Research on Carbon Emission of 5G Base Station

Jun 21, 2023 · As the core of new infrastructure, building the Five-Generation (5G) network requires the construction of a large number of base stations. Compared with 4G network, 5G

mobile communication base stations

Apr 21, 2021 · The competitive landscape of mobile communication base stations in China is characterized by rapid technological advancements and aggressive market strategies. Major

CBN: 700MHz Base Stations construction to be completed by

Recently, the 30th China Digital Broadcast Television and Network Development Annual Conference and the 25th International Radio and Television Technical Symposium (CCNS &

China''s Largest Grid-Forming Energy Storage Station

Apr 9, 2024 · On March 31, the second phase of the 100 MW/200 MWh energy storage station, a supporting project of the Ningxia Power''s East NingxiaComposite Photovoltaic Base Project

China sees steady progress in 5G base station construction

Sep 22, 2022 · The number of 5G base stations in China registered stable growth amid the country''s efforts to advance the construction of its 5G network in recent years, official data

Research into 6G technology promoted

Aug 5, 2025 · A model of the Beidou Navigation Satellite System is exhibited at the 6th Digital China Summit in Fuzhou, Fujian province, on Thursday. [PHOTO/CHINA NEWS SERVICE]

Optimization Method for Flight Path of UAV Airborne Base Stations

Mar 22, 2025 · Utilizing unmanned aerial vehicle (UAV) to carry 5G base stations to build emergency communication networks can flexibly provide stable and reliable wireless access in

CBN: 700MHz Base Stations construction to be completed by

Zeng Qingjun, deputy general manager of CBN, said at the conference that the construction of 700MHz base stations nationwide is expected to be completed by the end of 2022. And urban

Key technologies for 5G co-construction and shared base

Oct 22, 2021 · 5G network consumes huge investment cost, including 5G network construction, 5G network operation and maintenance etc. Therefore, China Unicom and China Telecom

Carbon emissions and mitigation potentials of 5G base station in China

Jul 1, 2022 · By 2020, China has established over 718,000 5G base stations, and this number is expected to increase exponentially between 2021 and 2025 due to the nation''s determination

CBN Builds 578,000 700M 5G base stations

According to Song Qizhu, China Broadcasting Network has achieved significant results in the construction of 5G networks. China Broadcasting Network, in collaboration with China Mobile,

Wireless Communication Base Station Location Selection

Jun 9, 2024 · 1. Introduction Recently, with the rapid development of wireless communication technology, the enhancement of wireless network performance is concerned with meeting the

Low-Carbon Sustainable Development of 5G Base Stations in China

May 4, 2024 · In order to increase the contribution of the communication industry to mitigate the global greenhouse effect, future efforts must focus on reducing the carbon emissions

ZTE exclusively wins bid for 5G nomadic base stations from China

Aug 30, 2021 · Based on the innovative solution of China Mobile Research Institute, ZTE has integrated its base station and local computing power and extended support for multiple

Reliability prediction and evaluation of communication

Dec 4, 2023 · In order to grasp the operation condition of post-earthquake communication base stations, Liu et al.1 from China Earthquake Administration conducted a study and analysis of

China Unicom Contributes to Green, Low-Carbon Development

Nov 24, 2021 · To meet demand for rapidly-developing base stations and highly-efficient and reliable operation and maintenance, China Unicom developed a smart outdoor 5G integrated

Optimised configuration of multi-energy systems

Dec 30, 2024 · Additionally, exploring the integration of communication base stations into the system''s flexibility adjustment mechanisms during the configuration is important to address the

Shanghai to set up nearly 10,000 new 5G-A base stations this

Feb 7, 2025 · People experience 5G technology in Shanghai. [Photo/IC] Shanghai will establish up to 10,000 new 5G-A base stations this year, routing more than 70 percent of the city''s

5G base stations to proliferate widely

2 days ago · Wang Zhiqin, deputy head of the China Academy of Information and Communications Technology, a government think tank, said China is likely to achieve several

Shanghai to set up nearly 10,000 new 5G-A base stations this

6 days ago · Shanghai will establish up to 10,000 new 5G-A base stations this year, routing more than 70 percent of the city''s internet traffic through 5G network, helping Shanghai maintain its

5G base stations to proliferate widely in China

Nov 17, 2021 · China plans to have 26 5G base stations for every 10,000 people by the end of 2025, as the nation works hard to build a new digital infrastructure that is intelligent, green,

China builds world''s largest 5G network with 475 million users

Aug 26, 2022 · China has built nearly 1.97 million 5G base stations and reached 475 million 5G mobile users by the end of this July, said the country''s Ministry of Industry and Information

1st Beidou base station with new system completed in NW China

Jul 7, 2020 · The first base station with a ground-based augmentation system is completed in Urumqi, capital of Northwest China''s Xinjiang Uygur autonomous region, which will offer high

6 FAQs about [Construction of inverters for communication base stations in China]

How many 5G base stations are built in China?

As 5G serves as the foundation for the construction of new infrastructure, China, as the world leader in 5G base station construction, has already built over 1.4 million 5G base stations in 2021 alone. In the same year, 5G base stations in China produced approximately 49.2 million tons of CO 2 eq.

How many 5G base stations are there in Guangdong Province?

Among them, the number of 5G base stations in Guangdong Province ranks first. According to the government report, Guangdong Province will accumulatively build 290,000 5G base stations by 2025, and a total of 50,000 5G base stations will have been built in Shenzhen. From 2021 to 2022, 5G broadband city clusters will be established in the Pearl River

What is the automatic data configuration model of 5G co-construction and shared base stations?

This paper focuses on the automatic data configuration model of 5G co-construction and shared base stations. By interacting with the core network and wireless network, this model can identify and match different 5G network modes such as SA and NSA (including dual-anchor scenarios and single-anchor scenarios).

How many 5G base stations will be built in Shenzhen in 2025?

According to relevant government reports, 50,000 5G base stations plans to be built in Shenzhen in 2025. Combined with the carbon emissions of a single base station, the cumulative carbon emission value of the construction of 5G base stations can be calculated by 2025 is 2.2–3 million tCO2e.

What is the system boundary of 5G base station?

The system boundary of the CO 2 of 5G base station The civil construction of 5G base stations is typically carried out using the existing infrastructure of 4G base stations, resulting in less material input during the construction phase. The primary focus on carbon emission generation is during the use phase due to power consumption.

How does a base station affect a 5G network?

The architecture and shape of the base station directly affect how the 5G network is deployed. In the technical standards, the frequency band of 5G is much higher than that of 2G, 3G and 4G networks. At this stage, 5G networks mainly work in the 3000-5000MHz band. The higher the frequency, the greater t

Learn More

- Reasons for stopping construction of battery energy storage systems for communication base stations

- What are the energy management systems for green communication base stations in China

- Construction of battery energy storage system for rural communication base stations

- Construction skills of flywheel energy storage for communication base stations

- What are the inverters for communication base stations in Vietnam

- There are many inverters in Western European communication base stations

- Temperature and humidity requirements for grid-connected inverters for communication base stations

- Where China s photovoltaic communication base stations store energy

- National policy on the construction of uninterrupted power supply for communication base stations

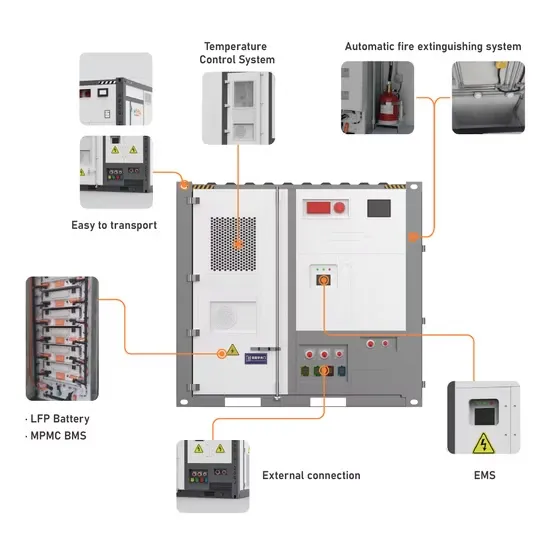

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

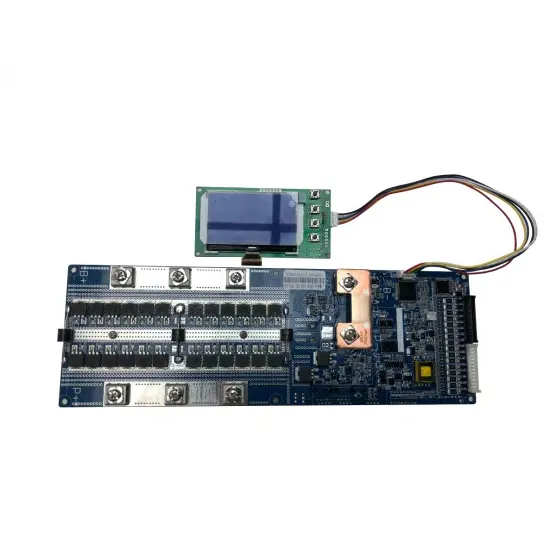

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.