research, the global Battery Pack Assembly Line market size reached USD 5.8 billion in 2024, with a robust CAGR of 8.2% recorded over the past year.

Lifetime and Aging Degradation Prognostics for Lithium-ion Battery

Jan 9, 2022 · 1 Introduction Lithium-ion batteries have been widely used as energy storage systems in electric areas, such as electrified transportation, smart grids, and consumer

Advanced Li-ion Batteries 2025-2035: Technologies, Players

Mar 31, 2006 · This report covers and analyzes many of the key technological advancements in advanced and next-generation Li-ion batteries, including silicon and lithium-metal anodes,

China Has Perfectly Tangled The Battery Value

Aug 17, 2023 · In doing so, they will invest $3.5 billion in an electric vehicle battery plant in Michigan with a first focus on licensing but later doing the

The status quo and future trends of new energy vehicle power batteries

Nov 1, 2022 · According to incomplete statistics, its proportion can reach 35%. From the global development of NEVs, the cathode material of the battery mainly includes lead–acid batteries,

Towards the lithium-ion battery production network:

Jul 1, 2022 · To remedy this, we deploy a global production network (GPN) approach that highlights the increasing intersection of battery manufacturing with the automotive and power

6 FAQs about [5 8 billion lithium batteries and packs]

Which country has the best lithium-ion battery supply chain?

Canada has overtaken China for the top spot in BloombergNEF’s (BNEF’s) Global Lithium-Ion Battery Supply Chain Ranking, an annual assessment that rates 30 countries on their potential to build a secure, reliable, and sustainable lithium-ion battery supply chain. This marks the first time China has not claimed the number one position.

What is the global lithium-ion battery supply chain ranking?

Now in its fourth edition, the Global Lithium-Ion Battery Supply Chain Ranking considers 46 individual metrics to track the supply chain potential across five equally weighted categories: raw materials, battery manufacturing, downstream demand, ESG considerations, and ‘industry, infrastructure and innovation’.

Why is lithium-ion battery demand growing?

Strong growth in lithium-ion battery (LIB) demand requires a robust understanding of both costs and environmental impacts across the value-chain. Recent announcements of LIB manufacturers to venture into cathode active material (CAM) synthesis and recycling expands the process segments under their influence.

Does China have a battery market in 2023?

China’s battery production in 2023 alone was similar to global demand. The US is not alone in trying to increase its share of the global battery market. Canada is matching US incentives, while Europe, India and others also are awarding subsidies to grow their battery industries.

How big is lithium-ion battery demand in 2021?

Demand for high capacity lithium-ion batteries (LIBs), used in stationary storage systems as part of energy systems [1, 2] and battery electric vehicles (BEVs), reached 340 GWh in 2021 . Estimates see annual LIB demand grow to between 1200 and 3500 GWh by 2030 [3, 4].

What content should a battery pack have?

Originating battery packs must have either 65% UK/EU content for the cell or 70% for the battery pack . See Re|Source, a pilot blockchain solution for end-to-end cobalt traceability involving China Molybdenum Co (CMOC), Eurasian Resources Group (ERG), Glencore, Umicore and Tesla.

Learn More

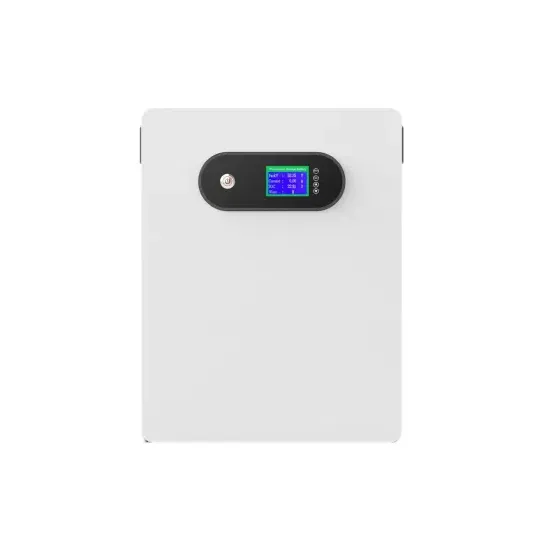

- Lithium batteries are divided into cells and battery packs

- Production of energy storage lithium batteries

- Can lithium battery packs be checked in

- BMS for lithium batteries

- Are all Singapore lithium batteries cylindrical

- What are the lithium batteries for photovoltaic energy storage

- How to choose lithium batteries for power tools

- 42 lithium battery packs in 14 strings

- Are large cylindrical lithium batteries durable

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.