looking at communication base station energy storage from 5g

Optimal Scheduling Strategy for 5G Base Station Backup Energy Storage With the swift proliferation of 5G technology, there''''s been a marked surge in the establishment of 5G

New EU Tool Tracks Real-Time Energy Storage Across Europe

Jun 18, 2025 · Energy storage is essential for balancing supply and demand, stabilising the grid, reducing energy waste, and improving the efficiency of renewable integration. With the EU

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · To maximize overall benefits for the investors and operators of base station energy storage, we proposed a bi-level optimization model for the operation of the energy storage,

Top 10 Energy Storage Companies in Europe

Jul 14, 2025 · Discover the current state of energy storage companies in Europe, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Optimal configuration of 5G base station energy storage

Mar 17, 2022 · it, in the case of a power failure. As the number of 5G base stations, and their power consumption increase significantly compared with that of 4G base stations, the demand

New tool maps Europe''s real-time sustainable

Mar 20, 2025 · According to findings from the inventory, Germany, Italy and Spain have the main relevant storage facilities among the member States. The main

Energy Storage Market Report 2020 | Department of Energy

Dec 17, 2020 · The Energy Storage Grand Challenge (ESGC) Energy Storage Market Report 2020 summarizes published literature on the current and projected markets for the global

looking at communication base station energy storage from 5g

The energy storage of base station has the potential to promote frequency stability as the construction of the 5G base station accelerates. This paper proposes a control strategy

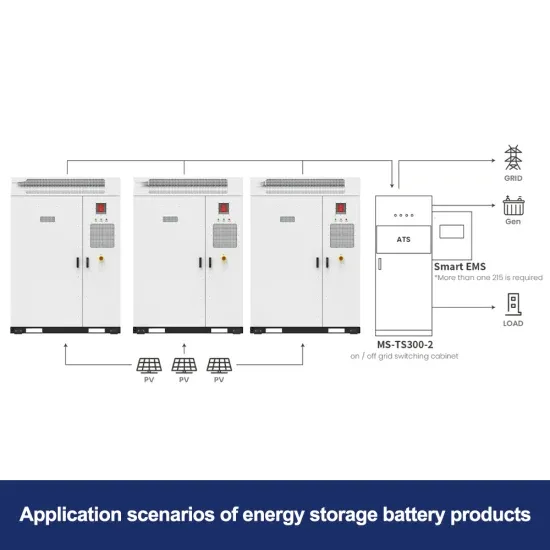

Energy storage system of communication base station

The Energy storage system of communication base station is a comprehensive solution designed for various critical infrastructure scenarios, including communication base stations, smart

The business model of 5G base station energy storage

In terms of 5G energy storage participation in key technologies for grid regulation, literature [4] introduces destructive digital energy storage (DES) technology and studies its application in

Simulation and Classification of Mobile Communication Base Station

Dec 16, 2020 · In recent years, with the rapid deployment of fifth-generation base stations, mobile communication signals are becoming more and more complex. How to identify and classify

Global Communication Base Station Battery Trends: Region

Mar 31, 2025 · The Communication Base Station Battery market is experiencing robust growth, driven by the expanding deployment of 5G and 4G networks globally. The increasing demand

Communication Base Station Energy Storage Systems

Powering Connectivity in the 5G Era: A Silent Energy Crisis? As global 5G deployments surge to 1.3 million sites in 2023, have we underestimated the energy storage demands of modern

Communication Base Station Energy Storage Systems

As global 5G deployments surge to 1.3 million sites in 2023, have we underestimated the energy storage demands of modern communication infrastructure? A single macro base station now

Energy Storage in Telecom Base Stations: Innovations

Innovative Applications and Development Trends of Energy Storage Technologies in Communication Base Stations Explore cutting-edge Li-ion BMS, hybrid renewable systems &

6 FAQs about [Which communication base station in Western Europe has the best energy storage]

Which countries have the most storage facilities in Europe?

Europe’s current total operational power is around 66 GW, and planned projects mean this might double to 132 GW by 2035. According to findings from the inventory, Germany, Italy and Spain have the main relevant storage facilities among the member States.

What is the inner goal of a 5G base station?

The inner goal included the sleep mechanism of the base station, and the optimization of the energy storage charging and discharging strategy, for minimizing the daily electricity expenditure of the 5G base station system.

How to optimize energy storage planning and operation in 5G base stations?

In the optimal configuration of energy storage in 5G base stations, long-term planning and short-term operation of the energy storage are interconnected. Therefore, a two-layer optimization model was established to optimize the comprehensive benefits of energy storage planning and operation.

Does a 5G base station use energy storage power supply?

In this article, we assumed that the 5G base station adopted the mode of combining grid power supply with energy storage power supply.

Can a bi-level optimization model maximize the benefits of base station energy storage?

To maximize overall benefits for the investors and operators of base station energy storage, we proposed a bi-level optimization model for the operation of the energy storage, and the planning of 5G base stations considering the sleep mechanism.

What is the European energy storage inventory?

A new interactive platform delivers real-time clean energy storage insights as Europe shifts toward sustainable energy sources. Energy storage helps to balance supply and demand. The European Energy Storage Inventory is the first of its kind at European level to show all forms of clean energy storage solutions.

Learn More

- Which manufacturer is the best for communication base station energy storage

- Which electromagnetic energy storage solar communication base station is the best

- Which company is the best flywheel energy storage equipment for North African communication base stations

- Construction quotation of battery energy storage system for communication base station

- How much does a flywheel energy storage room for a communication base station cost

- Cost of the computer room for the battery energy storage system of the communication base station

- Safe distance of battery energy storage system for Vietnam communication base station

- The reason why Xiaomi entered the communication base station battery energy storage system

- Jordan communication base station battery energy storage system battery

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.