Communications in Ethiopia

Jul 21, 2025 · The Eritrea-Ethiopia Border Commission in November 2007 remotely demarcated the border by geographical coordinates, but final demarcation of the boundary on the ground is

A Review on Green Communications

Mar 7, 2022 · Abstract— Green communication aims at addressing the exploration of sustainability regarding environmental condition, energy efficiency and the communication

Design of an off-grid hybrid PV/wind power system for

Jan 5, 2020 · The main electrical and electronics equipment of this mobile network site are Radio Base Station (RBS), Power Base Controller (PBC) including Rectifier, Battery Base Station

Ethiopia''s Climate Resilient Green Economy

Jun 28, 2019 · Executive Summary Ethiopia''s National Adaptation Plan (NAP-ETH) builds on ongoing efforts to address climate change in the country''s development policy framework,

Communication Base Station Green Energy | HuiJue Group E

As global telecom networks expand exponentially, how can communication base station green energy solutions address the sector''s mounting carbon footprint? With over 7 million cellular

Ethio Telecom, Huawei Expand Solar-On-Tower Deployment for Green

10 hours ago · Ethio Telecom, Ethiopia''s leading operator, together with Huawei, has announced the successful commercial deployment and stable operation of the first batch of Solar-on

The Green Base Station | VDE Conference Publication | IEEE

May 13, 2009 · The Green Base Station which is introduced is equipped with the regenerative energy sources wind power and photo-voltaic energy to reduce the power consumption taken

The Status of Green Technologies in Ethiopia

Oct 6, 2021 · Why Green Technology for Ethiopia? Ethiopia''s economy and social wellbeing are already exposed to climate variability and weather extremes though Ethiopia''s GHG emission

Green GSM Network Operation for Energy-Efficiency via

The study considers 26 Global System for Mobile communications (GSM) basestations in Addis Ababa around Leghare area. Based on the hourly traffic statistics obtained from the ethio

Ethiopia Unveils New 12-Metre Satellite Ground Station

Mar 18, 2025 · The new 12-metre ground station significantly enhances Ethiopia''s space communication and satellite operations capabilities. It serves multiple strategic purposes:

Energy‐Efficient Base Stations | part of Green Communications

Aug 29, 2022 · With the explosion of mobile Internet applications and the subsequent exponential increase of wireless data traffic, the energy consumption of cellular networks has rapidly

COMMUNICATION LANDSCAPE IN ETHIOPIA

Mar 3, 2023 · Interviews and discussions with communications professionals revealed important perspectives regarding the existing government communications structure and identified

The Ethiopian telecom industry: gaps and recommendations

Oct 1, 2021 · Then the inter-urban network started to expand in all directions from the capital Addis Ababa. Telegraph service began in 1906 between Dire Dewa, a city in Ethiopia, to

An Insight into Deployments of Green Base Stations (GBSs)

Several techniques have been deployed to reduce the energy consumption of the base station in what is called a green base station. This paper presents an insight into these approaches and

Use of Automatic Weather Stations in Ethiopia

1 Introduction In Ethiopia most socio-economic sectors are at risk due to climatic variability and change. Extreme weather and climatic events like drought and flood are frequently occurring in

Energy-efficient 5G for a greener future

Apr 22, 2020 · Compared to earlier generations of communication networks, the 5G network will require more antennas, much larger bandwidths and a higher density of base stations.

4 FAQs about [What communication green base station does Ethiopia use]

Are green cellular base stations sustainable?

This study presents an overview of sustainable and green cellular base stations (BSs), which account for most of the energy consumed in cellular networks. We review the architecture of the BS and the power consumption model, and then summarize the trends in green cellular network research over the past decade.

Where are green cellular BS operators located?

green cellular BS. Most of these operators are locate d in developing countries with limited electricity supply and unreliable electric grids. The financial issues in these countries must be investigated further. 4.5. Barriers that Hinder the Spread of Gr een Cellular BSs and Potential Solutions these barriers. Table 5.

Do operators establish a green cellular network?

operators establish a green cellular network. This section presents existing studies on cellular BSs and proposes directions for future research. 4.3.1. South Korea particularly its LTE cellular network, which offers data-oriented services. The LTE cellular network in South Korea use LTE 97% of the time).

Can cellular BSS operators establish a green cellular network?

Case Studies for Enabling Green Cellular BSs operators establish a green cellular network. This section presents existing studies on cellular BSs and proposes directions for future research. 4.3.1. South Korea particularly its LTE cellular network, which offers data-oriented services. The LTE cellular network

Learn More

- Communication green base station for reactive power compensation

- Communication Green Base Station Network Cable Requirements

- What are the hybrid energy generation of Reykjavik communication base station

- What is the battery capacity of base station communication equipment

- What is in a communication base station uninterruptible power supply

- What brand is the green base station of Bucharest Communications

- How about building a green communication base station project

- What is the power supply function of the communication base station

- Communication green base station carries out lightning protection

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

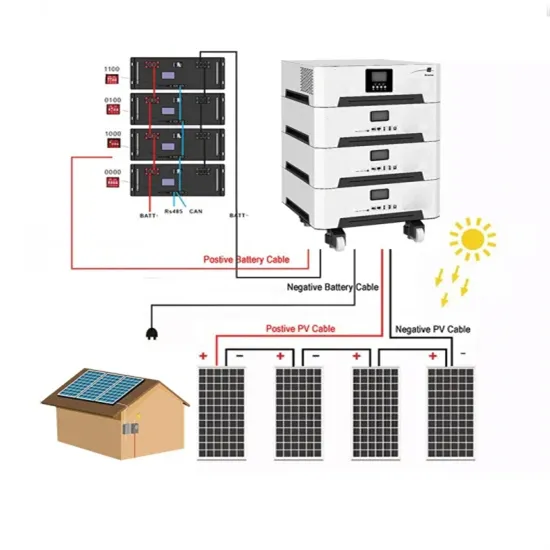

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.