Uninterruptible Power Supply (UPS) Market

The MT-UPS-1P-208V-6KVA-208V-R1-N1-M2 is an Industrial Uninterruptible Power Supply (UPS) for critical equipment and large facilities. This battery backup unit accepts single-phase 208V

Uninterruptible Power Supply Market Size, Forecast 2025

Based on distribution channel, the uninterruptible power supply market is segmented into direct sales and indirect sales. Indirect sales segment held around 60% of the market share and is

Malabo KCG UPS Power Continuity Solutions for Modern

Wondering how to maintain operational efficiency during power fluctuations? Discover how the Malabo KCG Uninterruptible Power Supply protects critical systems across industries while we

Uninterruptible Power Supply (UPS)

Nov 15, 2023 · This report profiles key players in the global Uninterruptible Power Supply (UPS) market based on the following parameters - company details (found date, headquarters,

Uninterruptible Power Supply (UPS), Load Shedding Solutions for sale

Shop online for Uninterruptible Power Supply (UPS) & Load Shedding Solutions, delivered anywhere in South Africa. We stock the best Uninterruptible Power Supply (UPS) at the lowest

Total Concept Sales, Inc. | Critical Power Specialists

Contact Total Concept Sales, Inc. for a quote on Uninterruptible Power Supply or Generator Installation, as well as emergency lighting systems, preventative maintenance services, and

Malabo UPS 10kW Reliable Power Backup for Industrial

In today''s energy-dependent world, the Malabo UPS 10kW uninterruptible power supply has emerged as a game-changer for businesses and facilities requiring stable backup power.

6 FAQs about [Uninterruptible power supply sales in Malabo]

How is the uninterruptible power supply market segmented?

Based on distribution channel, the uninterruptible power supply market is segmented into direct sales and indirect sales. Indirect sales segment held around 60% of the market share and is expected to grow at an approximate rate of 5% from 2025 to 2034.

What is the global uninterruptible power supply (UPS) market size?

The global uninterruptible power supply (UPS) market size was USD 12.70 Billion in 2023 and is likely to reach USD 25.30 Billion by 2032, expanding at a CAGR of 7.96 % during 2024–2032. The market growth is attributed to the rising advancement in battery technology and increasing digitalization.

How big is the uninterruptible power supply market in 2024?

The solution segment dominated with over 80% market share, generating around USD 9.5 billion in 2024. What is the market size of the uninterruptible power supply (UPS) market in 2024? The market was valued at USD 12.1 billion in 2024, with a projected CAGR of 5.6% from 2025 to 2034. What is the projected value of the UPS market by 2034?

Which region dominated the uninterruptible power supply market in 2022?

Regional Segment Analysis of the Uninterruptible Power Supply (UPS) Market Asia-Pacific dominated the market with more than xx% revenue share in 2022. Based on region, Asia-Pacific is the leader in the market with the highest revenue share in 2022.

Which country has the largest uninterruptible power supply market?

U.S. accounted for over 75% share in North America uninterruptible power supply market, generating revenue of USD 3.6 billion in 2024. The US has the biggest national market of UPS systems, which have been prompted by the presence of key technology firms and advanced data facility build-up.

What is an uninterruptible power supply (UPS)?

Market Overview an uninterruptible power supply (UPS) is an electrical device that provides backup power to connected equipment in the event of a power outage or voltage fluctuations. It acts as an intermediary between the main power source and the equipment, ensuring a continuous and stable power supply.

Learn More

- Malabo ups uninterruptible power supply

- Direct sales of UPS uninterruptible power supply

- Nanya UPS uninterruptible power supply sales price

- Naypyidaw Medical Uninterruptible Power Supply Sales

- Uninterruptible Power Supply Sales in Dubai

- Costa Rica Uninterruptible Power Supply Sales Manufacturer

- Uninterruptible power supply sales price in Belgium

- UPS5V Lithium-ion Uninterruptible Power Supply

- Avalo UPS Uninterruptible Power Supply Ranking

Industrial & Commercial Energy Storage Market Growth

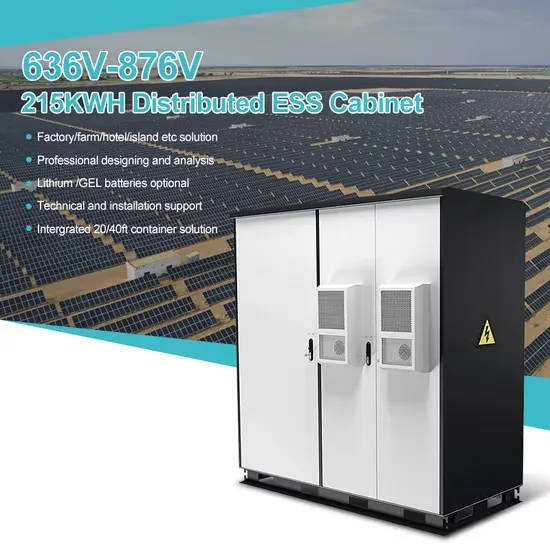

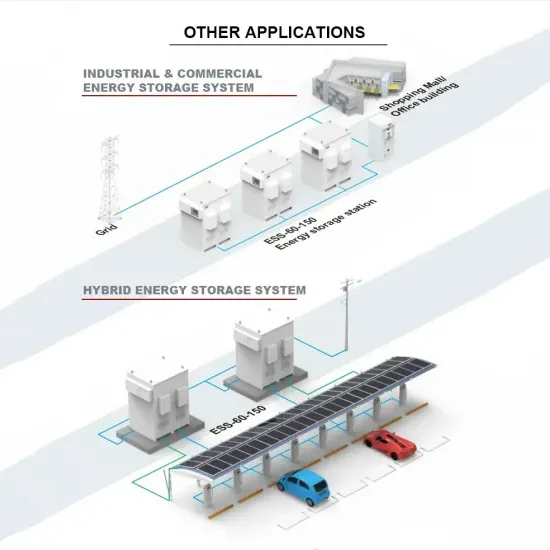

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.