The Joint Initiative at Lombrum Naval Base (PNG)

2 days ago · Defence Pacific Engagement Joint Initiative at Lombrum Naval Base (PNG) The Lombrum Joint Initiative will support the redevelopment of Lombrum Naval Base and build the

Papua New Guinea LTE Base Station System Market (2025

Papua New Guinea LTE Base Station System Industry Life Cycle Historical Data and Forecast of Papua New Guinea LTE Base Station System Market Revenues & Volume By Type for the

New Telecommunications Network in Papua New Guinea

Feb 25, 2023 · Things changed for the better when the private telecommunications company Digicel (PNG) built two mobile base stations in the Alotau district. An ADB $25 million loan

Establishing Telecommunications Infrastructure in Rural Areas: Papua

Sep 1, 2020 · In rural areas, even the simplest form of telephony can bring tremendous economic and social benefit to a region. Communications networks provide the means to not only

Russia''s alleged request to station long-range

Apr 15, 2025 · Russia''s alleged request to station long-range military aircraft at Manuhua Air Force Base in Biak Numfor, Papua, has sent geopolitical tremors

PSU_structural-reform final report.pdf

Oct 8, 2021 · Then in 1992 the Department of Information and Communication was instructed to begin the process of formulating a coherent national ICT policy (Department of Communication

Handover ceremony held for Lae Station of the Papua New Guinea

Oct 29, 2024 · Recently, the Lae Station of the Papua New Guinea Digital TV Transformation Project, constructed by CSCEC, held a handover ceremony. Attendees included Yang

State of Media & CoMMuniCation RepoR t 2013

Oct 5, 2023 · PNG Country Context papua new Guinea (pnG) is an independent state including the eastern half of the island of new Guinea, sharing a border with the indonesian province of

U.S. invests K1.6 Billion in Fuel Storage Facility

Apr 28, 2025 · In a significant move to bolster Papua New Guinea''s fuel security, the United States has announced a substantial investment of approximately

Communication, Culture and Society in Papua New Guinea

Jul 21, 2025 · Following in the steps of an earlier volume, Media, Information and Development in Papua New Guinea, by Papoutsaki and Rooney (2006), young, emerging and established

(PDF) Telecommunications in Papua New Guinea

Jan 1, 2011 · Reform of this market in Papua New Guinea (PNG) was perhaps the most difficult of the five cases, particularly with respect to the political struggle

Establishing Telecommunications Infrastructure in Rural Areas: Papua

Sep 1, 2020 · Initial mobile network deployment saw 59 mobile base-stations deployed by Digicel in remote areas of all four regions of this island-nation country, bringing telecom connectivity to

IEE: Regional: Bemobile Expansion Project

The loan will be used to partly finance (i) the construction of up to 300 base transceiver stations (BTS) and network upgrading across twenty provinces in PNG and (ii) around 33 BTSs and

Reliable Installation Works Papua New Guinea

We install fiber optic and copper networks, mobile towers, satellite ground stations, and wireless systems to improve communication and internet access across the country. Our work supports

Islanding in smart grid Papua New Guinea

The small island economy of Papua New Guinea (PNG hereafter) is one of the world''s least electrified countries and is facing major challenges with poor access to electricity. 1 Unreliable

Solar Power System Design For Utility Integration Training

The Solar Power System Design for Utility Integration training course equips engineers, utility professionals, and renewable energy consultants with the skills needed to develop utility-scale

Papua New Guinea Grid Forming Inverters Market (2025

Historical Data and Forecast of Papua New Guinea Grid Forming Inverters Market Revenues & Volume By Central Inverter for the Period 2021-2031 Historical Data and Forecast of Papua

6 FAQs about [Papua New Guinea construction of communication base station inverter]

Does Papua New Guinea have a mobile telecommunication expansion project?

Now, Papua New Guinea is joining a wave of Pacific island countries liberalizing their telecommunications industries and developing the private sector. The ADB Digicel Mobile Telecommunication Expansion Project, launched in 2009, is at the forefront of those efforts.

How did Papua New Guinea get its phone towers built?

An ADB $25 million loan funded the construction of the mobile phone towers, as well as phone towers in other remote locations across Papua New Guinea. As soon as the towers were built and operational, Dipole was able to set up his now successful eco-lodge business, which employs 10 people and has visitors all year round.

What was telecommunications like in Papua New Guinea before 2007?

Before 2007, telecommunications in Papua New Guinea - the largest economy in the Pacific region, with a population of 6.7 million - were dominated by the state-owned company, Telikom PNG. The result was fixed-line communications of around just 1% and mobile penetration of less than 5%.

Will Digicel help Papua New Guinea residents get better access to information?

Marcelo Minc, country director of ADB's Papua New Guinea Resident Mission, says improved telecommunications via Digicel's network will help residents of remote areas have better access to information.

Why is mobile penetration increasing in Papua New Guinea?

Photo by Digicel This cell phone tower in Kiunga in Western Province, Papua New Guinea evidences the spread of mobile penetration in the country, which Digicel says has quadrupled since the technology arrived, due to increased network coverage supported by ADB. Photo by Digicel

Does Papua New Guinea have a private sector?

The result was fixed-line communications of around just 1% and mobile penetration of less than 5%. Now, Papua New Guinea is joining a wave of Pacific island countries liberalizing their telecommunications industries and developing the private sector.

Learn More

- Papua New Guinea communication base station wind power tower manufacturer customization

- Power usage of communication base stations in Papua New Guinea

- Libya communication base station inverter grid connection construction bidding

- Agreement on the construction of communication base station inverter

- Beijing communication base station inverter grid connection construction time point

- Bidding for West Asia Communication Base Station Inverter Grid Connection Construction Project

- Big data communication base station inverter grid-connected construction project

- Papua New Guinea 5G base station electricity policy

- Ghana communication base station inverter grid connection maintenance construction

Industrial & Commercial Energy Storage Market Growth

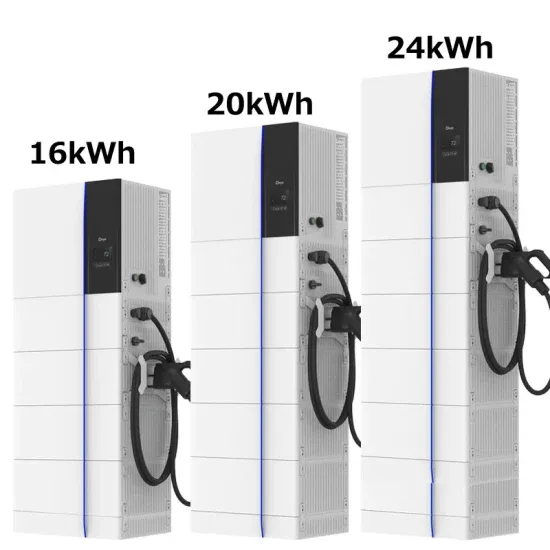

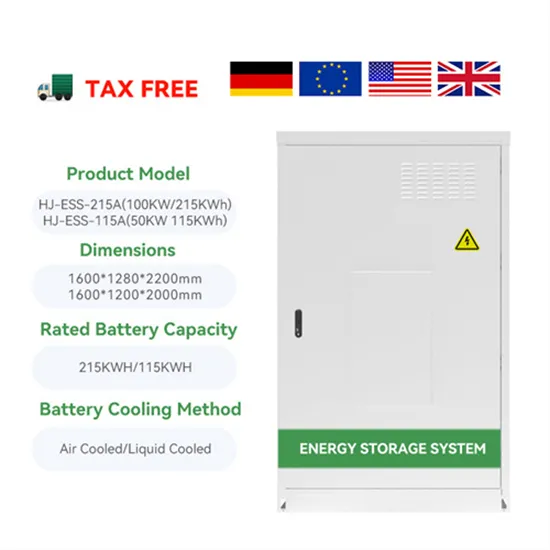

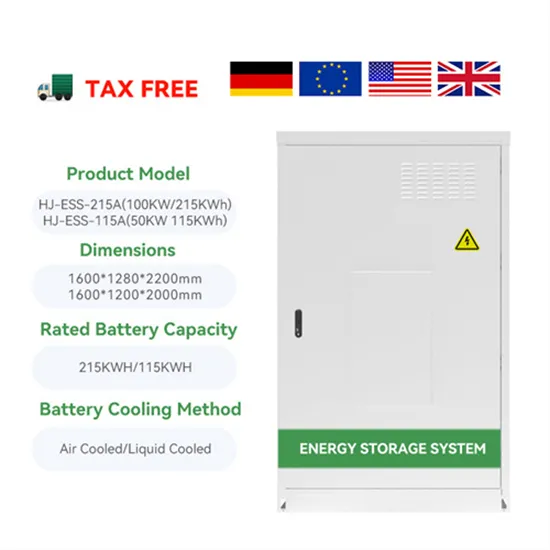

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

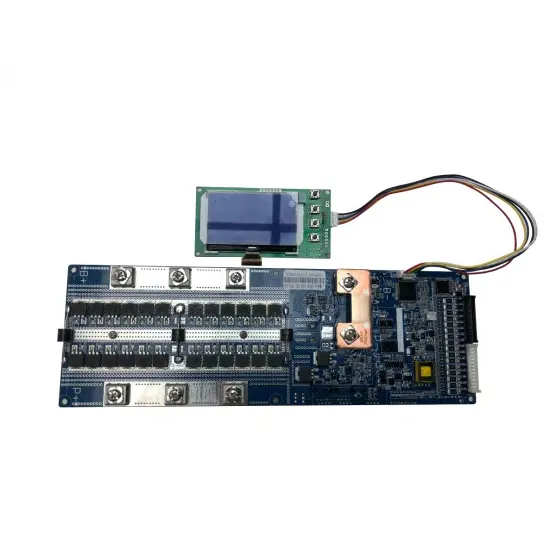

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.