Study on Power Feeding System for 5G Network

Oct 24, 2019 · High Voltage Direct Current (HVDC) power supply HVDC systems are mainly used in telecommunication rooms and data centers, not in the Base station. With the increase of

CB Radio Base Station Equipment Recommendations and

The basic components for a Base Station CB System include a CB radio, power supply (if you are using a mobile CB radio instead of a base station CB radio), coax, and an antenna. The article

Base Station Components | Radio Comms Warehouse

Base Station Components The NOVA range of power supplies is the most extensive by far. Each unit has been developed over the years incorporating value added features such as metering

Telecom Base Station Power System Solution

The EverExceed base station system is equipped with an AC and DC system, which consists of an AC distribution box/panel, a -48V high-frequency switch combined power supply (including

Towards Efficient, Reliable, and Cost-Effective Power Supply

May 7, 2021 · Power supplies requirements in 5G telecom base stations The requirements mentioned above for 5G infrastructure translate into some key features required for AC-DC

huawei base station

Dec 23, 2023 · Power Supply Unit (PSU): This provides the necessary electrical power to operate the base station components. It ensures that all parts of the base station have a consistent

Building better power supplies for 5G base stations

May 25, 2025 · Building better power supplies for 5G base stations Authored by: Alessandro Pevere, and Francesco Di Domenico, both at Infineon Technologies Infineon Technologies -

TETRA MTS1 Base Station Specification Sheet

Apr 5, 2025 · KEEPING COSTS DOWN The running costs of base station sites typically account for a significant portion of the total cost of ownership of any TETRA network. MTS1 base

Research on Design of Switching Power Supply Based on

Jan 6, 2024 · These special working conditions for mobile base stations for communications power equipment put forward higher requirements, mainly in the following areas: The use of

Telecom Power Supplies | Rectifiers | Inverters

The new SLIMLINE NG rectifier series covers the entire range of mobile radio applications, from the Mobile Switching Centre (MSC) to the Base Station Controller (BSC) and the individual

Communication Base Station Backup Battery

When natural disasters cut off power grids, when extreme weather threatens power supply safety, our communication backup power system with intelligent charge/discharge management and

Power Supply Solutions for Wireless Base Stations Applications

Power supplies can be employed in each of the three systems that compose wireless base stations. These three systems are known as the environmental monitoring system, the data

Base Station Power Supply

It allows mobile phones to work within a local area, as long as it is linked to a mobile or wireless service provider. It is a fixed point of communication for customer cellular phones on a carrier

Mobile base station site as a virtual power plant for grid

Mar 1, 2025 · The system consists of a live mobile base station site with a mobile connection to the site, local controller, an existing battery, and a power system that, in combination, can

6 FAQs about [Mobile base station equipment power supply unit]

What is a power supply system?

The power supply systems thus secure the entire transmission technology (LTE, 5G, VOIP, TV, servers, etc.) against network failures. They are precisely tailored to the requirements of the telecommunications network operators. These include:

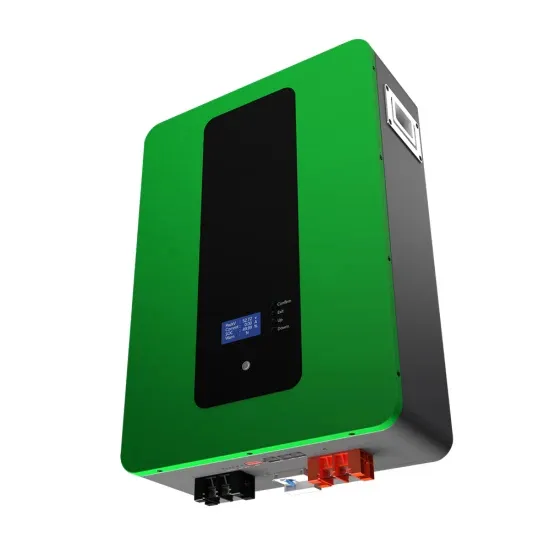

What is battery management system?

Battery management system used in the field of industrial and commercial energy storage.

How many kW does a telecom power supply have?

Telecom power supplies with rectifier (72 kW right, or 90 kW left) and inverter (7.5 kVA) in one system as well as 10" touch display of the MCU 3000 system controller built into the cabinet door.

What is Benning power supply?

Learn more BENNING has been supplying battery-based AC and DC power supplies to various mobile and fixed network operators worldwide for decades and has invested heavily in the development of highly efficient power supplies for energy-saving and reliable operation.

How does a 5G base station reduce OPEX?

This technique reduces opex by putting a base station into a “sleep mode,” with only the essentials remaining powered on. Pulse power leverages 5G base stations’ ability to analyze traffic loads. In 4G, radios are always on, even when traffic levels don’t warrant it, such as transmitting reference signals to detect users in the middle of the night.

How will mmWave based 5G affect PA & PSU designs?

Site-selection considerations also are driving changes to the PA and PSU designs. The higher the frequency, the shorter the signals travel, which means mmWave-based 5G will require a much higher density of small cells compared to 4G. Many 5G sites will also need to be close to street level, where people are.

Learn More

- Solar hybrid power supply for mobile base station equipment in Paramaribo

- China Mobile 5g base station power supply equipment supplier

- Base station power supply equipment mainly includes

- Mobile base station power supply application types

- Electric power equipment mobile base station installation

- Base station equipment power supply test

- Does the base station power supply equipment have a battery

- Railway base station equipment and power supply

- Internal power supply of mobile base station

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.