Mitsubishi Thin Film Photovoltaic Module

May 13, 2021 · The thin-film (a-Si) PV module is a nections of modules, the effect of voltage drop due to technology highly expected as a module for low manufactur- shadow (shade) can be

Thin-Film PV Modules Market Size, Share & Growth Report,

Jul 18, 2025 · Global Thin-Film PV Modules Market is poised for a significant growth, with market size projected to surge from USD 9.03 Billion in 2024 to USD 36.99 Billion by 2033,

Thin-film solar patents, manufacturing equipment listed for sale

Apr 2, 2025 · A cancelled factory led to the sale. The solar cells produced by the equipment are "game-changing tech at liquidation values," said the seller.

Thin Film Solar PV Module Market

Jul 26, 2019 · The global thin film solar PV module market size is anticipated to witness significant growth, expanding from USD 16.5 billion in 2023 to approximately USD 65.3 billion by 2032,

Thin Film Photovoltaic Modules market 2025-2034

4 days ago · The Thin Film Photovoltaic Modules market plays a pivotal role in the renewable energy sector, offering cost-effective and innovative solutions for solar power generation.

Thin-Film PV Modules 2025-2033 Market Analysis: Trends,

Apr 25, 2025 · The thin-film photovoltaic (PV) module market is experiencing robust growth, driven by increasing demand for renewable energy sources and the inherent advantages of

Thin-Film PV Modules 2025-2033 Market Analysis: Trends,

Apr 25, 2025 · The thin-film PV industry''s growth is fueled by escalating global energy demands, government support for renewable energy through subsidies and policies, continuous

Valletta Thin Film PV Modules Benefits Applications and

Discover why Valletta thin film photovoltaic (PV) modules are transforming solar energy adoption globally. Learn about their advantages, real-world applications, and how they outperform

Thin Film Photovoltaic Market Size, Industry Share | Forecast

The Thin-Film Photovoltaic market report summarizes top key players overview as Global Solar Energy, MiaSolé, Avancis GmbH, Solar Frontier K.K., and more

6 FAQs about [Valletta Thin Film PV Module Sales]

What is a commercial thin-film PV market?

Commercial thin-film PV market is projected to grow to a substantial share over the forecast timeframe owing to their increasing adoption as the building-integrated photovoltaic systems and inclination among consumers to produce green energy.

Which companies are involved in the thin-film photovoltaic market?

Some of the major participants that are operating in the thin-film photovoltaic market are Global Solar Energy, MiaSolé, Avancis GmbH, Solar Frontier K.K., First Solar, Solibro GmbH, Kaneka Corporation, Sharp Electronics Corporation USA, Ascent Solar Technologies, Inc., Xunlight (Kunshan) Co., Ltd., TS Solar GmbH, Flisom AG, and Crystalsol.

What is the global thin-film photovoltaic market?

On the basis of end-user, the global thin-film photovoltaic market can be primarily bifurcated into residential, commercial, and utility. Thin-film photovoltaics are widely incorporated in residential uses to generate inexpensive solar electricity and can withstand variable loads like rough wind conditions.

How can thin-film photovoltaic market grow?

Favorable policies to adopt renewable energy as a primary fuel along with continuous research & development to cut costs in the near future is set to positively cater to the thin-film photovoltaic market growth. Different governments are raising measures to curb national GHG emissions and deploy low carbon technologies.

What is CIGS thin-film photovoltaic market growth?

Extensive applications in large scale use, commercial operations, high absorption rate, tandem & protective design, and very high efficiency are some of the factors that are set to cater to the Copper Indium Gallium Diselenide (CIGS) thin-film photovoltaic market growth.

What is a thin-film solar cell?

A thin-film solar cell or photovoltaic (PV) cell is a device to produce electrical energy by using light or solar energy. It is made of different layers mounted on a substrate to provide efficient electricity generation in various applications.

Learn More

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

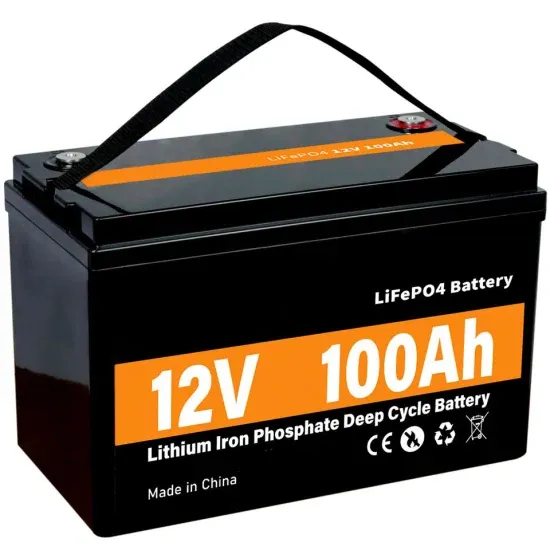

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.