Big Chinese Solar Glass Makers Confirm Output Cuts Amid

(Yicai) Sept. 5 -- Major Chinese producers of photovoltaic glass confirmed that they are idling furnaces to reduce output in response to a severe supply glut, but industry insiders are unsure

A decline in demand has triggered a drop in prices, and photovoltaic

Jul 1, 2025 · ①The industry predicts that the reduction in photovoltaic glass production may be between 15% to 20%; ② Due to the mismatch in supply and demand, the selling price of

The price of original glass slows down

In terms of spot and demand, the price of original films is high, and downstream funds are tight. Recently, many regions have been affected by the control of the epidemic, and the enthusiasm

Say No to Involution! Leading Glass Manufacturers to Cut

Jul 1, 2025 · Recently, PV glass manufacturers gathered to discuss the current supply-demand imbalance. The industry is facing increasing harm from intensified "involution-style"

Solar Photovoltaic Glass Market Analysis with Growth

Jan 7, 2025 · Key Market Drivers: Environmental Sustainability: With a pressing need to reduce carbon emissions and mitigate climate change, the demand for renewable energy solutions

Rising Demand For Solar Photovoltaic Glass Market: Driven

Aug 13, 2025 · Solar Photovoltaic Glass Market to Reach $243.7 Billion by 2033, Growing at 30.5% CAGR 🌞 Global solar photovoltaic glass market to hit $243.7B by 2033, fueled by green

Global and China Photovoltaic Glass

May 21, 2019 · Abstract In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total.

Strategic Vision for Solar Photovoltaic Glass Industry

Jun 30, 2025 · The solar photovoltaic (PV) glass market is experiencing robust growth, driven by the increasing global demand for renewable energy solutions and supportive government

Expectations For Supply and Demand Indicate a Slight

Aug 2, 2023 · The total domestic photovoltaic glass production capacity amounts to 96,440 tons/day, with an industry capacity utilization rate of 94.37%. However, due to market

Will the glass supply be tight in the next few years?

Sep 17, 2021 · At the same time, as the penetration rate of double-glass modules continues to increase, the demand for photovoltaic glass will maintain high growth. According to Huaxi

Photovoltaic Glass Industry Faces Downturn Cycle Amid

Jun 25, 2025 · The photovoltaic (PV) glass industry is currently navigating a challenging downturn, with June demand expected to shrink significantly while supply reductions struggle

China Solar Photovoltaic Glass Market Size and Forecasts 2030

Apr 26, 2025 · China Solar Photovoltaic Glass Market is driven by the rising adoption of solar energy systems, advancements in solar panel technology, and supportive government policies.

Rising Demand for Solar Photovoltaic Glass Market: Driven

Aug 13, 2025 · Conclusion The solar photovoltaic glass market is experiencing unprecedented growth, driven by climate change concerns, supportive policies, and continuous innovation.

Photovoltaic Glass Market | Size & Share Analysis

The photovoltaic glass market has witnessed significant growth in recent years, driven by the increasing demand for sustainable energy solutions and the rising awareness of environmental

Solar Market Analysis February 2025

Feb 27, 2025 · Not necessarily bad news. Overcapacity remains high, particularly in China, but analysts expect global demand for modules to rise while growth slows from 25% to 30%

Declining Demand Triggers Price Drop; Photovoltaic Glass

Jul 2, 2025 · According to industry sources, due to weak current demand and continued losses, some photovoltaic glass companies have opted for production reductions or cold maintenance,

Photovoltaic Glass Waste Recycling in the Development of

Apr 3, 2023 · Because of the increasing demand for photovoltaic energy and the generation of end-of-life photovoltaic waste forecast, the feasibility to produce glass substrates for

Solar Photovoltaic Glass Market: Solar Demand is

Jul 24, 2023 · The solar photovoltaic glass market size reached USD 7.6 billion in 2022 and is estimated to hit around USD 114.44 billion by 2032, growing at a CAGR of 31.2% from 2023 to

Polysilicon, PV glass manufacturers cut production to tackle

Jul 3, 2025 · National polysilicon output fell 44.1% y/y in H1, bringing production roughly in line with demand – a key driver behind this week''s price rebound. Industry leader Tongwei

Building Integrated Photovoltaics (Bipv) Glass Market Size

Building Integrated Photovoltaics (BIPV) Glass Market Analysis and Size The increasing demand for building integrated photovoltaic (BIPV) materials such as glass because of the growing

Technological learning for resource efficient terawatt

We assess demand for fundamental resources until the year 2100, which are necessary independently from the specific nature of the used PV technology, i.e. energy, float-glass, and

Photovoltaic Glass Demand Rises

Photovoltaic glass demand rises Under the background of "double carbon", the demand for photovoltaic glass has huge potential. Although photovoltaic glass rebounded sharply at the

PV Glass Prices Remain Stable Amid Inventory Challenges

Jul 5, 2023 · The high inventory levels pose a challenge to the de-stocking efforts, resulting in difficulties for photovoltaic glass prices to rebound. Currently, PV glass prices have stabilized,

Learn More

- Huawei Photovoltaic Industry s Demand for Glass

- Photovoltaic glass opens up demand space

- Australian double glass photovoltaic module manufacturer

- Montevideo Sun Room Photovoltaic Glass Price

- Abu Dhabi non-standard photovoltaic glass component research and development

- Manama Photovoltaic Multi-span Glass Greenhouse

- Companies producing photovoltaic glass stone in Mexico

- Solar photovoltaic transparent glass

- Installation of photovoltaic curtain wall with power generation glass

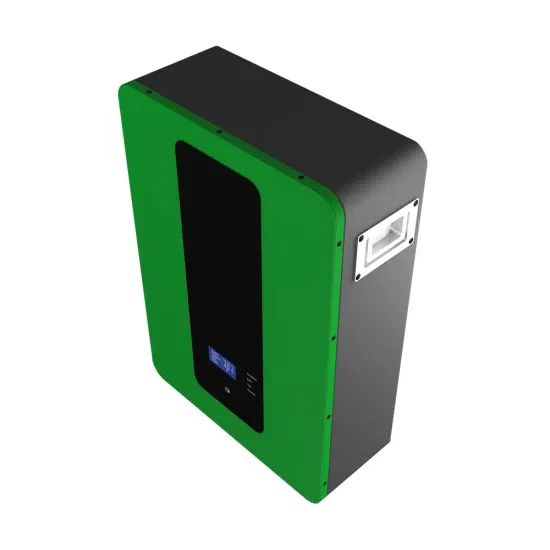

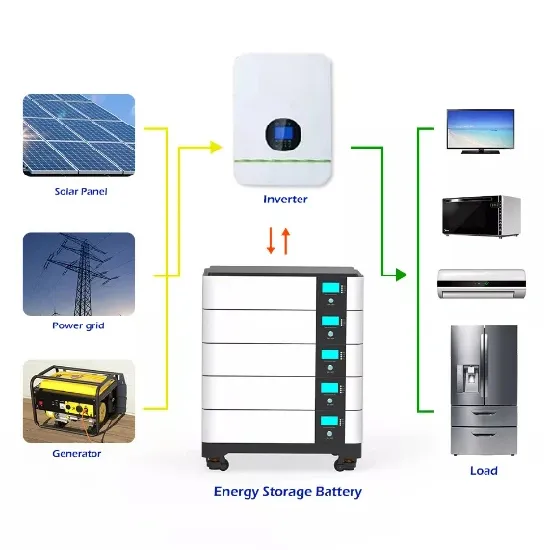

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.