U.S. Energy Storage Industry Commits $100 Billion

Apr 29, 2025 · The U.S. energy storage industry is committed to investing $100 billion in American grid batteries, including both capital for building new battery manufacturing facilities and

American Battery Factory Raises Development Capital in

Aug 12, 2023 · American Battery Factory Inc. (ABF), an emerging battery manufacturer leading the development of the first network of lithium iron phosphate (LFP) battery cell gigafactories in

Energy Storage | ACP

Aug 18, 2025 · Read the full press release: U.S. Energy Storage Industry Commits $100 Billion Investment in American-Made Grid Batteries. Critical resource to keep pace with the AI race,

American Battery Solutions, Inc. Spins Out ESS Division

Aug 18, 2025 · Lake Orion, Michigan - September 11, 2023 – American Battery Solutions (ABS) announced today the spinout of its Energy Storage Solutions Division to create a new,

Storage industry''s $100bn investment in US-made grid batteries

Jul 5, 2025 · The American Clean Power Association (ACP) has announced a commitment to invest $100bn into building and buying US-made grid batteries on behalf of the US energy

U.S. Energy Storage Industry Commits $100 Billion to American

May 2, 2025 · The American Clean Power Association (ACP), representing the U.S. energy storage industry, has announced a landmark $100 billion investment to build and procure

Energy Storage Safety Strategic Plan

May 5, 2024 · The Department of Energy Office of Electricity Delivery and Energy Reliability Energy Storage Program would like to acknowledge the external advisory board that

U.S. Energy Storage Industry Commits $100 Billion to Boost American

May 2, 2025 · The American Clean Power Association (ACP) announced a $100 billion commitment from the U.S. energy storage industry to invest in American-made grid batteries,

Energy Storage Industry Commits $100B to American-Made Grid Batteries

Apr 30, 2025 · Building a Pathway to 100% American-Made Grid Batteries. The U.S. energy storage industry is committed to investing $100 billion in American grid batteries, including

Advanced Lithium-Ion Energy Storage Battery

Jul 30, 2025 · Advanced Lithium-Ion Energy Storage Battery Manufacturing in the United States Due to increases in demand for electric vehicles (EVs), renewable energies, and a wide range

US energy storage industry ready to commit US$100 billion

May 1, 2025 · Clean energy trade body American Clean Power Association (ACP) announced a commitment on behalf of the US energy storage industry to invest US$100 billion in building

Battery Energy Storage System Evaluation Method

Jan 30, 2024 · Executive Summary This report describes development of an effort to assess Battery Energy Storage System (BESS) performance that the U.S. Department of Energy

Battery technologies for grid-scale energy storage

Jun 20, 2025 · Energy-storage technologies are needed to support electrical grids as the penetration of renewables increases. This Review discusses the application and development

TRANSFORMING ENERGY STORAGE: AESI AND THE DRIVE

Dec 4, 2024 · As the global energy landscape undergoes its most significant shift in over a century, American Energy Storage Innovations (AESI) is at the forefront, reshaping how they

6 FAQs about [American quality energy storage battery]

Will US energy industry invest $100 billion in battery energy storage systems?

Members of the US energy industry has committed to investing $100 billion over the next five years to build and buy American-made batteries for large, utility-scale deployments of battery energy storage systems (BESS).

Why is the battery industry investing in the United States?

The industry’s investment will advance a manufacturing expansion in the United States with the aim of enabling American-made batteries to meet 100% of domestic energy storage project demand.

Why is battery energy storage important?

“Battery energy storage is key to meeting America’s rapidly expanding electricity needs,” said Craig Cornelius, President and CEO of Clearway Energy Group. “As we deploy energy storage at record pace, this investment reflects the industry’s commitment to building these critical grid infrastructure projects with American-made batteries.”

How much money will the ACP invest in battery storage?

and subscribe to the . The ACP has committed to investing $100 billion over the next five years to build and buy American-made battery storage.

How will trump's energy investment impact the battery industry?

This investment is expected to fuel the creation of 350,000 jobs across the battery energy storage industry and transform the United States into a global battery manufacturing leader. This announcement aligns with actions taken by the Trump Administration to unleash American energy and develop critical minerals in the United States.

How is the energy storage industry preparing for a grid-scale energy storage supply chain?

The energy storage industry is making significant progress in laying the groundwork for a domestic battery energy storage supply chain, building or expanding more than 25 manufacturing facilities for grid-scale energy storage. With today’s investment commitment, the industry has announced plans to rapidly expand ongoing efforts.

Learn More

- Nuku alofa quality energy storage battery manufacturer

- Quality energy storage battery merchants in Mombasa Kenya

- Quality requirements for energy storage battery cabinets

- Algiers quality energy storage battery merchants

- Abu Dhabi quality energy storage battery manufacturer

- American photovoltaic energy storage battery manufacturers

- American New York smart energy storage battery company

- Quality energy storage battery merchants in Toronto Canada

- Kuala Lumpur large capacity energy storage battery

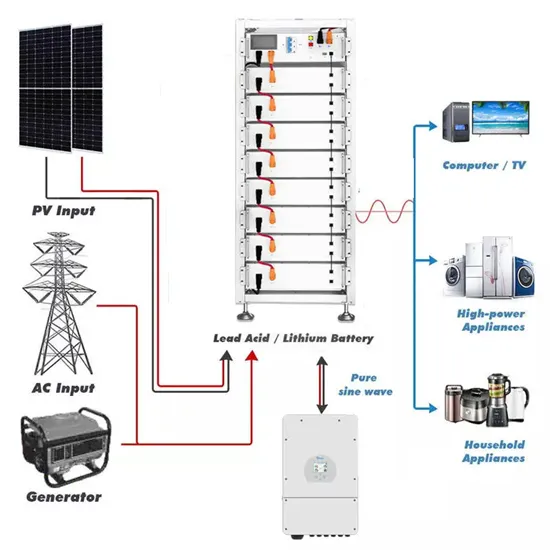

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.