Inverter Amps: The Ultimate Guide to Understanding Power

Jan 29, 2025 · Inverter amps also require complex control circuitry and high-frequency components, which can be prone to failure and require specialized maintenance and repair.

Understanding the Difference Between Low Frequency and

Mar 31, 2024 · There are two main types of inverters: low-frequency inverters and high-frequency inverters. Low-frequency inverters operate at a frequency of 50 or 60 Hz, which is the same

Inversion Methods Explained: High Frequency vs Low Frequency

4 days ago · Size and tolerances of the transistors used in the inversion process, and the speed at which they operate determines the classification of high or low frequency. The large majority

Surge vs. Efficiency: Choosing Between Low and High-Frequency Inverters

Jul 25, 2025 · High-frequency inverters represent a more modern approach, engineered to overcome the size and weight limitations of their line-frequency counterparts. The topology is

Solar high frequency vs low frequency inverter

Hz AC for the load through the IF transformer. High frequency inverters and low frequency inverters are two common types of inverters with distinct differences in their applic What is the

High frequency verses low frequency inverters

Nov 26, 2022 · What is the difference between high, or low frequency inverters the pros and cons? I have seen a few posts someone said low was better for high surge load like AC units,

How to Distinguish High Frequency Inverter and Low Frequency Inverter

Apr 11, 2024 · High frequency inverters produce AC power of a higher frequency and voltage level, while low frequency inverters produce AC power of a lower frequency and voltage. How

High-Frequency vs. Low-Frequency Inverters

High-Frequency Inverters: High-frequency inverters are generally more efficient in terms of energy conversion, with efficiencies ranging from 90% to 96%. They can operate with less power loss

MIT Open Access Articles A High Frequency Inverter for

Oct 1, 2022 · There are many applications that require high-frequency, high-power inverters such as induction heating, plasma gener-ation, and wireless power transfer. These applications are

Surge vs. Efficiency: Choosing Between Low and High-Frequency Inverters

Jul 25, 2025 · Line-Frequency vs. High-Frequency Inverters: A Technical Deep Dive for Engineers In the world of power electronics, the inverter is a cornerstone technology, responsible for the

High-frequency versus low-frequency inverters which is right

Jun 13, 2025 · Compare high-frequency and low-frequency frequency inverters to find the best fit for your power needs, efficiency, surge capacity, and reliability.

Inverters High or Low Frequency ? | DIY Solar Power Forum

Apr 15, 2020 · Low-frequency inverters use high-speed switches to invert (or change) the DC to AC, but drive these switches at the same frequency as the AC sine wave which is 60 Hz (60

High Frequency Inverter Technical Specifications Explained

Aug 7, 2025 · High frequency inverter technology utilizes switching frequencies typically ranging from 20kHz to 100kHz significantly higher than traditional low frequency inverters that operate

Low Frequency vs High Frequency Inverters: Key

Aug 15, 2025 · Explore the key differences in low frequency vs high frequency inverters including their applications, advantages, and which is best for your

6 FAQs about [How much frequency does a high frequency inverter require]

Should I buy a high frequency inverter or low frequency?

If you need to power heavy-duty appliances, such as air conditioners and refrigerators, a low frequency inverter may be the best option. If you need to power electronic devices, such as computers and televisions, a high frequency inverter may be the better option.

What are the advantages of a high frequency inverter?

High frequency inverters typically have an output of 20kHz or higher. Smaller size and weight compared to low-frequency inverters. Higher efficiency due to reduced power losses. Greater accuracy in output waveform due to the high frequency. Lower electromagnetic interference (EMI) due to higher switching frequency.

What is a high frequency inverter?

The high frequency inverter can deliver the same power at higher frequency with a much smaller and lighter transformer, as a result, the HF inverter is often called transformer-less inverter, or TL inverter.

What determines a high or low frequency inverter?

Size and tolerances of the transistors used in the inversion process, and the speed at which they operate determines the classification of high or low frequency. The large majority of inverters available in the retail market are high frequency.

How many Hz should an inverter output be?

The frequency of the inverter output must be in the range of 49.7Hz to 50.3Hz or 59.7Hz to 60 Hz according to the region.The variations in the frequency output of the inverter must not be too large and must be in the range specified above. Maximum Open Circuit Voltage

What type of inverter do I Need?

Heavy-duty items, such as air conditioners and refrigerators, may require a low frequency inverter with high surge capacity. For electronics like computers and televisions, then a high frequency inverter with a higher efficiency may be preferable.

Learn More

- How many watts does a pure high frequency inverter have

- How much is the price of high frequency inverter in Ho Chi Minh Vietnam

- Inverter high voltage main frequency or low voltage mixed frequency

- High frequency inverter 2025

- Industrial frequency high frequency low frequency inverter

- Eritrea High Frequency Inverter

- Fully automatic high frequency inverter

- High power industrial frequency inverter

- High frequency chopper inverter

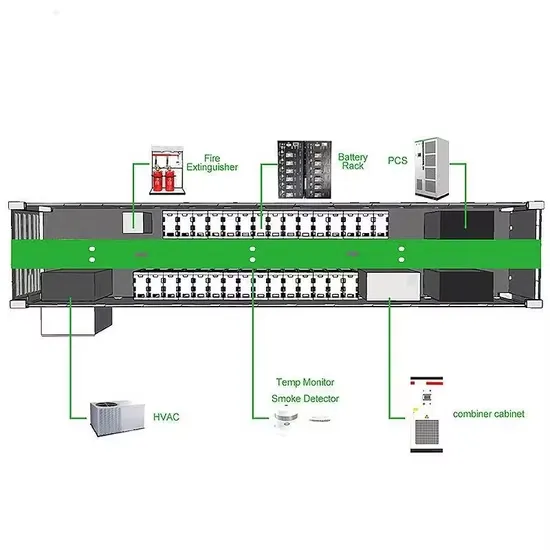

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.