Top 10 Solar Panel Manufacturers in Africa Powering the

May 23, 2025 · Africa''s solar energy sector is experiencing significant growth, driven by the continent''s abundant sunlight and increasing demand for sustainable energy solutions.

Top Photovoltaic Glass Factories in Gaborone Key Players

Key Players in Gaborone''s PV Glass Industry EK SOLAR: A leader in bifacial glass technology, supplying 25% of Botswana''s solar projects. SunTech Manufacturing: Specializes in anti

Solar PV Glass Market Valuation and Growth Forecast 2025

Jul 25, 2023 · The latest 2025 Solar PV Glass Market Research Unveils Breakthrough Trends And Opportunities. Access Real-Time Industry Data, Pricing Analysis, And Expert Forecasts

Middle East and Africa Photovoltaic Polyester Film Market

Jul 3, 2025 · Middle East and Africa Photovoltaic Polyester Film Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a CAGR of

Solar photovoltaic manufacturing in Africa:

Sep 25, 2024 · How can Africa leverage its natural resource endowments, trade, and latent productive capabilities for solar PV manufacturing, and what are the

Solar Photovoltaic Glass Market Size, Share & Growth

Jul 10, 2025 · The global Solar Photovoltaic Glass market size is expected to be valued at USD 256.21 Billion by 2033. Asia-Pacific held the major share of the global market in 2024.

Middle East and Africa Solar PV Glass Market Outlook 2025:

Aug 1, 2025 · The Middle East and Africa Solar PV Glass Market report by Precision Business Insights provides a comprehensive research approach combining primary and secondary

Middle East and Africa Solar PV Glass Market Price Analysis

Middle East and Africa Solar PV Glass Market Key Developments: In July 2024, Saudi Arabia''s Ministry of Industry and Mineral Resources has greenlit a $1.5 billion investment for a new

Solar Photovoltaic Glass Market Demand and Growth

Oct 31, 2024 - Solar Photovoltaic Glass Market is projected to register a 26.5 CAGR from 2023 to 2030. Geographically, the market is classified into major regions such as North America,

Africa Solar Photovoltaic Glass Market Size and Forecasts 2030

Apr 26, 2025 · Solar photovoltaic (PV) glass, a key component in solar panels, plays an essential role in enhancing the efficiency and durability of solar power generation. The market is driven

Solar Photovoltaic Glass: Features, Type and

Jun 27, 2023 · 1. What is solar photovoltaic glass?Solar photovoltaic glass is a special type of glass that utilizes solar radiation to generate electricity by

Dubai Photovoltaic Glass Export Ratio Trends Opportunities

Summary: Dubai''s photovoltaic glass export ratio has surged by 28% since 2021, driven by renewable energy investments and smart city initiatives. This article explores market drivers,

Africa Solar Photovoltaic Glass Market with Market Size | 2025

Emirates Float Glass LLC (EFG) is one of the largest float glass manufacturers in the Middle East and Africa region. Its PV glass product, SolarMax, is specifically designed for solar panels and

The African Glass Market Boom

Feb 27, 2025 · In a 2024 report by GlobeNewswire, the Middle East & Africa BIPV glass market was valued at US$ 315.58 million in 2023 and is expected to reach US$ 910.03 million by

Africa Solar Photovoltaic Glass Market with Market Size | 2025

Top Companies in Africa Solar Photovoltaic Glass Market with Market Size Africa Solar Photovoltaic Glass Market has been rising rapidly. As the demand for renewable energy

Oman Photovoltaic Glass Manufacturers Powering Solar

Summary: Oman''s photovoltaic glass manufacturers are emerging as key players in the global solar energy sector. This article explores their growing capabilities, technological advantages,

PHOTOVOLTAIC GLAZING IN BUILDINGS

Jul 15, 2022 · PV glazing is an innovative technology which apart from electricity production can reduce energy consumption in terms of cooling, heating and artificial lighting. It uses

Middle East and Africa Building-Integrated Photovoltaic

Jul 5, 2025 · Middle East and Africa Building-Integrated Photovoltaic Skylights Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at

EMEA (Europe, Middle East and Africa) Solar Photovoltaic Glass

In this report, the EMEA Solar Photovoltaic Glass market is valued at USD XX million in 2016 and is expected to reach USD XX million by the end of 2022, growing at a CAGR of XX% between

Middle East and Africa PVB Double Glass Photovoltaic

Jul 3, 2025 · Several dynamic factors influence the development of the Middle East and Africa''s PVB Double Glass PV Module Market, including advancements in module efficiency and

6 FAQs about [East Africa EK makes photovoltaic glass]

Does Africa have a solar PV market?

Silicon, a key input for the production of c-Si solar PV cells, is also found in Africa, albeit in smaller quantities compared to global leaders like China. Nonetheless, Africa’s mineral wealth represents a significant opportunity for the continent to leverage its natural resources to become a player in the global solar PV market.

Can Africa become a leader in solar power generation & solar PV Manufacturing?

Africa has significant potential to become a leader in solar power generation and solar PV manufacturing. However, the continent faces several challenges, including market concentration, technological limitations, and financial constraints.

Are African countries able to develop a competitive solar PV industry?

Individually, most African countries lack the financial resources, technological capabilities, and infrastructure needed to develop a competitive solar PV manufacturing sector. Moreover, the global solar PV market is highly concentrated, with China dominating nearly every segment of the value chain.

Do African countries need a manufacturing base for solar PV?

The production of solar PV cells, modules, and other components requires advanced manufacturing processes, skilled labor, and well-developed infrastructure. Unfortunately, many African countries lack the necessary industrial base to support solar PV manufacturing.

Can Africa enter the global solar PV value chain?

Africa’s natural resource endowments present a unique opportunity for the continent to enter the global solar PV value chain. Key minerals required for solar PV production—such as copper, tin, and silicon—are found in significant quantities in several African countries.

Is Africa a good place to invest in solar energy?

Africa, with its vast landmass and abundant sunlight, is geographically well-positioned to take advantage of the global growth in solar PV. Many African countries experience high levels of solar irradiance, providing them with a natural advantage in solar energy generation.

Learn More

- Photovoltaic glass production in East Africa

- East Asia makes solar photovoltaic panels

- East Africa Photovoltaic Energy Storage Power Generation Project

- East Africa Photovoltaic Panel Sales Manufacturer

- EK photovoltaic single glass module

- Bandar Seri Begawan double glass photovoltaic module manufacturer

- Photovoltaic power station is sealing glass

- Angola Photovoltaic Solar Glass Manufacturer

- Demand for photovoltaic glass slows down

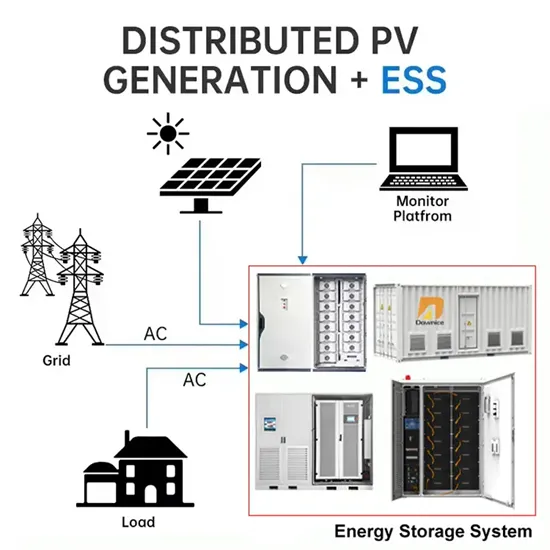

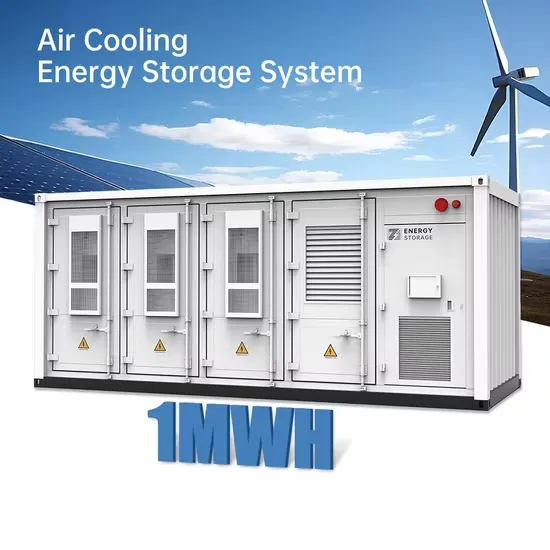

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.