The evolution of Romania''s Solar PV market

Mar 5, 2024 · Overview of solar PV developments Following a period of lull, Romania has achieved in 2023 a significant milestone in its renewable energy journey – over 1 GW of new

Data–driven analysis of Romania''s renewable energy

Mar 30, 2024 · The findings also suggest a clear and growing commitment in Romania towards the adoption of alternative energy sources, as reflected in the trends of public procurement.

Romania Solar Photovoltaic (PV) Power Market Outlook

Over 55 charts, tables and maps Overview of Romanian Photovoltaic Market Development 2014 ÷ 2034 Grid-connected photovoltaic installations Future market trends and planned photovoltaic

Advancements In Photovoltaic (Pv) Technology for Solar

Jul 13, 2023 · Abstract: Photovoltaic (PV) technology has witnessed remarkable advancements, revolutionizing solar energy generation. This article provides a comprehensive overview of the

Romania''s solar energy market set for rapid growth in 2025

Feb 6, 2025 · Romania is set for a significant expansion in the photovoltaic sector in 2025, driven by funding programs such as Casa Verde and RePower EU, the liberalization of energy prices,

Monitor of the Romanian Photovoltaic Projects

Mar 12, 2024 · Thus, by 2023, in terms of investments in new renewable generation capacity through photovoltaic projects, the prosumer area has become one of the most dynamic areas

Photovoltaic development in Romania. Reviewing what has

Oct 1, 2018 · This study traces the evolution of Photovoltaic energy in Romania from its beginnings (2006) to its current state by presenting the climatic factors influencing Romania''s

ROMANIA: Solar Power sector

Apr 3, 2024 · In 2023, Romania witnessed a record-breaking year for solar, adding over 1 GW of new capacity through distributed generation and utility-scale projects, the sector association

Guidelines on developing a solar project in

Mar 13, 2024 · The eligible activities which can be financed are the construction of renewable wind, solar or hydro power generation capacity and the purchase of

Romania''s Integrated National Ener

Mar 5, 2024 · the components are readily available. Considering that the solar PV sector alone would require 88 465 full-time employees by 2027, the NECP must include concrete actions

A review of solar photovoltaic technologies: developments,

Jul 1, 2025 · Solar PV is considered one of the most decarbonized electricity generation systems, offering a promising solution to mitigate climate change and enhance energy security. By

Enery Secures €214.45 Million Bank Loan for Romanian

Dec 15, 2024 · The loan facility is strategically allocated to refinancing the entire Romanian renewable energy portfolio, providing financial stability and operational efficiency, constructing

Learn More

- New Energy Photovoltaic Power Generation Glass Component Lamination

- Photovoltaic power generation new energy and energy storage

- Photovoltaic wind power energy storage new energy

- Which company is professional in photovoltaic power generation glass house

- 2kw photovoltaic power generation with 5 kWh of energy storage for home use

- Podgorica photovoltaic energy storage power generation system

- External glass curtain wall photovoltaic power generation

- Awalu Energy Storage Photovoltaic Power Generation Enterprise

- How much does it cost to wholesale glass photovoltaic power generation

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

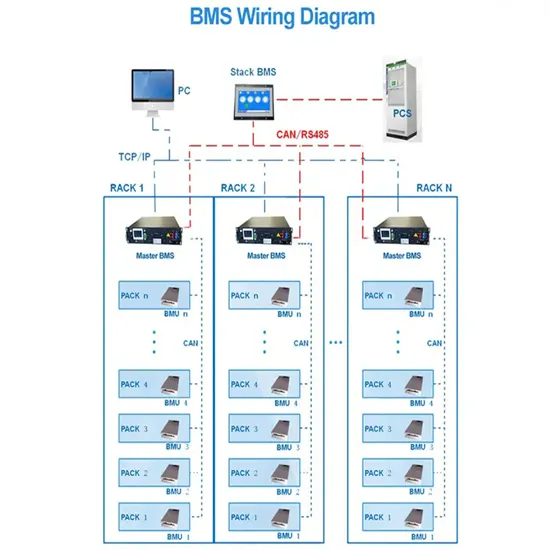

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.