Japan Uninterruptible Power Supply Market Databank

The Japan Uninterruptible Power Supply market was valued at $134.2 Million in 2020, and is projected to reach $260.4 Million by 2029 growing at a CAGR of 7.69% from 2021 to 2029.

Japan Uninterrupted Power Supply (UPS) Market 2033

Japan uninterrupted power supply (UPS) market size reached USD 494.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 658.9 Million by 2033, exhibiting a

Japan Uninterrupted Power Supply (UPS) Market Growth

Jan 10, 2025 · The Uninterruptible Power Supply (UPS) market in Japan is experiencing significant growth, fueled by the rising demand for dependable and uninterrupted power

Japan Uninterruptible Power Supply (UPS) Market | Size 2031

The Japan Uninterruptible Power Supply (UPS) Market report thoroughly covers the market by KVA rating, phases, and applications. The report provides an unbiased and detailed analysis

Uninterruptible USB Power Supply Kit, Solar Power, 4W Load Tokyo

IW1205K is a power supply kit that can supply USB power 24 hours a day, 365 days a year by combining a solar panel and storage battery. Compatible with single board computers such as

Total Concept Sales, Inc. | Critical Power Specialists

Contact Total Concept Sales, Inc. for a quote on Uninterruptible Power Supply or Generator Installation, as well as emergency lighting systems, preventative maintenance services, and

Japan Uninterrupted Power Supplies (UPS) Market Overview,

Apr 30, 2024 · Line-interactive and online marine-grade UPS systems ensure uninterrupted operations of critical navigation and communication equipment onboard ships, even during

Tokyo imported UPS uninterruptible power supply price

Next-Gen Photovoltaic Modules Engineered for superior efficiency, our photovoltaic modules integrate cutting-edge solar cell technology and anti-reflective coatings to deliver maximum

Japan Data Center Uninterruptable Power Supply Market

4 days ago · Japan Data Center Uninterruptable Power Supply (UPS) market size was valued at USD 256.92 million in 2023 and is anticipated to reach USD 396.74 million by 2032, at a

[Tokyo Metropolitan Police Department] Purchase Uninterruptible Power

Japan government tender for [Tokyo Metropolitan Police Department] Purchase Uninterruptible Power Supply 2, TOT Ref No: 124130659, Tender Ref No: -, Deadline: 22nd Aug 2025,

Where to Find Uninterruptible Power Supply in Tokyo A

May 20, 2025 · Tokyo, a bustling hub of technology and commerce, faces frequent power fluctuations due to its dense infrastructure and extreme weather conditions. Whether you''re

only sale 2.50 usd for Battery Backup Uninterruptible Power Supply (UPS

Aug 22, 2024 · only sale 2.50 usd for Battery Backup Uninterruptible Power Supply (UPS) And Power Conditioner For Tokyo Rikakikai - EYELA CA-3310 (S) Rotary Evaporator / Lyophilizer

Uninterruptible Power Supply (UPS) Market Outlook: France

Jul 17, 2025 · Overall, the Uninterruptible Power Supply (UPS) Market outlook remains highly promising, with long-term opportunities for players prioritizing strategic innovation and global

Online Uninterruptible Power Supply (Ups) System Sales

May 19, 2025 · Online Uninterruptible Power Supply (UPS) System Sales Market Size was valued at 8.29 (USD Billion) in 2024.The Online Uninterruptible Power Supply (UPS) System Sales

6 FAQs about [Tokyo Uninterruptible Power Supply Sales]

What is Japan uninterrupted power supply (UPS) market?

The Japan Uninterrupted Power Supply (UPS) Market is Segmented by Capacity (Less than 10 kVA, 10-100 kVA, and 101-250 kVA), Type (Standby UPS System, Online UPS System, and Line-interactive UPS System), and Application (Data Centers, Telecommunications, Healthcare, Industrial, and Other Application Types).

Who are the major players in the Japanese uninterrupted power supply market?

The Japanese Uninterrupted Power Supply (UPS) market is fragmented. Some of the major players (in no particular order) include Fuji Electric Co. Ltd, Toshiba Corporation, Mitsubishi Corporation, Schneider Electric SE, and Sanyo Denki Co. Ltd. Need More Details on Market Players and Competitors?

What are the different types of ups in Japan?

The Japan UPS market can be segmented based on: Type: Offline/Standby UPS, Line-Interactive UPS, Online/Double Conversion UPS. Power Rating: Low Power (Less than 5 kVA), Medium Power (5 kVA to 20 kVA), High Power (Above 20 kVA). End-User: Data Centers, Healthcare, Manufacturing, Commercial, Residential, Others.

What is an uninterrupted power supply (UPS)?

Uninterrupted Power Supply, commonly known as UPS, is an electrical apparatus that provides emergency power to critical devices or systems during power outages. It acts as a safeguard against data loss, equipment damage, and operational downtime, making it an indispensable tool for various industries and applications. Executive Summary

How competitive is the UPS market in Japan?

Competitive Landscape The UPS market in Japan is highly competitive, with several domestic and international players vying for market share. Key players such as Mitsubishi Electric Corporation, Panasonic Corporation, and Schneider Electric SE dominate the market with their diverse product portfolios and extensive distribution networks.

Why is ups so popular in Japan?

Data Center Expansion: The exponential growth of data centers in Japan, catering to the rising demand for cloud computing and big data analytics, has substantially boosted the demand for UPS solutions.

Learn More

- Uninterruptible power supply sales in Malabo

- St Johns high power ups uninterruptible power supply sales

- Sierra Leone computer room UPS uninterruptible power supply sales

- Uninterruptible Power Supply Sales in Africa

- Uninterruptible Power Supply Sales in Dubai

- Nanya UPS uninterruptible power supply sales price

- Uninterruptible power supply sales price in Belgium

- Uninterruptible power supply sales in Osaka Japan

- Naypyidaw Medical Uninterruptible Power Supply Sales

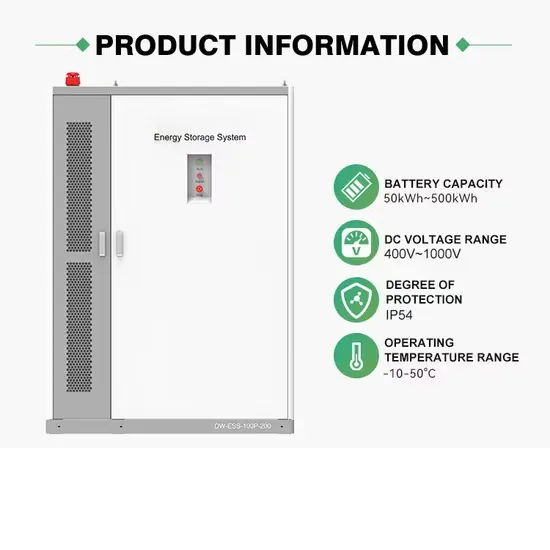

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.