Congo energy storage power station

The Zongo II Power Station, also Zongo 2 Power Station, (French: Centrale hydroélectrique de Zongo II) is a 150 MW hydroelectric power station across the Inkisi River that harnesses the

How can energy storage be used to bridge the energy access gap in Congo

Jul 19, 2024 · In the Democratic Republic of Congo, energy storage serves as a pivotal mechanism for bridging the energy access gap through 1. enhancing renewable energy

Democratic Republic of Congo off-grid energy storage power station

The Nuru company put a mini hybrid solar power plant with a storage system into operation in Goma, the capital of the North Kivu province in the Democratic Republic of Congo (DRC). The

Can energy storage be used to power critical services during

Mar 25, 2024 · Significant investments have been made in energy storage systems globally, and its applicability in the Democratic Republic of Congo (DRC), especially during blackouts, is

Energy storage advantages in the Democratic Republic

Energy Capital & Power will launch Congo-Brazzaville''''s first ever energy sector specific report, Africa Energy Series: Congo-Brazzaville 2022, in the second quarter of 2022, which will outline

Democratic Congo s new energy storage industry

Recent pilot projects by Belgian startup H2Congo show promising results – storing surplus hydro energy as hydrogen during rainy seasons, then converting it back to electricity

Energy Storage Power Station Democratic Republic of

What is the main energy resource of the Democratic Republic of Congo? Hydroelectric power(See Annex 1) is the main energy resource of the Democratic Republic of Congo. The DRC ranks

Democratic Republic of Congo Energy Storage Power Station

Does Power Africa support the development of electricity projects in DRC? Power Africa has supported the development of electricity generation projects in the Democratic Republic of the

What are the primary factors driving energy storage adoption in Congo

Aug 17, 2024 · The rapid pace of technological innovation is reshaping the energy storage landscape in the Democratic Republic of the Congo. Revolutionary advancements in batteries

Energy Storage Power Station Democratic Republic of

Out of various renewable resources the sun, wind and biomass associated with energy storage are considered to hold one of the most promising alternative to the electricity crisis in

Republic of Congo energy storage user-side energy storage subsidies

The Democratic Republic of Congo has huge hydropower potential while also dealing with extreme energy poverty. Foreign investors are currently partially lifting constraints on the

What are the key policy challenges for energy storage adoption in Congo

Sep 24, 2024 · The Democratic Republic of the Congo (DRC) faces numerous obstacles regarding the widespread adoption of energy storage technologies. 1. Lack of Infrastructure, 2.

Republic of Congo energy storage user-side energy storage subsidies

In the context of China''''s new power system, various regions have implemented policies mandating the integration of new energy sources with energy storage, while also introducing

How can energy storage support Congo''s tourism industry?

Apr 23, 2024 · 1. RELIABLE POWER SUPPLY The backbone of any thriving tourism industry is a consistent and dependable power supply. In the Democratic Republic of Congo, frequent

How does residential energy storage improve resilience to Congo

Apr 8, 2024 · 1. RESIDENTIAL ENERGY STORAGE ENHANCES RESILIENCE TO CONGO''S ENERGY CRISES BY1 providing a reliable power supply during outages, 2 enabling energy

congolese energy storage subsidy policy

Impact of government subsidies on total factor productivity of energy storage Government subsidies improve the TFP of energy storage enterprises. • The government''''s "picking

World Bank Document

3 days ago · The main priority for the Democratic Republic of Congo''s power sector is to increase access to electricity. The Democratic Republic of Congo is a large country with 10 million

What are the legal frameworks supporting energy storage in Congo

Feb 6, 2024 · Energy storage initiatives in the Democratic Republic of Congo (DRC) are backed by a combination of 1. National policies, 2. International agreements, 3. Regulatory

How can energy storage help address Congo''s informal power

Jan 12, 2024 · 1. Energy storage plays a crucial role in addressing Congo''s informal power sector by 1. enhancing electricity reliability, 2. facilitating renewable energy integration, 3. reducing

Powering Progress Energy Storage Solutions in the Democratic

As the Democratic Republic of Congo (DRC) seeks to overcome chronic energy shortages, energy storage systems are emerging as game-changers. This article explores how

How does residential energy storage reduce energy inequality in Congo

Jan 1, 2024 · 1. Residential energy storage enhances equity, affordability, accessibility, and sustainability of energy sources for underserved communities, improving overall quality of life.

Democratic Congo Photovoltaic Energy Storage Power Station

Recently, the government of the Democratic Republic of Congo announced the construction of a 600MW photovoltaic power station in Menkao, Maluku, 25 kilometers east of

How does energy storage reduce energy costs for households in Congo

Feb 18, 2024 · 1. THE ROLE OF ENERGY STORAGE Energy consumption patterns within urban settlements in the Democratic Republic of Congo are markedly influenced by various factors

Republic of Congo energy storage user-side energy storage subsidies

Clean power unplugged: the rise of mobile energy storage A mobile battery storage unit from Moxion, its product to displace diesel generators for construction sites, film sets and more.

6 FAQs about [Democratic Congo Energy Storage Power Station Subsidy]

What is the main priority for the Democratic Republic of Congo's power sector?

The main priority for the Democratic Republic of Congo’s power sector is to increase access to electricity. The Democratic Republic of Congo is a large country with 10 million households of which 1.6 million have access to electricity. This makes it the third largest population in the world without access to electricity.

Does Congo have a potential for renewable power generation?

As mentioned earlier, the country possesses a significant potential for renewable power generation, which is illustrated further as follows : Hydropower: For which the Congo River is the main source, with an average flow rate 42,000 m 3 /s. Biogas: Coming mainly from both plant and animal waste.

How much would it cost to get grid electricity in DRC?

Providing all households of the 26 provincial capitals of DRC access to grid electricity through a mix of mid-sized hydro and solar power plants would cost approximately USD 10.5 billion in CAPEX. This would raise the access rate to about a third of the population, at a cost equivalent to 30% of GDP.

Why does DRC have a high electricity demand?

All segments of electricity demand are severely constrained by supply. Most demand in the residential sector is unmet, partly because DRC has one of the largest deficits in electricity access in the world and high geographical disparities (see chapter 2 for information about access). So is industrial demand.

What solar projects are being built in the DRC?

The main existing solar project in the DRC is a 1MW solar mini-grid with 3MWh of battery storage capacity built by Enerdeal and Congo Energy in the city of Manono, to supply the local population and SMEs. Enerkac has also developed a 1MW hybrid plant powering SNEL’s Kananga mini-grid in Kasaï Central (non operational in 2019).

What are the main sources of energy in the Congo?

Hydropower: For which the Congo River is the main source, with an average flow rate 42,000 m 3 /s. Biogas: Coming mainly from both plant and animal waste. Solar: The DRC has noticeably high solar radiation averaging 6 kWh/m 2 /day.

Learn More

- Energy storage system of power plant in Democratic Republic of Congo

- Investment in industrial and commercial power grid energy storage in the Democratic Republic of the Congo

- Emergency Energy Storage Power Supply in the Democratic Republic of the Congo

- Democratic Congo energy storage power supply chassis custom manufacturer

- Tskhinvali Lead Carbon Energy Storage Power Station

- Home power station villa-style solar energy storage

- Energy storage power station is suitable for several frequency regulation

- Central Asia Company s own power station energy storage

- Is the 5G base station in the Democratic Republic of Congo a communication or a hybrid energy source

Industrial & Commercial Energy Storage Market Growth

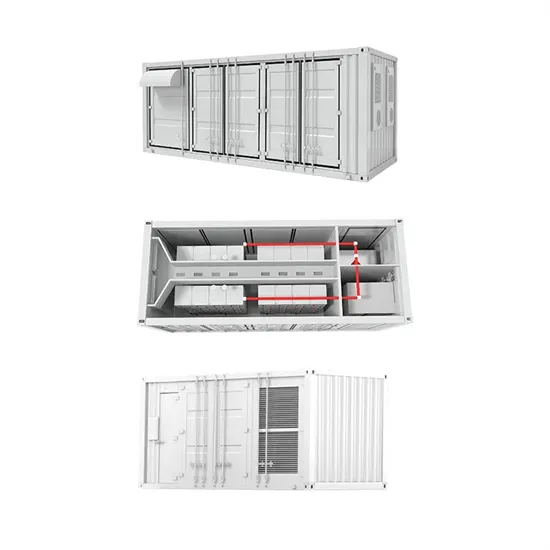

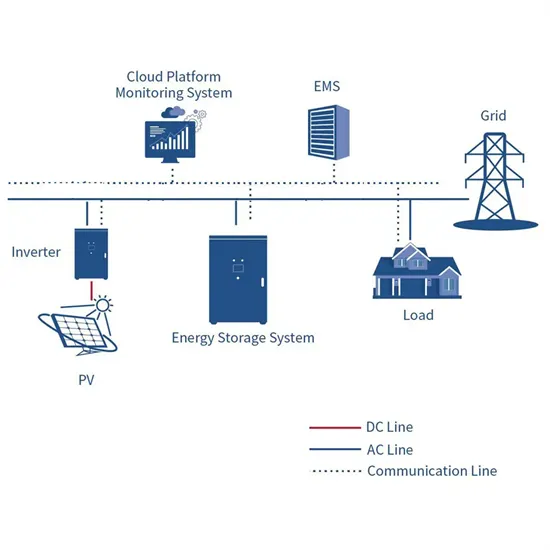

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

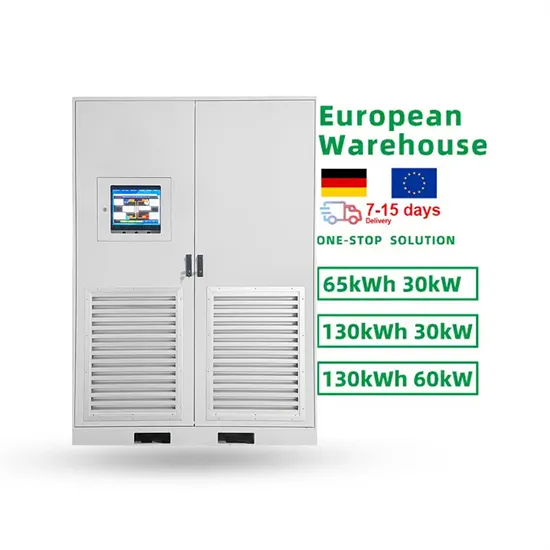

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.