5G in Latin America: unleashing the potential

Jun 28, 2023 · GSMA Intelligence research shows that 55% of operators in Latin America with live 5G networks have announced plans to upgrade to 5G SA – in line with the global average.

Installation Criteria for a 5G Technology Cellular Base

Mar 1, 2024 · On the other side, the operators in other South American countries are using Huawei technology to implement their 5G networks, as said in the research developed by [4], [5].

5g base station architecture

Dec 13, 2023 · 5G (fifth generation) base station architecture is designed to provide high-speed, low-latency, and massive connectivity to a wide range of devices. The architecture is more

5G Plans for South America: Deployment, Growth Potential,

Nov 1, 2024 · South America has expanding 5G coverage. Brazil offers 5G in all state capitals. Chile and the Dominican Republic provide coverage in every district. In Mexico, Telcel

Ambitious 5G base station plan for 2025

Dec 28, 2024 · Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base

5G RAN Architecture: Nodes and Components

Jan 24, 2023 · Discover 5G RAN and vRAN architecture, its nodes & components, and how they work together to revolutionize high-speed, low-latency wireless communication.

5G spectrum landscape in South America » Network Strategies

Regulators and operators in South America are working towards the deployment of 5G infrastructure and services, and access to spectrum is a key enabler. Service availability, the

Explore the growth of 5G in Latin America

Aug 12, 2025 · The Latin American 5G market is projected to generate over USD 28.4 billion annually by 2030 in enhanced mobile broadband revenues. In addition, the 5G FWA market

Technical Requirements and Market Prospects of 5G Base Station

Jan 17, 2025 · With the rapid development of 5G communication technology, global telecom operators are actively advancing 5G network construction. As a core component supporting

Installation Criteria for a 5G Technology Cellular Base

Mar 1, 2024 · Therefore, the objective of this research article is focused on proposing installation criteria that an operator must have into consideration when doing a 5G implementation, like

Global 5G Progress-Europe, USA, China, Japan, South Korea

Latest 5G Progress In The World According to the data released by GSA, as of December 2020, 140 operators in 59 countries and regions around the world have opened 5G base stations

4g 5g lte base station Competitive Strategies: Trends and

Feb 2, 2025 · Market Overview The global 4G/5G LTE base station market size is anticipated to reach USD 46.7 billion by 2033, registering a CAGR of 6.7% from 2025 to 2033. The market

5G Plans for South America: Deployment, Growth Potential,

Nov 1, 2024 · The future promise of 5G plans for South America relies on overcoming challenges such as infrastructure investment and regulatory frameworks. Collaboration between

5G Base Station Market Size, Share, Research Report 2033

Jul 28, 2025 · The global 5g base station market size was valued at USD 22.9 billion in 2024, with a projected growth to USD 20.78 billion by 2033, at a CAGR of -1.1%.

5G Base Station Market is estimated to record a CAGR of

Dec 12, 2024 · The leading 5G base station market players focus on feature upgrades, expansion and diversification, collaboration, and acquisition strategies, which enable them to grab new

How Baseband Boards Contribute to 5G and Beyond

Aug 15, 2025 · The transition from 4G to 5G base stations has been driven by significant advancements in hardware and software technologies. 5G base stations incorporate cutting

Installation Criteria for a 5G Technology Cellular Base

Jun 10, 2025 · On the other side, the operators in other South American countries are using Huawei technology to implement their 5G networks, as said in the research developed by [4], [5].

5G Wireless Base Station Market Size, Trends, Growth

A 5G base station is a fixed communication location that is part of the wireless telephone system of a network that is connected to a single antenna or multiple antennas. It is a wireless

South & Central America 5G Base Station Market

The South & Central America 5G base station market was valued at US$ 1,168.07 million in 2022 and is expected to reach US$ 3,232.73 million by 2030; it is estimated to register a CAGR of

Coverage-based location for 5G base stations | AIP

Nov 5, 2024 · 5G (fifth generation) base station deployment while considering cost, signal coverage, the availability of varied demographic areas with varying user density and expected

5G Base Station Chips: Driving Future Connectivity by 2025

Nov 27, 2024 · The evolution of wireless technology has brought the world to the brink of a connectivity revolution. As 5G networks become the backbone of modern communication, 5G

6 FAQs about [South America Communication 5g base station signal]

What will 5G mean for Latin America?

By the end of 2027, 5G is expected to represent 44 percent of mobile subscriptions in Latin America and the average traffic per smartphone is forecast to be approximately 35GB per month. The deployment of 5G networks represents a significant opportunity for development in the region.

Will 5G SA be available in Brazil?

Moving to cloud-native infrastructure will be crucial to enable 5G standalone (5G SA) deployments. As is the case globally, most initial 5G deployments in Latin America have used a non-standalone (NSA) architecture. 5G networks in Brazil are a notable exception. 5G SA availability will increase in other parts of the region, however.

What factors shape Latin America's 5G deployment?

As Latin America prepares for next-generation telecommunications, a wide variety of factors—domestic and external—will shape 5G deployment in the region. The following are five key observations of Latin Americas mobile telecoms landscape at present. 1. At present, the Latin American region is making considerable strides in 4G availability.

How many countries in Latin America have 5G services?

As of March 2023, eight countries in Latin America had launched commercial 5G services. The number of 5G connections is forecast to grow steadily over the next couple of years, before accelerating in the second half of the decade as new 5G markets go live and existing networks expand to cover new areas.

What is the 5G rollout in Latin America?

The 5G rollout across Latin America varies significantly in terms of timelines and spectrum assignment. For example, Uruguay was the first market to deploy 5G in the region commercially in 2019, although on a very limited scale, only available to businesses.

Does Colombia have 5G?

Colombia is one of the newest 5G markets in Latin America, having launched commercial services in early 2024. This means that its 5G networks are lightly loaded, allowing them to achieve relatively quick average download speeds. At the same time, congestion on Colombia’s 4G networks is high, leading to lower 4G speeds.

Learn More

- South Tarawa Communication 5G Base Station Construction Project

- South Sudan 5g base station communication energy

- Dushanbe 5g communication signal base station

- Which 5G base station is better for communication

- Construction of battery energy storage system for 5G communication base station in Nassau

- Tbilisi 5G communication base station wind and solar complementary battery

- Antananarivo Communication 5G Base Station Project Bidding Project

- Swiss 5G communication base station wind and solar complementary project

- Jakarta hybrid energy 5g signal base station

Industrial & Commercial Energy Storage Market Growth

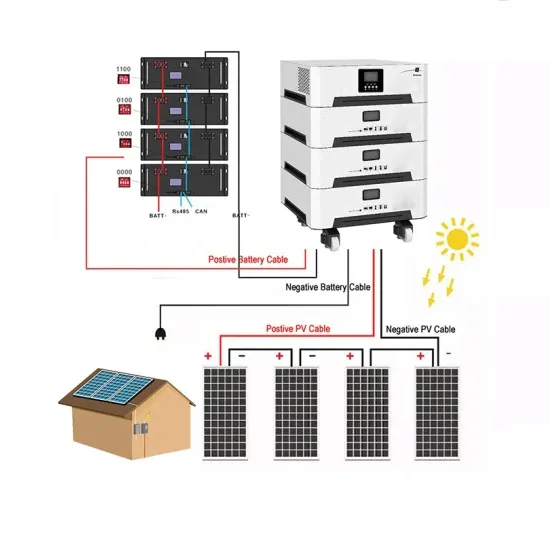

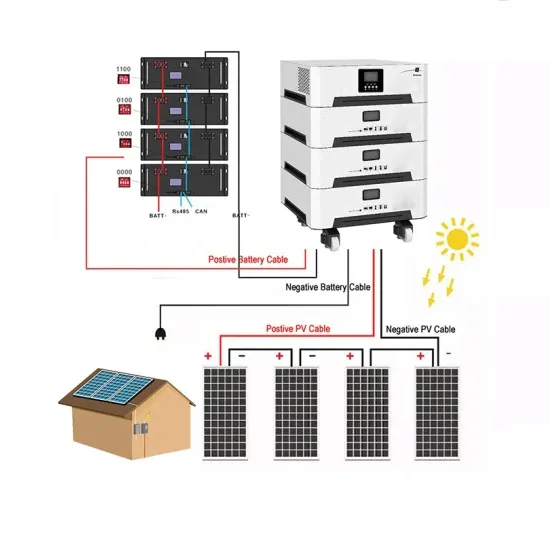

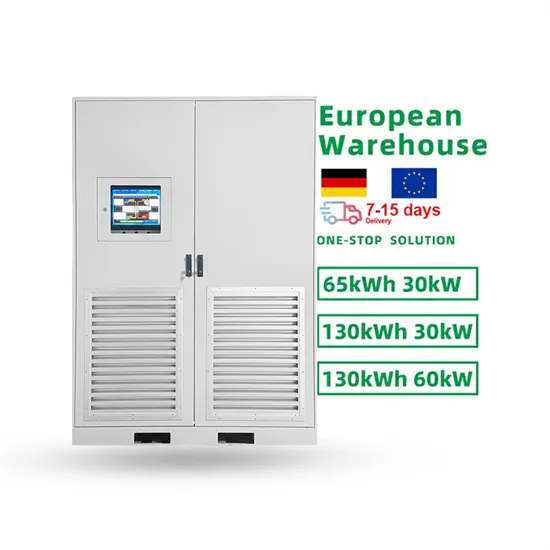

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.