Congo Democratic Republic | Africa Energy Portal

2 days ago · Considered as the 11th largest country in the world, With a surface area equivalent to that of Western Europe, the Democratic Republic of Congo (DRC) is the largest country in Sub

Congo Republic energy storage systems definition

This study facilitates the best storage system associated with the integration of renewable energy technology into the multiple DRC power plant systems. The benefits of such systems will

Democratic Republic of Congo Energy Storage Agency

London and Kinshasa, November 24, 2021 - The Democratic Republic of the Congo (DRC) can leverage its abundant cobalt resources and hydroelectric power to become a low-cost and low

Energy Storage Power Station Democratic Republic of

Out of various renewable resources the sun, wind and biomass associated with energy storage are considered to hold one of the most promising alternative to the electricity crisis in

Powering Progress Energy Storage Solutions in the Democratic Republic

As the Democratic Republic of Congo (DRC) seeks to overcome chronic energy shortages, energy storage systems are emerging as game-changers. This article explores how

KfW digitalises DRC substation to better connect

Oct 4, 2024 · Germany''s state-owned development bank KfW invested €20 million ($22.1 million) to finance the modernisation of the substation at the Inga I and

World Bank Document

3 days ago · The main priority for the Democratic Republic of Congo''s power sector is to increase access to electricity. The Democratic Republic of Congo is a large country with 10 million

30,000 homes in DR Congo to receive energy storage systems

Jan 5, 2012 · With the intention to supply at least 300,000 homes with solar power, a contract with Korea-based Leo Motors has been concluded. Leo Motors will supply 20,000 units of e-Box to

Congo Accelerates Power Sector Expansion with Gas,

Mar 13, 2025 · The Republic of Congo''s parastatal Centrale Électrique du Congo (CEC) is set to recommission its GT1 turbine following a period of maintenance. This initiative is anticipated to

ENERGY PROFILE Democratic Republic of the Congo

Additional notes: Capacity per capita and public investments SDGs only apply to developing areas. Energy self-sufficiency has been defined as total primary energy production divided by

ENERGY PROFILE Democratic Republic of the Congo

a/yr Indicators of renewable resource potential Solar PV: Solar resource potential has been divided into seven classes, each representing a range of ann. al PV output per unit of capacity

OVERVIEW OF THE ELECTRICITY SECTOR IN THE

Dec 11, 2019 · 4. ELECTRICITY DEMAND AND SUPPLY SITUATION IN DRC The Democratic Republic of Congo "DRC" is a big country in the heart of Africa with an area of 2,345,000 km2

Energy Storage Power Station Democratic Republic of

What is the main energy resource of the Democratic Republic of Congo? Hydroelectric power(See Annex 1) is the main energy resource of the Democratic Republic of Congo. The DRC ranks

FP096: DRC Green Mini-Grid Program | Green

Oct 20, 2018 · The Programme will support the development of three solar green mini-grid pilot projects, each with battery storage, aggregating to a capacity of

6 FAQs about [Energy storage system of power plant in Democratic Republic of Congo]

How does the Democratic Republic of the Congo support the economy?

In the AC, Democratic Republic of the Congo supports an economy six-times larger than today’s with only 35% more energy by diversifying its energy mix away from one that is 95% dependent on bioenergy.

What solar projects are being built in the DRC?

The main existing solar project in the DRC is a 1MW solar mini-grid with 3MWh of battery storage capacity built by Enerdeal and Congo Energy in the city of Manono, to supply the local population and SMEs. Enerkac has also developed a 1MW hybrid plant powering SNEL’s Kananga mini-grid in Kasaï Central (non operational in 2019).

Could the Congo become an electricity exporter?

Almost all electricity generation today comes from hydropower and the Inga project has the potential to provide much more. If network constraints are addressed, Democratic Republic of the Congo could become an electricity exporter.

What is the main priority for the Democratic Republic of Congo's power sector?

The main priority for the Democratic Republic of Congo’s power sector is to increase access to electricity. The Democratic Republic of Congo is a large country with 10 million households of which 1.6 million have access to electricity. This makes it the third largest population in the world without access to electricity.

How much does solar energy cost in DRC?

Equipping the remaining two third of the population with Tier 2 access to electricity through solar home systems comes with a much lower price tag, estimated at about USD 3.3 billion. Only a few private operators both local and international - have started to get into the DRC market.

Where can solar power be found in DRC?

Vast land areas with high-quality solar resource are found in the three regions of DRC. The best potential is located where unmet demand is the highest along the Eastern border and in the Eastern half of the South-Western region (Map 8).

Learn More

- Emergency Energy Storage Power Supply in the Democratic Republic of the Congo

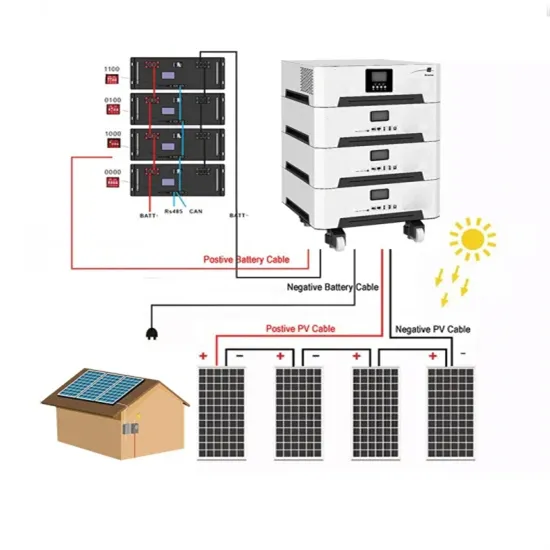

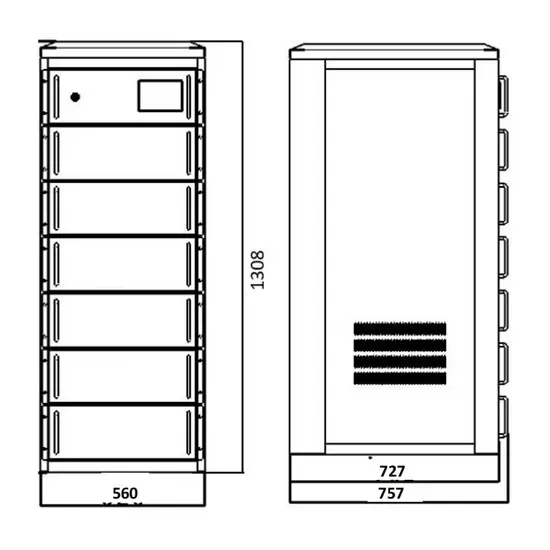

- Investment in industrial and commercial power grid energy storage in the Democratic Republic of the Congo

- Democratic Republic of Congo portable energy storage battery

- Cost of energy storage for distribution network in the Democratic Republic of Congo

- Energy storage for the Russian-Ukrainian conflict in the Democratic Republic of the Congo

- Huawei Energy Storage in the Democratic Republic of Congo

- Democratic Republic of Congo liquid cooling energy storage cabinet site requirements

- Democratic Congo Energy Storage Power Station Subsidy

- Power Plant Energy Storage

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.