Japan Modular Uninterruptible Power Supply Market By

Sep 27, 2024 · The Japan modular uninterruptible power supply (UPS) market is characterized by several key types, each catering to different operational needs and scalability requirements.

Uninterruptible Power Supply (UPS) Market Outlook: France

Jul 17, 2025 · Japan Uninterruptible Power Supply (UPS) Market Geographic Snapshot: Tokyo, Osaka, and Nagoya are the key economic zones, with significant investment in smart cities,

Japan Uninterrupted Power Supply (UPS) Market Growth

Jan 10, 2025 · The Uninterruptible Power Supply (UPS) market in Japan is experiencing significant growth, fueled by the rising demand for dependable and uninterrupted power

Japan Uninterruptible Power Supply(UPS) for IDC(Internet

Jun 26, 2025 · Japan Uninterruptible Power Supply(UPS) for IDC(Internet Data Center) Market size was valued at USD 1.1 Billion in 2024 and is projected to reach USD 1.

Uninterruptible Power Supplies (UPS) Suppliers in Japan

Uninterruptible power supplies (UPS) are backup batteries that provide emergency power to electrical systems in case power becomes unavailable. They are connected between a power

Japan Uninterrupted Power Supply (UPS) Market 2033

Japan uninterrupted power supply (UPS) market size reached USD 494.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 658.9 Million by 2033, exhibiting a

Data Center UPS (Uninterruptible Power Supply) Market

Jul 21, 2025 · Japan''s Data Center UPS (Uninterruptible Power Supply) market thrives on its deep-rooted commitment to technological excellence, automation, and product innovation.

Japan Data Center Uninterruptible Power Supply (UPS)

Jul 20, 2025 · What drives the Data Center UPS System Market in Japan? Japan''s market growth is fueled by its role as a digital hub in East Asia, supported by major smart city projects and

Uninterruptible Power Supply Ups Suppliers from South

Apr 17, 2025 · Find Economical Suppliers of Uninterruptible Power Supply Ups: 122 Manufacturers in South Korea based on Export data till Apr-25: Pricing, Qty, Buyers & Contacts.

Osaka International Airport uninterruptible power supply

Osaka Civil Aviation Bureau Japan has Released a tender for Osaka International Airport uninterruptible power supply equipment maintenance work in Energy, Power and Electrical.

Osaka Real Estate & Homes for Sale

2 days ago · Osaka Real Estate & Homes for Sale. We provide information on Osaka real estate & homes prices and real estate investment. If you''re thinking of buying a Real Estate & Homes

Uninterruptible Power Supply Systems

An Uninterruptible Power Supply (UPS) is the best protection for all electrical systems that are sensitive to power cuts, micro-outages and other electrical disturbances that could affect or

【2024 Edition】Top Japanese Companies in Industrial

Oct 23, 2024 · What is Industrial Electrical Equipment?Industrial electrical equipment refers to a broad range of devices and systems used to generate, transmit, and control electrical power in

Uninterruptible power supply (UPS) market size in Japan

Jan 22, 2025 · The domestic shipment value of the uninterruptible power supply (UPS) market in Japan was estimated to be worth 86.8 billion Japanese yen in fiscal year 2022. UPS refers to

日本不斷電系統(UPS):市場佔有率分析、產業趨勢/統計

Jan 5, 2025 · 日本最大的兩個經濟叢集大東京和大大阪是線上消費和數位應用需求最活躍的地區,正在推動資料中心市場的發展。 總體而言,預計在預測期內,資料中心投資的增加將創造

Japan Lead-acid Battery Uninterruptible Power Supply

Jun 21, 2025 · The Japan Lead-acid Battery Uninterruptible Power Supply market is experiencing dynamic growth, driven by evolving consumer preferences, technological advancements, and

Japan Uninterruptible Power Supply (UPS) Market | Size 2031

The Japan Uninterruptible Power Supply (UPS) Market report thoroughly covers the market by KVA rating, phases, and applications. The report provides an unbiased and detailed analysis

Storage Batteries for Uninterruptible Power Supply System

Jun 26, 2025 · Ministry of Land,Infrastructure and Transport - Notice of Procurement (Goods & Services) Storage Batteries for Uninterruptible Power Supply System 10 sets Back to list

Uninterrupted Power Supply Suppliers from Japan

Jun 26, 2024 · Find Economical Suppliers of Uninterrupted Power Supply: 323 Manufacturers in Japan based on Export data till Jun-24: Pricing, Qty, Buyers & Contacts.

6 FAQs about [Uninterruptible power supply sales in Osaka Japan]

What is Japan uninterrupted power supply (UPS) market?

The Japan Uninterrupted Power Supply (UPS) Market is Segmented by Capacity (Less than 10 kVA, 10-100 kVA, and 101-250 kVA), Type (Standby UPS System, Online UPS System, and Line-interactive UPS System), and Application (Data Centers, Telecommunications, Healthcare, Industrial, and Other Application Types).

Who are the major players in the Japanese uninterrupted power supply market?

The Japanese Uninterrupted Power Supply (UPS) market is fragmented. Some of the major players (in no particular order) include Fuji Electric Co. Ltd, Toshiba Corporation, Mitsubishi Corporation, Schneider Electric SE, and Sanyo Denki Co. Ltd. Need More Details on Market Players and Competitors?

What is an uninterrupted power supply (UPS)?

Uninterrupted Power Supply, commonly known as UPS, is an electrical apparatus that provides emergency power to critical devices or systems during power outages. It acts as a safeguard against data loss, equipment damage, and operational downtime, making it an indispensable tool for various industries and applications. Executive Summary

What are the different types of ups in Japan?

The Japan UPS market can be segmented based on: Type: Offline/Standby UPS, Line-Interactive UPS, Online/Double Conversion UPS. Power Rating: Low Power (Less than 5 kVA), Medium Power (5 kVA to 20 kVA), High Power (Above 20 kVA). End-User: Data Centers, Healthcare, Manufacturing, Commercial, Residential, Others.

What is the UPS market in Japan?

The UPS market in Japan showcases a robust presence across major regions, including Tokyo, Osaka, and Yokohama. These metropolitan areas, being economic and technological hubs, witness high demand for UPS systems from various industries. Competitive Landscape

Why is ups so popular in Japan?

Data Center Expansion: The exponential growth of data centers in Japan, catering to the rising demand for cloud computing and big data analytics, has substantially boosted the demand for UPS solutions.

Learn More

- Price quotation for medical UPS uninterruptible power supply in Osaka Japan

- Japan Osaka 12v ups uninterruptible power supply

- Uninterruptible power supply sales in Romania

- Uninterruptible power supply sales price in Belgium

- Naypyidaw Medical Uninterruptible Power Supply Sales

- Tokyo Uninterruptible Power Supply Sales

- Uninterruptible power supply ups factory direct sales

- Costa Rica Uninterruptible Power Supply Sales Manufacturer

- Nanya UPS uninterruptible power supply sales price

Industrial & Commercial Energy Storage Market Growth

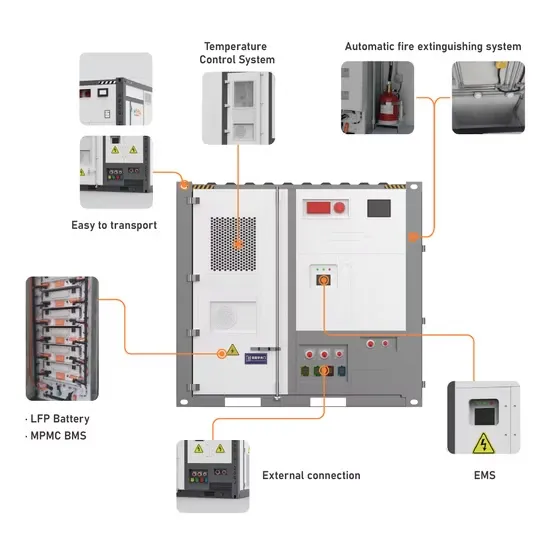

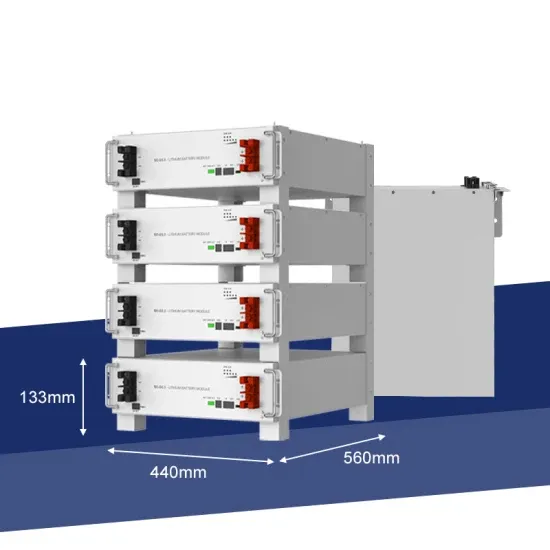

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.