Important components for cellular equipment have been

Apr 24, 2025 · The Russian industry has begun to actively develop the production of equipment and components for cellular communications. Until 2022, base stations (BS), without which

Inverter Transformers for Photovoltaic (PV) power plants:

Dec 22, 2022 · I. INTRODUCTION Utility scale photovoltaic (PV) systems are connected to the network at medium or high voltage levels. To step up the output voltage of the inverter to such

Solar Transformers: Sizing, Inverters, and E

May 29, 2024 · Learn all about transformer sizing and design requirements for solar applications—inverters, harmonics, DC bias, overload, bi-directionality,

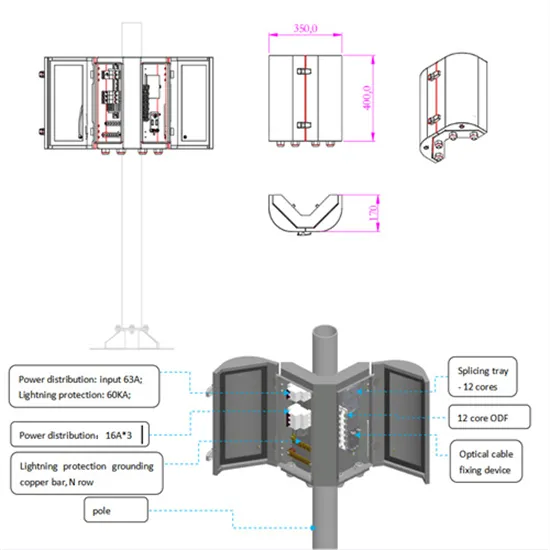

Wireless Communication Base Station Location Selection

Jun 9, 2024 · 1. Introduction Recently, with the rapid development of wireless communication technology, the enhancement of wireless network performance is concerned with meeting the

Rostec showed the first 5G base station created in Russia

Sep 23, 2020 · Rostec presented the first 5G base station created in Russia during CIPR 2020 conference. The base station model is assembled from three parts: a radio transmitting

Mass installation of base stations to connect villages in Russia

Jan 31, 2025 · Mass installation of domestic base stations as part of the Elimination of Digital Inequality project to connect small settlements in Russia to high-speed Internet will begin in

The first 5G base station in Russia was presented at CIPR-2025

Jun 2, 2025 · MTS presented the first Russian 5G base station "Irteya" at the All-Russian CIPR-2025 conference.According to the company''s press service, the new generation of base

5G Base Station Prototyping: Architectures Overview

Jul 17, 2024 · BS type 1-С is similar in its structure with distributed base stations used in 4th generation of mobile communication. It includes as well as 4G BS a separate remote antenna

Smart grids in Russia: status, barriers, and prospects for

Jan 1, 2022 · The most urgent problems in the complex power grid of Russia include a high losses level and high equipment wear. The average level of losses in grids is about 9%, which is 3%

Simulation and Classification of Mobile Communication Base Station

Dec 16, 2020 · In recent years, with the rapid deployment of fifth-generation base stations, mobile communication signals are becoming more and more complex. How to identify and classify

[Solved] In wireless communication, the base station is connected

Jul 11, 2022 · The Correct answer is MSC: Key Points Wireless communication It is a broad term that incorporates all procedures and forms of connecting and communicating between two or

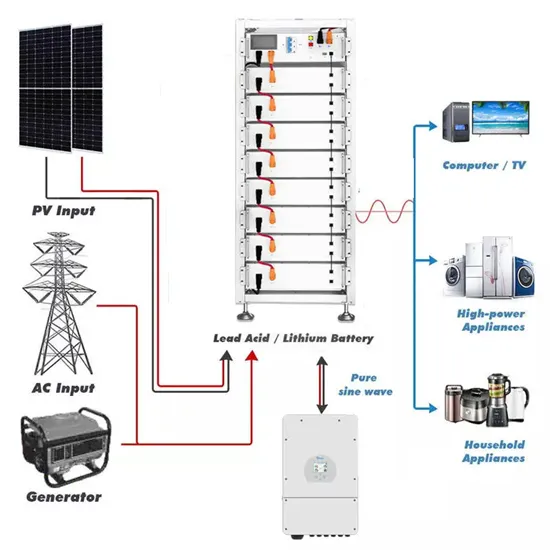

Energy storage system of communication base station

Energy storage system of communication base station Base station energy cabinet: floor-standing, used in communication base stations, smart cities, smart transportation, power

Ericsson deploys 25,000 base stations in Russia; 100 5G

Aug 19, 2020 · Ericsson is deploying 25,000 5G capable base stations across Russia as part of their five year agreement with Tele2. This milestone represents the completion of 50 percent of

6 FAQs about [The most used communication base station inverter in Russia is connected to the grid]

Will Russian base stations speed up the development of Russian components?

Experts consider the mechanism timely, but emphasize that it will not speed up the development of Russian components. In early October 2022, it became known about the decision of the Government of the Russian Federation to support manufacturers of Russian base stations for 4G- and 5G networks .

Will Russia support Russian base stations for 4G & 5G networks?

In early October 2022, it became known about the decision of the Government of the Russian Federation to support manufacturers of Russian base stations for 4G- and 5G networks . { {quote 'As for 5G and 4G, we have introduced a restriction on the use of new foreign base stations since 2023, now a lot of work is underway with telecom operators.

How many base stations are there in Russia?

According to Vedomosti, by the end of November 2020, there are about 90 thousand base stations in the Russian capital, and with the launch of 5G networks, the number of such equipment will at least triple.

Will Ericsson build a 5G base station in Russia?

In December 2021, Kommersant, citing its sources, wrote that Ericsson is preparing for the process of localizing the production of 5G base stations in the Russian Federation. According to the publication, the Swedish company is considering options for partnership or creating its own site for the production of equipment.

Who makes cellular base stations in Russia?

For example, Yadro has opened the first production line in Russia for electronic modules for cellular base stations, Izvestia was told by X Holding, which it belongs to. This is one of the key production elements required for a full-fledged large-scale production of base stations, which is scheduled for the end of this year.

Will a new LTE base station be made in Russia?

The head of the Ministry of Digital Science Maksut Shadayev said earlier in 2021 that an agreement had been reached with two manufacturers on localization in the Russian Federation, the transfer of rights to Russian partners for the production of modern LTE base stations.

Learn More

- Australian outpost communication base station inverter connected to the grid 6 9MWh

- A small communication base station inverter in Georgia is connected to the grid

- The inverter for Moldova s communication base station is connected to the grid by Huawei

- Pakistan s first communication base station inverter connected to the grid 125kWh

- Energy storage ESS rate of communication base station inverter grid connection

- How big is the impact of connecting the inverter of the communication base station to the grid

- What communication base station inverters are connected to the grid in Kazakhstan

- Bidding for West Asia Communication Base Station Inverter Grid Connection Construction Project

- Is the communication base station inverter incompatible with the grid

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.