The Effectiveness of Solar Photovoltaic Energy Policies in

Jun 10, 2024 · The Effectiveness of Solar Photovoltaic Energy Policies in Dubai and Abu Dhabi Climate change and resource depletion have been affecting the world for several

A Review on Solar Energy Utilization and Projects: Development

Aug 18, 2025 · In this review, we discuss five major aspects of solar energy utilization and projects within the framework of the UAE starting with (i) recent advances in solar scenario

A path to sustainable development goals: A case study on

Apr 1, 2024 · Noor —the Arabic word for light— Abu Dhabi is the largest single-site solar power facility near Abu Dhabi in Sweihan, with 3.2 million solar panels. Ninety thousand people in

(PDF) A Review on Solar Energy Utilization and Projects: Development

May 19, 2022 · Abu Dhabi, on the other hand, focuses on monumental projects like Noor Abu Dhabi and the Al Dhafra Solar PV Project, which highlight large-scale strategic renewable

The Effectiveness of Solar Photovoltaic Energy Policies in

Feb 25, 2025 · Both Dubai and Abu Dhabi have strongly emphasized building local capacity in solar technology through partnerships with academic institutions and international companies,

Plan Abu Dhabi 2030 | The Official Portal of the UAE

Plan Abu Dhabi 2030 ''Plan Abu Dhabi 2030 - Urban Structure framework Plan'' is designed to help Abu Dhabi Government filter and respond to current and future development needs, establish

(PDF) A Review on Solar Energy Utilization and Projects: Development

May 19, 2022 · In this review, we discuss five major aspects of solar energy utilization and projects within the framework of the UAE starting with (i) recent advances in solar scenario

ASPIRE – Technology Transition Arm of Advanced

Aug 8, 2025 · ASPIRE is a Research and Development Funding Organization in the UAE that liaises with leading stakeholders to frame problem statements, design research projects,

New Year''s first stop | Light and rigid components shine in Abu Dhabi

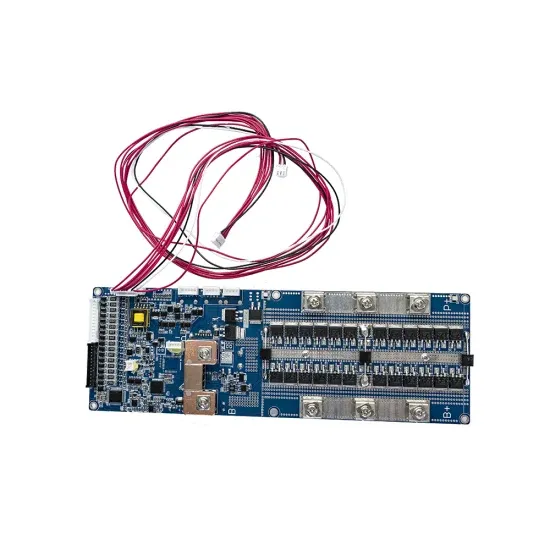

Jan 20, 2025 · In summary, the light and rigid components rely on the company''s own patented technology, retaining the safety and reliability genes of traditional components, achieving

The Effectiveness of Solar Photovoltaic Energy Policies in

May 7, 2024 · Abstract The study examines the effectiveness of solar photovoltaic (PV) energy policies in Dubai and Abu Dhabi, focusing on their roles in the UAE''s transition to renewable

The Rise of Solar Energy Sector in Abu Dhabi

Jan 29, 2025 · Abu Dhabi leads the solar energy sector, driving sustainability with ambitious renewable goals. Solar power plays a key role in reducing fossil fuel

Stavanger Innovation Summit_Final Paper

Oct 11, 2023 · One preliminary conclusion is that, for energy city regions such as Abu Dhabi, research universities must pursue a varied set of activities to support innovation and industry

Assessing the sustainability of solar photovoltaics: the case of glass

Sep 12, 2024 · The life cycles of glass–glass (GG) and standard (STD) solar photovoltaic (PV) panels, consisting of stages from the production of feedstock to solar PV panel utilization, are

Almaden plans photovoltaic glass plant in Abu Dhabi to

Apr 29, 2025 · The company intends to invest in a major photovoltaic glass production line project located in the Khalifa Industrial Park Free Trade Zone (KIZAD) in Abu Dhabi, UAE. This

Almaden Announces Photovoltaic Glass Production Line

Jun 5, 2025 · The company''s main business focuses on the research and development of photovoltaic glass coating technology, as well as the production and sales of photovoltaic

Value Engineering Guidelines

Jun 2, 2021 · 1.2 Scope During development of this guide, information was collected through a comprehensive literature review including documents from various transportation agencies in

4 FAQs about [Abu Dhabi non-standard photovoltaic glass component research and development]

Does Abu Dhabi have solar energy?

According to the study, which discusses UAE solar energy projects, Abu Dhabi covers 84% of the total land area in the country, ultimately enabling the capital to utilize the high sunlight exposure to convert it into electrical power to be consumed by residents in the cities .

How is photovoltaic technology transforming the United Arab Emirates?

Photovoltaic (PV) technology is rapidly evolving to meet the demands of people in the United Arab Emirates (UAE) by generating more electricity. The UAE has demonstrated that it has the world’s highest rates of sun exposure, indicating a significant efficiency in solar energy development.

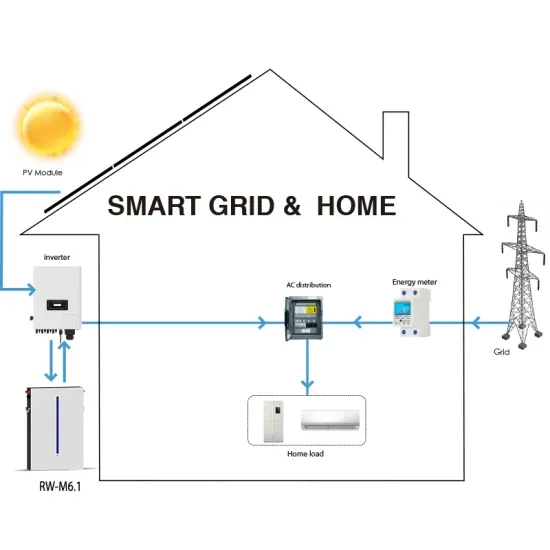

Why should UAE invest in solar power & battery energy storage?

The world-leading project reflects the vision and commitment of the UAE leadership in driving socioeconomic and environmental progress. The accelerated integration of solar power and advanced battery energy storage sets a new benchmark in clean energy, driving sustainability and reducing carbon emissions.

Is UAE a good place to invest in solar energy?

The UAE has demonstrated that it has the world’s highest rates of sun exposure, indicating a significant efficiency in solar energy development. This might be a way to cut down on fossil fuel consumption and greenhouse gas emissions even further.

Learn More

- Abu Dhabi s new photovoltaic solar panels

- San Marino non-standard photovoltaic glass shipments

- London New Energy Building Photovoltaic Glass Component Wholesale

- Abu Dhabi Solar Photovoltaic Module Company

- New Energy Photovoltaic Power Generation Glass Component Lamination

- Abu Dhabi monocrystalline photovoltaic panel prices

- Abu Dhabi greenhouse photovoltaic panel manufacturer

- Huawei Niamey Photovoltaic Glass

- Companies producing photovoltaic glass stone in Mexico

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.