Niger 5G Wireless Ecosystem Market (2025-2031) | Outlook,

Market Forecast By Ecosystem Component (Base Stations, IoT Sensors, Edge Devices, Cloud Platforms), By Frequency (Sub-6 GHz, mmWave, 26-39 GHz, Above 39 GHz), By Use Case

Unity™ Outdoor Integrated Base Station 5W_Unity™ 5G Outdoor

May 9, 2025 · SageRAN Unity™ 5G Integrated Base Station leverages the NXP LX2160A platform, featuring low power consumption, easy customization, and high integration

5G Outdoor Coverage Solution_5G Outdoor Coverage

May 9, 2025 · Based on the integrated base station developed by LX2160A, SageRAN adopts the integrated design method of 5G BBU and RRU. Based on the completely self-developed

Quick guide: components for 5G base stations and antennas

Mar 12, 2021 · 5G technology manufacturers face a challenge. With the demand for 5G coverage accelerating, it''s a race to build and deploy base-station components and antenna mast

Optimizing the ultra-dense 5G base stations in urban outdoor

Dec 1, 2020 · The objective of this study is to develop a location optimization model to support the planning of ultra-dense 5G BSs in urban outdoor areas and to help address the cost

Unity™ Outdoor Integrated Base Station 2W_Unity™ 5G Outdoor

May 9, 2025 · SageRAN Unity™ 5G Integrated Base Station leverages the NXP LX2160A platform, featuring low power consumption, easy customization, and high integration

Ambitious 5G base station plan for 2025

The move comes as the country charted its vision for industrial growth during a two-day work conference of the Ministry of Industry and Information Technology. With 4.19 million 5G base

5g base station architecture

Dec 13, 2023 · 5G (fifth generation) base station architecture is designed to provide high-speed, low-latency, and massive connectivity to a wide range of devices. The architecture is more

Unity™ Outdoor Integrated Base Station 20W_Unity™ 5G Outdoor

May 9, 2025 · SageRAN Unity™ 5G Integrated Base Station is based on the advanced multi-core ARM and FPGA scheme, and adopts the integrated design method of 5G BBU and RRU.

Types of 5G NR Base Stations: A Comprehensive Overview

Mar 26, 2025 · telcomatraining - As 5G technology continues to revolutionize the telecommunications industry, different types of 5G New Radio (NR) base stations have

Unity™ 4+5G Outdoor Integrated Base Station

May 9, 2025 · SageRAN Unity™ 4+5G Outdoor Integrated Base Station is a highly efficient 4+5G base station designed for outdoor use. It features an integrated 4 and 5G BBU and RRU, and

6 FAQs about [Niger outdoor 5g base station]

What is a 5G small cell base station?

5G Small Cell indoor and outdoor 'all-in-one' radio access for private 5G wireless networks. 5G Small Cell Base Stations (Micro Cell, Femtocell) offer advanced features and “stand alone” capability for private networks.

Which 5G bands are prioritized for deployment in Nigeria?

In the first phase of 5G deployment in Nigeria, all/some parts of the bands below are prioritized for release, recovery, re-farming and/or re-planning in line with global trends. These bands are: 2100 MHz Band 2300-2400 MHz 2600-2690 MHz

What is a 4G & 5G LTE base station?

Covering all common 4G and 5G LTE bands, the base stations feature software-defined radio, allowing great flexibility of operation and future upgrade paths. The CableFree Advanced 4G and 5G LTE SDR (software-defined radio) Small Cell Base Station – Outdoor Version – is suitable for a wide variety of applications.

What is a x4000 5G base station?

"Stand Alone" operation is possible which enables the 5G Base station to connect remote terminals without need for external network elements. Custom designed for private 5G mobile networks using 5G FR1 radio spectrum. The X4000 5G 'All-in-One' includes Radio Unit (RU), Distributed Unit (DU) and Centralised Unit (CU).

What is a 4G & 5G LTE SDR base station?

The CableFree Advanced 4G and 5G LTE SDR (software-defined radio) Small Cell Base Station – Outdoor Version – is suitable for a wide variety of applications. Covering all common 4G and 5G LTE bands, the base stations feature software-defined radio, allowing great flexibility of operation and future upgrade paths.

What is x4000 5G SDR small cell outdoor base station?

X4000 5G SDR Small Cell Outdoor base stations enjoy great flexibility, high performance as well as very low cost of operation and ownership. "Stand Alone" operation is possible which enables the 5G Base station to connect remote terminals without need for external network elements.

Learn More

- Outdoor 5G base station within the 5th ring of Muscat

- 5g outdoor base station company

- Hybrid Energy 5G Base Station Outdoor Power Station Procurement

- Uzbekistan 5g communication base station wind power construction project

- Is there only a 5G base station in Podgorica

- The working function of Moscow Communications 5G base station

- Belize Communications 5G Base Station Progress

- 5G base station battery connector

- Communication base station outdoor solar energy storage dedicated battery wholesale

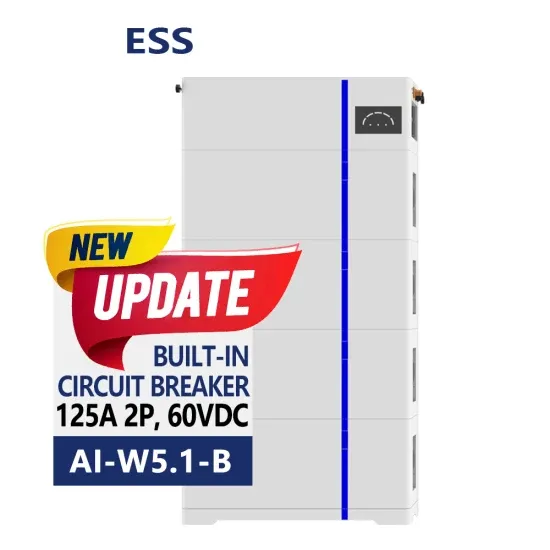

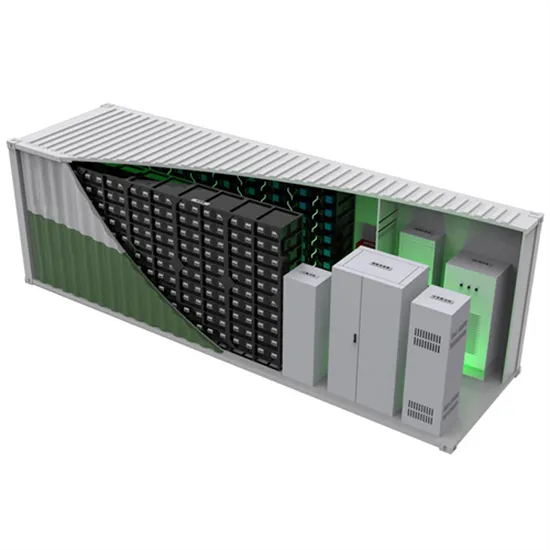

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.