Top 10 BESS manufacturers in Canada

4 days ago · This paper will introduce the top 10 BESS manufacturers in Canada including TERIC Power, Northland Power, TransAlta, EVLO, Hecate Energy, Discover Battery, AltaStream,

Northland Power Announces Commercial Operations at Oneida Energy

May 7, 2025 · Oneida Energy Storage Project, April 2025 TORONTO, May 07, 2025 (GLOBE NEWSWIRE) -- Northland Power Inc. (" Northland " or the " Company ") (TSX: NPI) is pleased

Over 700 MW of Energy Storage Projects Announced as Next Step in Canada

16 May 2023 Today the Independent Electricity System Operator (IESO) announced seven new energy storage projects in Ontario for a total of 739 MW of capacity. The announcement is part

Advanced Clean Energy program: Battery energy storage

Sep 18, 2024 · Canada has all the resources needed to provide lithium, cobalt and nickel to the rapidly expanding battery industry. There is significant potential to increase resource

A snapshot of Canada''s energy storage market in 2023

Jun 2, 2023 · By Justin Rangooni, Executive Director, Energy Storage Canada The last 12 months have seen considerable development in Canada''s energy storage market. The result

Top 100 Battery Suppliers in Canada (2025) | ensun

The battery industry in Canada is experiencing significant growth, driven by increasing demand for electric vehicles and renewable energy storage solutions. When researching companies in this

26 Top Energy Storage Companies in Canada · August 2025

Aug 1, 2025 · Moment Energy provides affordable, clean, and reliable energy storage by repurposing retired EV batteries. EV batteries still have an average of 80% original capacity

Sizing Merchant Energy Storage for Maximum Revenues

Jan 20, 2025 · The first considers only energy arbitrage and costs $4,812,909, which is less than the cost without storage at $9,299,623. The second scenario allows for energy arbitrage and

quality manager batteries jobs in Toronto, ON

Founded in 2019, Proventus Global is a vibrant company offering comprehensive solutions in renewable energy, battery storage, power quality, and power equipment, aiding Canada in its

26 Top Energy Storage Companies in Canada · August 2025

Aug 1, 2025 · Detailed info and reviews on 26 top Energy Storage companies and startups in Canada in 2025. Get the latest updates on their products, jobs, funding, investors, founders

Bluesphere Plans Dozens of Energy Storage Facilities in Toronto

Mar 5, 2025 · Bluesphere Ventures is set to develop dozens of five-megawatt (MW) energy-storage projects across Toronto as part of a broader plan to deploy 200 MW of battery-storage

Market Snapshot: Energy storage in Canada may multiply by

Jul 23, 2025 · BESS is the fastest growing energy storage technology in Canada and is also the dominant storage technology in terms of capacity and number of sites. All but four projects

e-STORAGE Toronto Office: Careers, Perks + Culture | Built In Toronto

Founded in 2001 and headquartered in Ontario, Canada, the Company is a leading manufacturer of solar photovoltaic modules; provider of solar energy and battery energy storage solutions;

6 FAQs about [Quality energy storage battery merchants in Toronto Canada]

What is Canada's battery storage capacity?

Over the same period, Canada’s storage capacity is expected to grow from 124,102 kW to 296,318 kW. At this critical time in the energy transition, Canadian battery storage companies are playing an important role in improving the flexibility and reliability of the energy system and driving the widespread adoption of green energy.

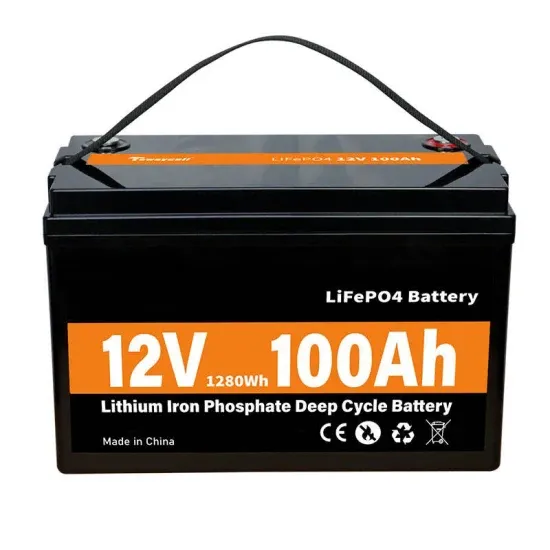

Where can I find the best solar battery solutions in Canada?

Choose Solar Power Store for the best solar battery solutions in Canada — engineered for performance, and built for reliability. Shop for reliable high-capacity battery & energy storage solutions for solar power systems of all types. LiFePO4 batteries from top-quality manufacturers at Solar Power Store Canada.

Which energy storage companies are in Canada?

We're tracking Moment Energy, Hydrostor and more Energy Storage companies in Canada from the F6S community. Energy Storage forms part of the Energy industry, which is the 14th most popular industry and market group.

Why is the battery industry growing in Canada?

The battery industry in Canada is experiencing significant growth, driven by increasing demand for electric vehicles and renewable energy storage solutions. When researching companies in this sector, it is crucial to consider regulatory frameworks and government incentives that support clean energy initiatives.

Where is Canada's largest battery storage facility located?

Northland is currently building Oneida, Canada’s largest battery storage facility. Located in Nanticoke, Ontario, the project uses 250,000 kilowatts of lithium-ion battery technology for a total energy storage capacity of 1 million kilowatt-hours.

Where can I find a good energy storage company?

If you're interested in the Energy market, also check out the top Energy & Cleantech, Renewable Energy, Recycling, Oil & Gas or Energy Efficiency companies. Moment Energy provides affordable, performant, and reliable energy storage. Meet Edward and Gurmesh that work here

Learn More

- Algiers quality energy storage battery merchants

- Quality energy storage battery merchants in Mombasa Kenya

- India Mumbai energy storage battery quality merchants

- American quality energy storage battery

- Nauru quality energy storage battery

- Huawei Canada dedicated energy storage battery

- Bangladesh energy storage battery merchants latest

- Abu Dhabi quality energy storage battery manufacturer

- Emergency Energy Storage Power Supply in Toronto Canada

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.