5G Network Architectures and Technologies

Aug 1, 2025 · In NSA networking, 5G base stations cannot be deployed independently, requiring LTE base stations to be used as anchor points on the control plane for access to the core

What is 5g base station architecture

Aug 21, 2024 · A 5G base station, also known as a gNodeB (gNB), is a critical component of the 5G Radio Access Network (RAN). It facilitates wireless communication between user

Serial production of 5G base stations in Russia to be

Jan 22, 2024 · Russia may start serial production of base stations supporting the 5G communication format in 2025-2026, Minister for Digital Development Maksut Shadaev said in

Russia allocates over 630 mln rubles for development of 4G/5G base stations

Oct 9, 2023 · "The work is being as part of the ''Modern and Prospective Mobile Communication Networks'' roadmap to 2030. One of its threads calls for the development of 4G/5G mobile

Research and Implementation of 5G Base Station

Oct 28, 2023 · Especially with the development and promotion of national 5G technology, the construction of 5G base stations is an important part of the future communication

Rostec showed the first 5G base station created in Russia

Sep 23, 2020 · The development of a prototype of a Russian base station suggests that Russia has a chance to enter the world market of communication equipment for 5G and take its place

Learn What a 5G Base Station Is and Why It''s Important

A 5G base station is the heart of the fifth-generation mobile network, enabling far higher speeds and lower latency, as well as new levels of connectivity. Referred to as gNodeB, 5G base

5G Base Station Prototyping: Architectures Overview

Jul 17, 2024 · Among the requirements for the fifth-generation (5G) enhanced mobile broadband communications such as high-speed network parameters, mobility, spectral and energy

Development of 5G networks in Russia

Due to the fact that base stations with 5G support consume 2 times more electricity compared to LTE equipment, the development of fifth-generation networks in Moscow and other megacities

5G base station prototyping: implementation

Currently, mobile operators are actively working on testing and implementing the fifth generation (5G) mobile communications equipment (IMT-2020 standard). The concept of creating and...

5G base station prototyping: implementation possibilities in Russia

A brief overview of the development of 5G mobile communications in the world and in Russia is presented. 5G pilot projects in Russia are considered. The basic requirements for 5G

5G base station prototyping: implementation possibilities in Russia

The work of MIET on the development of software and algorithmic support for 5G transceiver equipment is described. An estimation is given concerning the feasibility of implementing 5G

5G base station prototyping: implementation

The work of MIET on the development of software and algorithmic support for 5G transceiver equipment is described. An estimation is given concerning the feasibility of implementing 5G

6 FAQs about [The working function of Moscow Communications 5G base station]

Will Russia test 5G in 2025?

According to Russian news agency Tass, Russia expects to conduct pilot testing of 5G networks in 2025 using “home grown”/ locally built base stations. Russia’s Ministry of digital development, communications and mass media Maksut Shadayev said, “We expect a pilot test to begin in 2025 in cities with more than one million people.”

Who created the first base stations in Russia for 5G networks?

On September 18, 2020, it became known about the creation of the first base stations in Russia for 5G networks. The development is carried out by the leading research center (FACE) "Global Wireless Communication Systems" on the basis of the company " GlobalInformService ." Read more here .

Is 5G coming to Moscow?

Moscow is now one of the cities where the testing of fifth generation communication - 5G - has already begun. These test operations anticipate the forthcoming commercial launch of the new technology. 5G is notable for gigabit speeds of data transfer, low latencies, high energy efficiency and ultra-high mobility for millions of connected devices.

What is a 5G base station?

It plays a central role in enabling wireless communication between user devices (such as smartphones, IoT devices, etc.) and the core network. The base station in a 5G network is designed to provide high data rates, low latency, massive device connectivity, and improved energy efficiency compared to its predecessors.

Will 5G provide new generation communication services in Russia?

According to the FAS, access to the released radio frequency spectrum for the construction of 5G networks and the subsequent provision of mobile radiotelephone services on 5G networks is an opportunity to provide new generation communication services in Russia.

What is the range of 5G networks in Russia?

This is stated in the strategy for the development of the communications industry published Ministry of Digital Development of the Russian Federation. The document was published in mid-August 2023. According to the strategy, the main range for 5G networks will be 4800-4990 MHz, with the potential to expand to 4400-4990 MHz.

Learn More

- China Communications Domestic 5G Base Station

- Israel Communications 5g base station main construction

- Vatican Communications 5G Base Station Address

- Jamaica Communications shares 5g base station

- Saudi Arabia Communications 5G Base Station Hybrid Power Supply

- Peru HJ Communications 5g base station bidding

- Equatorial Guinea Communications 5g Micro Base Station Construction Tendering Company

- Belize Communications 5G Base Station Progress

- Communications 5g base station construction in the third quarter

Industrial & Commercial Energy Storage Market Growth

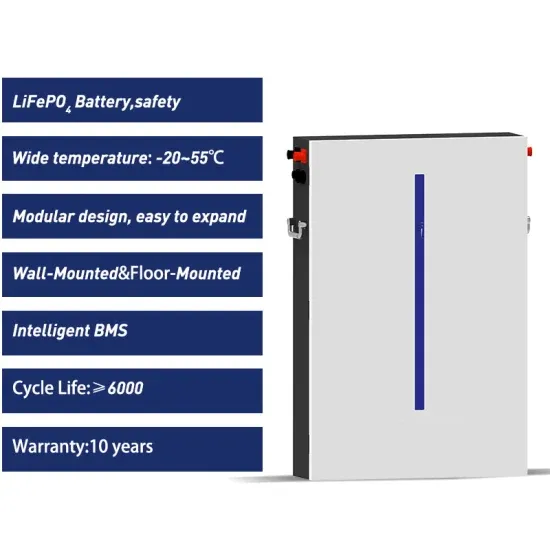

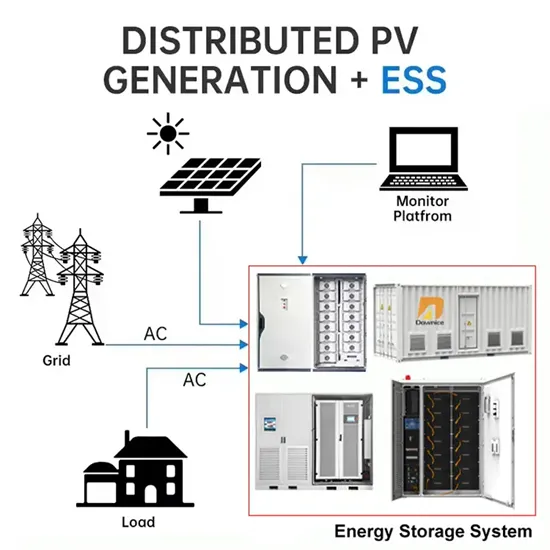

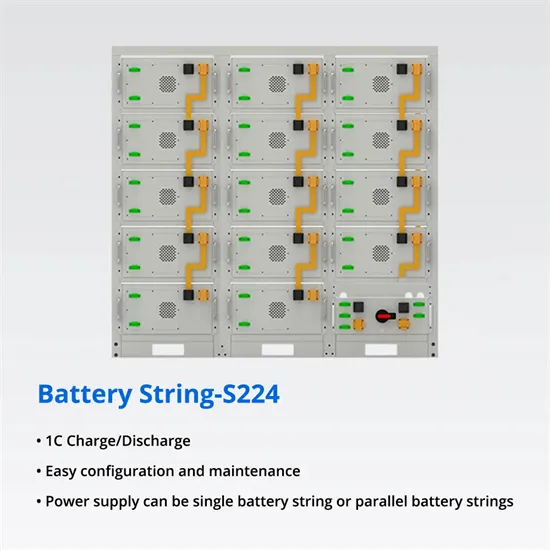

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.