Ranking of electromagnetic energy storage manufacturers in

Optimal allocation of energy storage in a future Optimal allocation of energy storage in a future congolese power system. Abstract: The Democratic Republic of Congo is facing a dramatic

Democratic Republic of the Congo

5 days ago · The Democratic Republic of Congo has huge hydropower potential while also dealing with extreme energy poverty. Foreign investors are currently partially lifting constraints

Congo Democratic Republic | Africa Energy Portal

2 days ago · Considered as the 11th largest country in the world, With a surface area equivalent to that of Western Europe, the Democratic Republic of Congo (DRC) is the largest country in Sub

Democratic Republic of the Congo

Mar 14, 2024 · Learn about the market conditions, opportunities, regulations, and business conditions in congo, the democratic republic of the, prepared by at U.S. Embassies worldwide

Democratic Republic of Congo Energy Storage Agency

The Democratic Republic of the Congo (DRC) intends to conditionally reduce its greenhouse gas (GHG) emissions by at least 21% by 2030. 2 While the DRC has historically been a low

What is the energy storage potential in Congo''s mining

Jun 18, 2024 · The Democratic Republic of Congo is a treasure trove of mineral resources, particularly those essential for modern energy storage technologies. Rich deposits of lithium,

How can energy storage help address Congo''s informal

Jan 12, 2024 · The informal power sector in the Democratic Republic of the Congo (DRC) often suffers from inconsistent supply and inadequate infrastructure, leading to energy inequities. By

Congo, Republic of the

Jun 12, 2024 · Infrastructure projects, technical assistance and national grid or distribution network upgrades are leading sub-sectors with investment potential. The Ministry of Energy

Energy storage advantages in the Democratic Republic

Abstract: The Democratic Republic of Congo is facing a dramatic electricity crisis. For the population, the access to electricity is 1% in rural areas, 30% for cities and 9% nationally.

Democratic Republic of Congo

Feb 1, 2010 · Petroleum activities in the Democratic Republic of Congo are organized around the exploration / production, refining, transportation, storage and distribution of petroleum

What are the leading renewable energy storage projects in Congo?

Mar 4, 2024 · 1. In the Democratic Republic of the Congo (DRC), several pioneering renewable energy storage initiatives stand out as exemplars of innovation, including Project 1: Inga Dam

How does energy storage reduce the environmental impact of Congo

Jul 16, 2024 · 1. Energy storage technologies contribute significantly to the reduction of negative environmental effects emanating from the energy sector in the Democratic Republic of the

Spotlight: the energy markets in Democratic Republic of Congo

Jun 13, 2023 · This article explores the key features of the energy markets in Democratic Republic of Congo, gauging market climate and reviewing recent developments, as well as contractual

What are the legal frameworks supporting energy storage in Congo

Feb 6, 2024 · Energy storage initiatives in the Democratic Republic of Congo (DRC) are backed by a combination of 1. National policies, 2. International agreements, 3. Regulatory

How does energy storage support the development of smart grids in Congo

Mar 30, 2024 · Energy storage signifies a transformative opportunity for the evolution of smart grids in the Democratic Republic of Congo. With its capacity to enhance power reliability,

PATHWAYS TO ENERGY TRANSITION Democratic

Apr 22, 2022 · The Democratic Republic of the Congo (DRC) intends to conditionally reduce its greenhouse gas (GHG) emissions by at least 21% by 2030.2 While the DRC has historically

DRC: Chinese-built hydroelectric power plant

Jan 28, 2024 · The Chinese-built power facilities stand as a beacon of progress, illuminating the path toward a brighter and more electrified future for Kinshasa

How does residential energy storage align with Congo''s renewable energy

May 29, 2024 · 2. UNDERSTANDING CONGO''S RENEWABLE ENERGY LANDSCAPE The Democratic Republic of the Congo is endowed with immense renewable energy resources,

Optimal allocation of energy storage in a future congolese

Sep 4, 2015 · Out of various renewable resources the sun, wind and biomass associated with energy storage are considered to hold one of the most promising alternative to the electricity

Congo Energy Solutions Ltd. ("NURU")

Aug 16, 2025 · NURU develops and operates commercially-viable isolated solar-hybrid "metrogrids" (utility-scale urban mini-grids) that provide reliable, affordable and clean energy in

6 FAQs about [Electrochemical energy storage distribution in the Democratic Republic of Congo]

What is the main energy resource of the Democratic Republic of Congo?

Hydroelectric power (See Annex 1) is the main energy resource of the Democratic Republic of Congo. The DRC ranks first in Africa in terms of its potential (100,000 MW), which accounts for 13% of the global hydropower potential.

What is the electricity access rate in the Republic of the Congo?

The electricity access rate is 45 % in urban area and 5.6 % in rural area. The Government plans to bring this rate up to 90 % in urban areas and to 50 % in rural areas by 2015. The electric power sector in the Republic of the Congo is chiefly governed by Law No 14-2003 of April 10, 2003 on the Electricity Code, and by:

How is the electricity sector governed in the Republic of the Congo?

The electric power sector in the Republic of the Congo is chiefly governed by Law No 14-2003 of April 10, 2003 on the Electricity Code, and by: Law No 17-2003 of April 10, 2003 creating the development funds for electricity sector (FDSEL); Law No 16-2003 of April 10, 2003 creating the regulatory agency for electricity sector (ARSEL);

Is the Democratic Republic of the Congo an energy exporter?

One of the Inga dams, a major source of hydroelectricity in the Democratic Republic of the Congo. The Democratic Republic of the Congo was a net energy exporter in 2008. Most energy was consumed domestically in 2008. According to the IEA statistics the energy export was in 2008 small and less than from the Republic of Congo.

What renewable resources does the DRC have?

Nevertheless, the DRC possesses huge potential in renewable resources such as hydropower, biomass, methane gas, solar geothermal and moderate wind potential that can be used for energy generation.

Why is the Democratic Republic of Congo experiencing a general energy crisis?

The Democratic Republic of Congo (DRC) is currently experiencing a general energy crisis due to the lack of proper investment and management in the energy sector. Some 93.6% of the country is highly dependent on wood fuel as main source of energy, which is having severe impacts such as deforestation and general degradation of the environment.

Learn More

- Cost of energy storage for distribution network in the Democratic Republic of Congo

- Democratic Republic of Congo liquid cooling energy storage cabinet site requirements

- Investment in industrial and commercial power grid energy storage in the Democratic Republic of the Congo

- Installation of energy storage integrated charging pile in the Democratic Republic of Congo

- Democratic Congo Photovoltaic Energy Storage Ratio Company

- Is the 5G base station in the Democratic Republic of Congo a communication or a hybrid energy source

- Electrochemical Energy Storage Project Power Distribution

- Wind energy complementary energy storage DC distribution system 84v

- Energy storage configuration for incremental distribution network

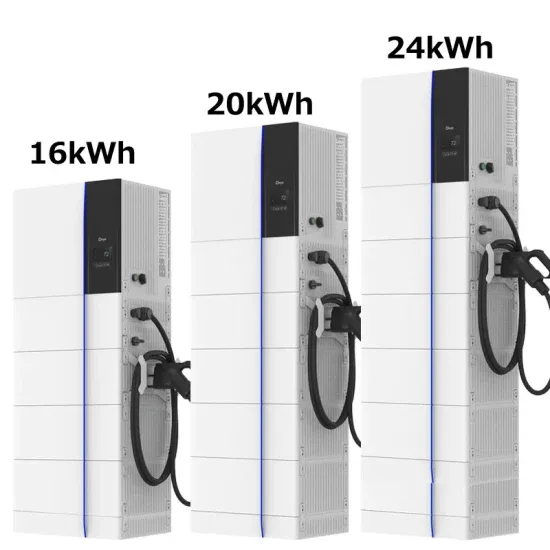

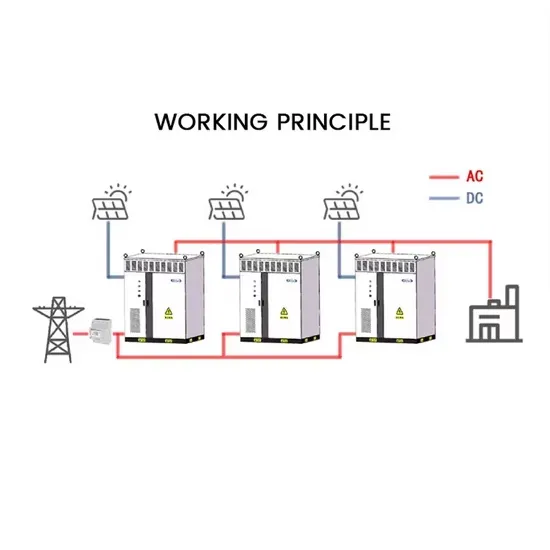

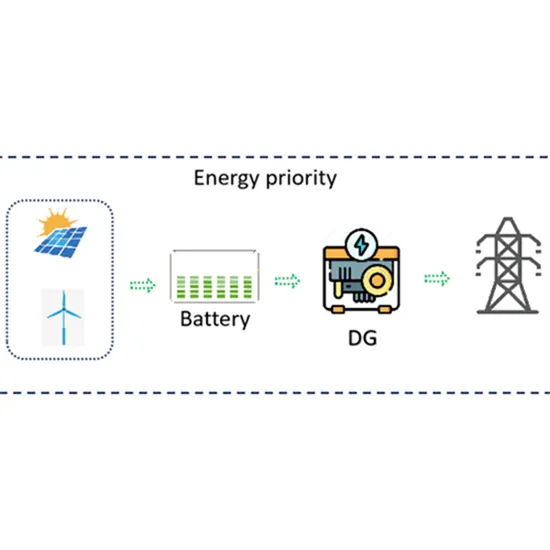

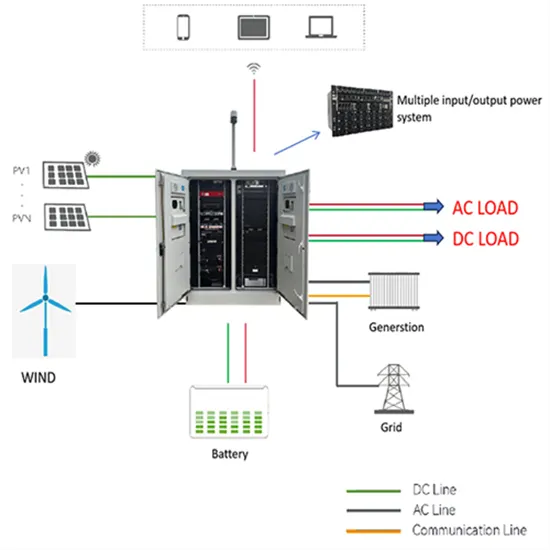

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.