Sino-Moroccan Venture Begins Battery Materials Production in Morocco

Jun 26, 2025 · COBCO, a joint venture between Morocco''s Al Mada investment fund and China''s CNGR Advanced Materials, has commenced production of lithium-ion battery components at

1.6GWh Battery Energy Storage System Tender Launched!

Apr 14, 2025 · Morocco holds 71% of the world''s phosphate reserves and is rich in cobalt resources, providing core raw materials for lithium iron phosphate and ternary batteries.

COBCO Starts Production of Battery Materials in Morocco

Jun 27, 2025 · Sino-Moroccan company COBCO has begun producing components for lithium-ion batteries in the Jorf Lasfar industrial area. Located about 125 kilometers south of Casablanca,

Morocco Battery Pack Market (2022-2028) | Trends, Outlook

Market Forecast By Product Type (Laptop Battery Pack, Power Battery Pack, Phone Battery Pack, Others), By Battery Type (Lithium-ion Battery, Nickel Metal Hydride Battery, Lithium

BMS 3S 40A Li-ion Chargeur de Batteries Lithium

5 days ago · Un BMS (Battery Management System) de 3 cellules de 40A est un dispositif de gestion de batterie qui surveille et contrôle les cellules de batterie

COBCO opens in Morocco first lithium battery

Jun 25, 2025 · COBCO, a joint venture between CNGR and Al Mada, launched today a two billion dollar lithium-ion battery materials plant in Morocco, the first

Morocco Casablanca Lithium Battery Pack Factory Powering

From supporting Morocco''s 52% renewable energy target by 2030 to enabling cost-effective storage solutions across Africa, Casablanca''s lithium battery factories are reshaping the

Duracell ENERGIZER 357-303 BP Energizer Silver Oxide Battery

Best prices for Duracell ENERGIZER 357-303 BP Energizer Silver Oxide Battery 1.5v Blister Pack | Batteries and all Multimeters in Morocco - Casablanca, Fez, Tangier, Marrakesh, Salé,

Tinci Materials Announces $2 Billion Morocco Investment as

Jun 17, 2025 · Weike Lithium Battery Network noted that Morocco is becoming a hotbed for Chinese lithium battery company investments.For instance, in May, Gotion High-Tech''s

How Morocco could benefit from the Honeywell

Mar 5, 2025 · Since 2023, Tinci has committed to investing $280 million in the construction of a lithium-ion battery material production plant in Morocco. This

Morocco expects more EV battery investments, minister says

Apr 5, 2024 · The Moroccan government is in talks to attract more electric battery manufacturers as it seeks to adapt its growing automotive sector to an increasing demand for electric

Buy Dakota Lithium Batteries Products on Desertcart Morocco

Shop for Dakota Lithium Batteries products online in Casablanca, a leading shopping store for Dakota Lithium Batteries products at discounted prices along with great deals and offers on

Lithium Battery Packs | BigBattery | Your Source

2 days ago · "Big Battery made converting our 48v lead acid EZGO cart to lithium a breeze. Our cart is lighter, faster and the range went up dramatically using

Morocco EV recycling: $500M Circular Tech Projects Open

The Morocco EV recycling project includes: Battery collection centers at ports and transport hubs Metal recovery plants for lithium, cobalt, and nickel Second-life battery assembly lines for grid

Sino-Moroccan COBCO begins producing EV battery materials

Jun 25, 2025 · Sino-Moroccan company COBCO said on Wednesday it had begun production at a plant for lithium-ion battery components in Jorf Lasfar, 125 kilometres (78 miles) south of

Morocco new energy lithium battery price list

IEA analysis based on data from Bloomberg and Bloomberg New Energy Finance Lithium-Ion Price Survey (2023). Notes "Battery pack price" refers to the volume-weighted average pack

6 FAQs about [Morocco Casablanca large single lithium battery pack]

Does Morocco have a battery supply chain?

This initiative reinforces the country’s growing role in the renewable energy sector and its ambition to integrate itself into the global battery supply chain. Rather than merely exporting raw materials like cobalt and phosphates, Morocco aims to develop a full-fledged industrial ecosystem around battery technology.

Which Chinese lithium battery companies are based in Morocco?

Since 2023, several Chinese lithium battery industry chain companies, including CATL, Gotion High-Tech, Sunwoda, BTR, Huayou Cobalt, CNGR Advanced Material and Tinci Materials, have collectively invested in Morocco and built factories. The battery industry chain centered around LFP is forming rapidly.

What's going on with EV batteries in Morocco?

The battery industry chain centered around LFP is forming rapidly. In June this year, the Moroccan government announced that Gotion High-Tech would invest $1.3 billion (US) to build a gigafactory for EV batteries.

Why is Morocco a key player in the lithium-ion battery industry?

The lithium-ion battery industry is experiencing rapid growth, driven by the global shift toward clean energy and the increasing demand for electric vehicles. In this evolving landscape, Morocco is emerging as a key player, attracting major industrial investments.

Why is Morocco a good place to invest in lithium-ion batteries?

Several factors position Morocco as an attractive hub for this burgeoning industry. Its geographical proximity to Europe, government-driven push for green industrialization, and rich reserves of strategic raw materials make it an appealing destination for lithium-ion battery investments.

Does CATL have a battery production base in Morocco?

CATL has already planned over 100 GWh of production capacity at its European factories. Additionally, Sunwoda is also setting up a battery production base in Morocco. The number of material manufacturers investing in Morocco is even larger.

Learn More

- Pakistan Karachi large single lithium battery pack

- 150a large single lithium battery pack

- Ljubljana single lithium battery pack

- Customized large monomer lithium battery pack

- Maseru large monomer lithium battery pack

- 12v lithium battery pack 30000 mAh

- High voltage lithium battery pack protection solution

- 4-cell 24v lithium battery pack production

- Major lithium battery pack companies in Bolivia

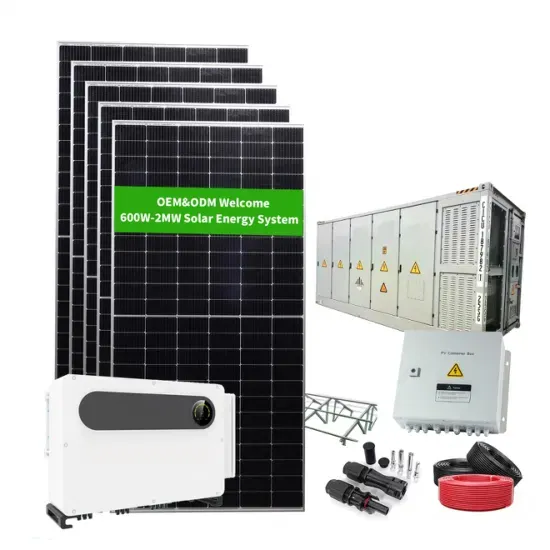

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

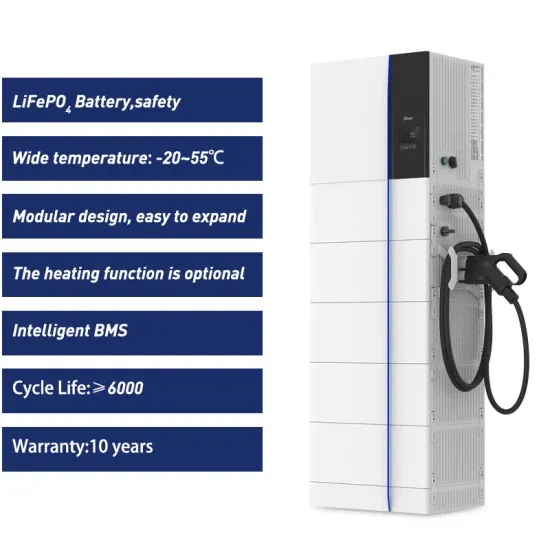

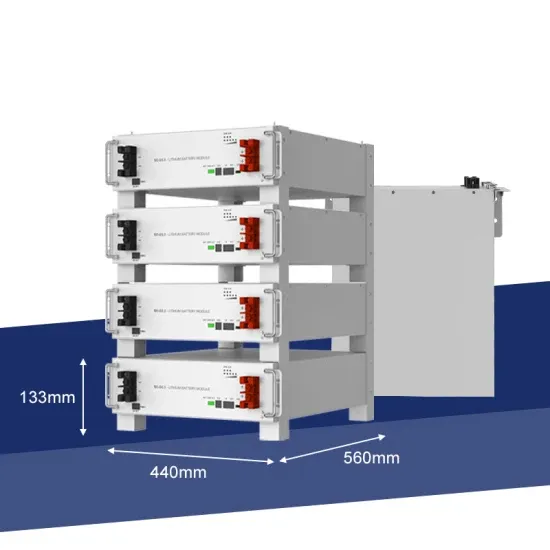

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.