Global Photovoltaic Module Glass Supply, Demand and Key

Global Photovoltaic Module Glass consumption by region & country, CAGR, 2019-2030 & (Tons) U.S. VS China: Photovoltaic Module Glass domestic production, consumption, key domestic

Photovoltaic Module Glass Market Report | Global Forecast

The global market size for Photovoltaic (PV) Module Glass was valued at approximately USD 5.3 billion in 2023 and is projected to reach around USD 12.4 billion by 2032, growing at a

Solarspace Double Glass Photovoltaic Modules

Jun 18, 2024 · Thanks for choosing Solarspace Solar PV modules. This guide contains information regarding the installation and safe handling of Solar- space photovoltaic module

Global Photovoltaic Module Glass Sales Market Report,

The global key manufacturers of Photovoltaic Module Glass include NSG, Interfloat, Saint-Gobain, Toray Solar, Guardian, Xinyi Solar, Flat Glass Gr Co, IRICO Group New Energy, China

Photovoltaic Glass Market Size, Trend & Share [2025-2033]

May 19, 2025 · global photovoltaic glass market size was USD 6.5 billion in 2024 & the market is expected to reach USD 26.4 billion by 2033, exhibiting a CAGR of 16.85 %

Global PV Module Market Analysis and 2025

Dec 11, 2024 · PV modules are the central component of the solar industry. This analysis reviews market conditions that affect solar panel pricing and availability.

Solar Photovoltaic Glass Market | Trends & Forecast 2025

The Global Solar Photovoltaic Glass Market size reached US$ 12.2 Billion in 2022 and the market is expected to reach US$ 51.7 Billion by 2031, exhibiting a growth rate (CAGR) of 25.75%

Solar Photovoltaic Glass Market Size, Demand, Opportunities

Technological advancements in ultra-thin and lightweight solar glass solutions are significantly shaping the global solar photovoltaic glass market. Manufacturers are focusing on developing

Global Double Glass PV Modules Sales Market Report,

The global Double Glass PV Modules market size was US$ 22060 million in 2024 and is forecast to a readjusted size of US$ 51600 million by 2031 with a CAGR of 13.1% during the forecast

Solar Photovoltaic Glass Market Size & Forecast [Latest]

Feb 13, 2025 · Solar Photovoltaic Glass Market by Type (AR-Coated, Tempered, TCO-Coated), Application, End User (Crystalline Silicon PV Module, Thin Film Module, Perovskite Module),

Specialist in Solar Panel Manufacturing Equipment | Horad

Jan 16, 2025 · Since foundation, Horad has been committed to becoming a leading manufacturer of intelligent PV panel production lines by focusing on the solar panel line R&D, designing,

Global Solar Photovoltaic Glass Analysis, Size and Forecast

Global Solar Photovoltaic Glass Market Segmentation, By Type (AR Coated Solar PV Glass, Tempered Solar PV Glass, TCO Coated Solar PV Glass, Annealed Solar PV Glass, and

6 FAQs about [Glass photovoltaic module sales]

How big is the Solar Photovoltaic Glass market?

The Market Size and Forecasts for the Solar Photovoltaic Market are Provided in Terms of Volume (tons) for all the Above Segments. The Solar Photovoltaic Glass Market size is estimated at 27.11 Million tons in 2024, and is expected to reach 63.13 Million tons by 2029, growing at a CAGR of 18.42% during the forecast period (2024-2029).

Who are the major players in the Solar Photovoltaic Glass market?

The solar photovoltaic glass market is consolidated in nature. The major players in this market include Xinyi Solar Holdings Limited, Flat Glass Group Co., Ltd, AGC Inc., Nippon Sheet Glass Co., Ltd, and Saint-Gobain, among others (not in a particular order). Need More Details on Market Players and Competitors?

Where are solar photovoltaic glasses made?

The largest producers of solar photovoltaic glasses are in the Asia-Pacific region. Some of the leading companies in the production of solar photovoltaic glasses are Jinko Solar, Mitsubishi Electric Corporation, Onyx Solar Group LLC, JA Solar Co. Ltd, and Infini Co. Ltd. China is the world’s largest solar photovoltaic glass manufacturer.

How big is the global photovoltaic glass market by 2033?

The global photovoltaic glass market is expected to touch USD 26.4 billion by 2033. What CAGR is photovoltaic glass market expected to exhibit by 2033?

What is Solar Photovoltaic Glass?

Solar photovoltaic glass is a technology that enables the conversion of light into electricity. The glass is incorporated with transparent semiconductor-based photovoltaic cells, also known as solar cells. These cells are sandwiched between two sheets of glass, which enables them to capture these solar rays and convert them into electricity.

What is the largest solar PV glass market in Asia?

Asia Pacific is the largest and the second-fastest-growing solar PV glass market, in terms of volume, owing to large scale consumption of glass by solar module manufacturers located in Asia, especially in China.

Learn More

- Glass photovoltaic module sales

- Tanzania double glass photovoltaic module manufacturer

- Australian double glass photovoltaic module manufacturer

- Podgorica BIPV photovoltaic glass module

- Huawei photovoltaic module ultra-hard glass

- Somaliland glass photovoltaic module panels

- 9BB high efficiency photovoltaic double glass module

- Mongolia New Energy Photovoltaic Module Glass

- Is there a photovoltaic glass factory in Borno

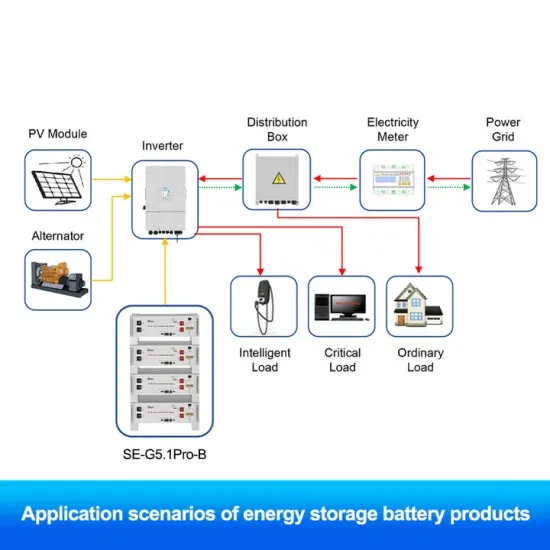

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.