Trends in PV Applications 2024

Key Highlights: · Global PV Installations: A record-breaking 456 GW of photovoltaic capacity was installed globally in 2023. · China''s Dominance: China''s solar market accounted for the

Cell & Module Technology Trends 2025

May 7, 2025 · This report offers a bird''s-eye view of overall technology developments, focusing on key advancements across each mainstream PV technology. The TaiyangNews Cell & Module

Fall 2023 Solar Industry Update

Dec 4, 2023 · The upward trend of "levelized storage adders" (premiums for PV+battery PPAs relative to standalone PV PPAs) continued in 2022 despite the year''s modest battery system

Falling Li-ion battery prices mirror solar photovoltaics trends:

May 22, 2025 · EVs are driving large-scale demand for Li-ion batteries which will result in substantial volumes of spent batteries in the near future. This scenario highlights the potential

The research progress on recycling and resource utilization

Jun 15, 2024 · Therefore, the review advocates for pyrolysis treatment as the mainstream technology for the recycling of waste PV modules. Finally, the article discusses the challenges

Battery Index to track price trends and brand dynamics

Aug 14, 2025 · Here, price disparities remain stark and are even widening in some segments. PV Index July – prices ease as demand stays soft The Battery Index will track these trends in

Future of photovoltaic technologies: A comprehensive review

Oct 1, 2021 · Each module, on the other hand, is an aggregation of several series-connected PV cells. Hence, a small increase in the efficiency of PV cells enhances the power output of the

A review of solar photovoltaic technologies: developments,

Jul 1, 2025 · Solar photovoltaic (PV) technology has emerged as a key renewable energy solution, yet its widespread adoption faces several technical and economic challenges. This review

Solar Panel Tech Trends: 2025 PV Module Index Insights

Aug 12, 2025 · The 2025 PV Module Index Report provides a clear summary of current risks, innovations, and performance in the solar module market. As technologies evolve and new

Solar PV Significantly Grew Globally in 2024,

May 7, 2025 · In all areas: electricity generation growth, installed capacity growth, and cost competitiveness, solar PV domination is now overwhelming. And

Solar Charging Batteries: Advances, Challenges, and

Jan 16, 2020 · These technologies demand the use of batteries. Sunlight, an abundant clean source of energy, can alleviate the energy limits of batteries, while batteries can address

A review of solar photovoltaic technologies: developments,

Jul 1, 2025 · Solar PV is considered one of the most decarbonized electricity generation systems, offering a promising solution to mitigate climate change and enhance energy security. By

Solar Installed System Cost Analysis | Solar

Apr 3, 2025 · Solar Installed System Cost Analysis NREL analyzes the total costs associated with installing photovoltaic (PV) systems for residential rooftop,

Falling Li-ion battery prices mirror solar photovoltaics trends:

May 22, 2025 · Evolution of the PV module global annual production (in GW, blue bars and left-hand axis), and of the annual average price of PV modules and Li-ion batteries in relation to

6 FAQs about [The trend of photovoltaic module batteries]

How much is the solar PV module market worth in 2023?

According to GlobalData’s Solar PV Modules and Inverters Market Trends and Analysis report, the global solar PV module market was valued at $102.76bn in 2023. The Asia-Pacific (APAC) region led the charge in 2023, registering $60.15bn.

Will solar PV module prices decline in 2025?

These innovations are expected to contribute to a steady decline in solar pv module prices. According to recent market analyses, the average price of solar PV modules dropped by nearly 10% in 2023 alone, with projections indicating further decreases in 2025 due to increased production capacity and technological advances.

Does China still dominate the global solar PV module market?

China continues its dominance of the global solar PV module market. Declining costs of PV module production have made solar installations more affordable globally. Source: abriendomundo/Shutterstock.com.

What is Taiwan solar photovoltaic (PV) market outlook?

Taiwan Solar Photovoltaic (PV) Analysis: Market Outlook to 2035, Up... The solar industry’s rapid expansion has directly benefitted the market for key components such as PV modules, which make up solar panels that harness solar energy for both residential and commercial applications.

How will emerging photovoltaic materials and technologies impact the PV industry?

The advance of emerging photovoltaic materials and technologies has the potential to invigorate the PV industry by reducing costs, improving efficiency, and fostering sustainable development.

How can advanced storage technologies improve solar PV module sustainability?

Advanced storage technologies reduce energy waste and enhance sustainability. These advancements complement trends in declining solar pv module prices. The solar industry is increasingly focused on sustainability. Manufacturers are adopting eco-friendly production methods, such as using recycled materials and reducing carbon emissions. 1.

Learn More

- What are the types of photovoltaic module batteries

- 265w solar photovoltaic module

- Price of 1 kW photovoltaic module

- What are the parameters of photovoltaic power generation of communication base station batteries

- North Korean thin-film photovoltaic module prices

- Oslo double glass photovoltaic module price

- Monocrystalline photovoltaic module panels in Lagos Nigeria

- Photovoltaic cell silicon wafers and module silicon wafers

- 270w photovoltaic module price

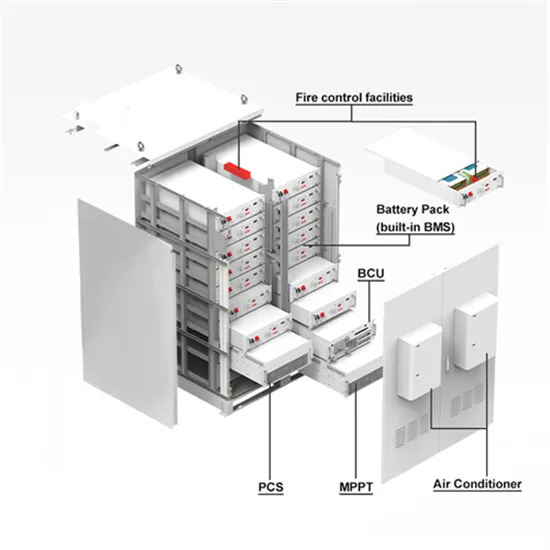

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.