China acts to halt solar price slump, declares low

Oct 22, 2024 · China''s solar industry has reached a consensus to curb domestic price wars by setting a price floor for solar modules. China Photovoltaic

Solar modules now selling for less than €0.06/W

Nov 14, 2024 · Search4Solar, a European platform for buying and selling solar panels, inverters, and batteries, received a record-low PV module price this

Prices rising across China''s PV supply chain, says

Mar 20, 2025 · Taiwan-based research firm EnergyTrend says market optimism in China has driven up solar module prices, while production of modules, cells,

Solar Module Sector Unsettled by Falling Prices and

Jul 16, 2024 · Oversupply issues in Asia have driven down solar module prices over the past year and a half. Chinese manufacturers are grappling with high inventories and waning demand,

Brand of Lobamba photovoltaic thin-film modules

Thin-film solar panels use a 2nd generation technology varying from the crystalline silicon (c-Si) modules, which is the most popular technology. Thin-film solar cells (TFSC) are

Global average price for solar PV modules 2024| Statista

Jul 14, 2025 · Average spot price for solar photovoltaic modules worldwide from 2016 to 2024 (in U.S. dollars per watt-peak) You need a Statista Account for unlimited access Immediate

Solar module prices on a clear downward trend

Jul 17, 2025 · Solar module prices on a clear downward trend PV module prices have fallen by around 5% to 8% across all technology classes in recent weeks. says Martin Schachinger, the

[Fact Check] Rumors About China''s Top PV Module Makers

Oct 31, 2024 · According to data from the Silicon Branch of the China Nonferrous Metals Industry Association, prices of silicon materials, wafers, cells, and modules have all declined this year,

4 FAQs about [Lobamba downgrades PV module prices]

How much does a top-five module cost in 2025?

A top-five module maker told OPIS that 2025 loading prices have not meaningfully increased, even with higher upstream costs. Current offers from leading manufacturers of utility-scale projects are in the low-$0.080/W range. The FOB China TOPCon module price for the first-half 2025 loading was at $0.085/W, with values between $0.082-0.087/W.

How much does a Topcon module cost in Brazil?

Module sellers describe the Brazilian market as particularly price-sensitive, with prices generally lower compared to other regions. For instance, TOPCon module prices destined for Brazil have dipped into the range of $0.08 to $0.09 per watt FOB China, with Tier 2-3 module sellers offering prices at the lower end of the spectrum.

When will BC module prices change in China?

BC module prices in China will be added and split into ground-mounted and C&I segments from June 2025. Weekly spot price report for 182mm modules will be based on the 182*182-210mm format from June 2024 onwards due to the slim price gap among varying formats .

Why are Topcon modules slashing prices?

These price reductions reflect a broader trend of subdued market activity driven by weak demand. In response, module manufacturers are slashing prices to secure new orders and maintain cash flow. The current tradable indications for TOPCon modules are being reported at $0.10 per watt Free-on-Board (FOB) China.

Learn More

- Santo Domingo downgrades PV module exports

- Sanaa PV module prices

- Astana PV module prices

- Supercapacitor module prices in South America

- Czech monocrystalline photovoltaic module prices

- Samoa modern energy storage module prices

- Sf photovoltaic module models and prices

- Huawei Havana PV Module Project

- Huawei PV module project in Barcelona Spain

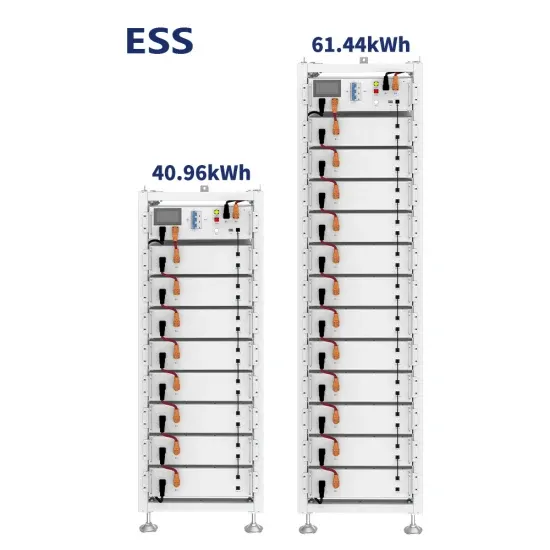

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.