Chinese PV Industry Brief: Polysilicon, solar module prices

Apr 26, 2025 · Some modules are now trading below CNY 0.70 per watt, with prices as low as CNY 0.68. Cell prices fell CNY 0.02 to CNY 0.03 week-on-week, with most deals ranging from

Module prices set for another rise, hinging on demand

Feb 12, 2025 · Manufacturers are delivering TOPCon modules at USD 0.2-0.27/W. PERC and TOPCon modules see a price gap of USD 0.01-0.02/W. Price quotes for new orders keep

Global solar module prices mixed on varying

Jan 17, 2025 · In a new weekly update for <b>pv magazine</b>, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global

Solar panel price in Pakistan August 2025 Daily Update

Solar panel price in Pakistan are longi 31.50 jinko n type29.50 astro energy n type 29 canadian topcon32.57 trina n type29, and all p type module are below 25 rupees per watt

Sanaa single glass photovoltaic module price

New Energy Market Price Website,The Chinese Photovoltaic Price DBM provides you with the latest prices for Chinese photovoltaic industry chain products, including: PV Modules,Solar

Global solar module prices largely stabilize with

Feb 28, 2025 · In a new weekly update for <b>pv magazine</b>, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global

Global average price for solar PV modules 2024| Statista

Jul 14, 2025 · Average spot price for solar photovoltaic modules worldwide from 2016 to 2024 (in U.S. dollars per watt-peak) You need a Statista Account for unlimited access Immediate

Market Analysis July 2025

Jul 18, 2025 · Although module market trends were unclear in June, a picture has since begun to reemerge. July was a landmark month, but the air was apparently too thin for higher prices

China | Photovoltaic: Price | CEIC

Aug 1, 2025 · CN: Price: Photovoltaic Module: 210 Single Crystal data remains active status in CEIC and is reported by Shandong Longzhong Information Technology Co., Ltd.. The data is

6 FAQs about [Sanaa PV module prices]

How much does a PV module cost in China?

According to price analysis firm InfoLink: “Since March, the spot price of n-type modules in China has soared from RMB0.7/W to RMB0.73/W. Quotes from leading manufacturers are approaching the RMB0.75/W mark.” The results of the China Datang Group’s 2025-2026 PV module framework. Image: Datang.

How much does photovoltaic module 182 single crystal data cost?

CN: Price: Photovoltaic Module: 182 Single Crystal data was reported at 0.660 RMB/W in Apr 2025. This records an increase from the previous number of 0.650 RMB/W for Mar 2025. CN: Price: Photovoltaic Module: 182 Single Crystal data is updated monthly, averaging 1.694 RMB/W from May 2021 (Median) to Apr 2025, with 48 observations.

How much does photovoltaic module: polycrystal cost?

CN: Price: Photovoltaic Module: Polycrystal data was reported at 1.450 RMB/W in Aug 2024. This stayed constant from the previous number of 1.450 RMB/W for Jul 2024. CN: Price: Photovoltaic Module: Polycrystal data is updated monthly, averaging 1.637 RMB/W from May 2021 (Median) to Aug 2024, with 40 observations.

How much will PV modules cost in 2025?

On 11 March 2025, the results of the China Datang Group’s 2025-2026 PV module framework purchase tender were announced, with the spot price of n-type modules increasing from RMB0.7/W (US$0.097/W) to RMB0.73/W (US$0.1/W), and some modules priced as high as RMB0.75/W (US$0.11/W).

How much does a solar panel cost?

Average EXW prices from distributors for residential solar panels are reported between €0.125/W and €0.100/W, depending on the volumes. US DDP: The spot price for TOPCon utility-scale modules DDP US rose this week from 0.71% to $0.284/W.

Is photovoltaic module 210 single crystal data still active in CEIC?

CN: Price: Photovoltaic Module: 210 Single Crystal data remains active status in CEIC and is reported by Shandong Longzhong Information Technology Co., Ltd.. The data is categorized under China Premium Database’s Energy Sector – Table CN.RBN: Photovoltaic: Price.

Learn More

- Asmara PV module prices

- Samoa PV module prices

- Huawei PV module project in Barcelona Spain

- Romania PV Module Inverter Factory

- Serbia polycrystalline photovoltaic module prices

- Romania PV module project

- Morocco photovoltaic module specifications and prices

- Solar PV Energy Storage Prices

- Santo Domingo downgrades PV module exports

Industrial & Commercial Energy Storage Market Growth

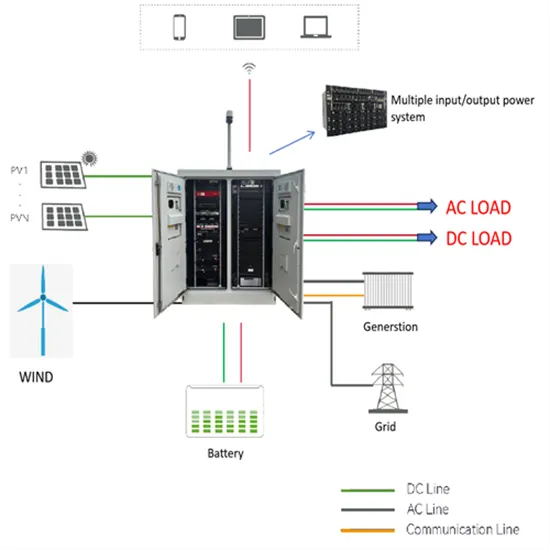

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

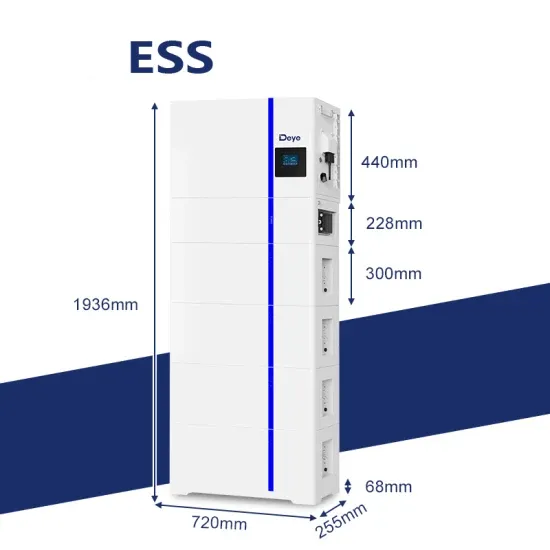

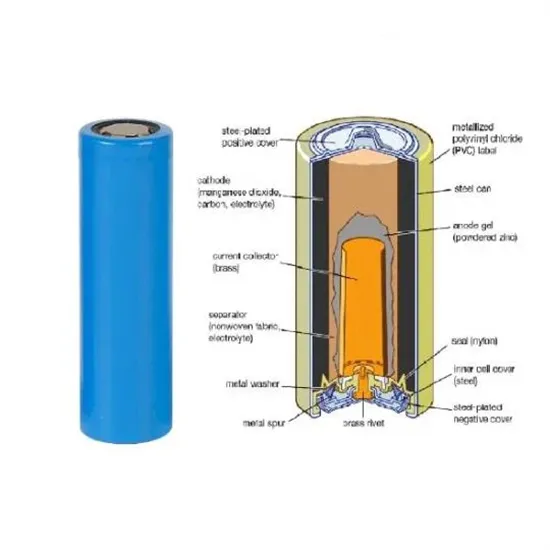

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.