Myanmar Energy Storage Power Supply Customization

Having good energy statistics will allow Myanmar to contribute to and share data with ASEAN, International Energy Agency, Joint Organization Data Initiative (JODI), and other international

Myanmar photovoltaic energy storage power supply price

Why is Myanmar a good place to invest in solar energy? "Low energy access rates, high solar irradiance for most of the year, supply lagging behind the demand, [and the] high cost of

myanmar air-cooled energy storage technology

The AirBattery is Augwind''''s novel energy storage system, a combination of pumped-hydro and compressed air energy storage- using circular water and air as raw materials for safe,

Myanmar new energy storage container price | Solar Power

Powering Ahead: 2024 Projections for Growth in the Chinese Energy Reflecting on the developments in 2023, China witnessed a remarkable uptick in new energy storage

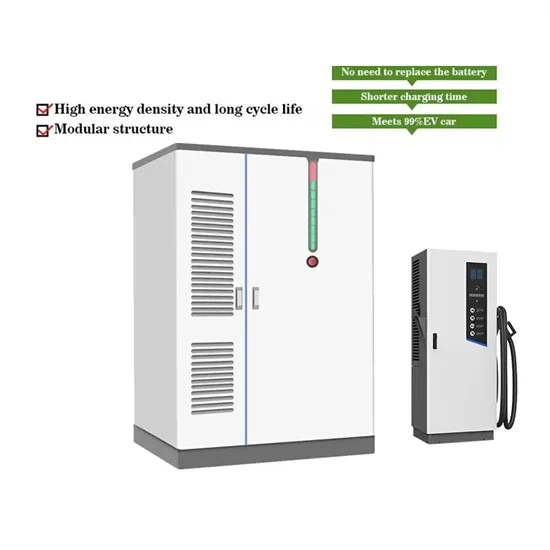

Myanmar replaces energy storage charging piles

Energy Storage Systems Boost Electric Vehicles'''' Fast Charger In this calculation, the energy storage system should have a capacity between 500 kWh to 2.5 MWh and a peak power

Myanmar''s EV Sector Continues to Grow in 2025 as Newly

May 30, 2025 · Once in its infancy, Myanmar''s electric vehicle (EV) industry is steadily developing. The National Level Electric Vehicle and Related Industry Development Steering

Solis Commissions 50kW Solar-Plus-Storage System in Myanmar

Jun 3, 2025 · Solis and Amara Power completed a 50kW solar + 50kWh storage system in Yangon, boosting commercial energy reliability and cost efficiency.

Myanmar electric vehicle energy storage

Myanmar has abundant renewable energy resources like solar and hydropower. Integrating these resources with the EV charging infrastructure can create a sustainable and environmentally

energy storage for grid stability myanmar

Independent solar photovoltaic with Energy Storage Systems (ESS) Low energy price has served as a main factor to deteriorating the energy efficiency of Myanmar. Low utility rates

Principle of Myanmar s new energy storage charging pile

New energy electric vehicles will become a rational choice to realize the replacement of clean energy in the field of transportation; the advantages of new energy electric vehicles depend on

Myanmar Electric Vehicle Market (2025-2031) | Industry

The future outlook for the Myanmar Electric Vehicle (EV) market is promising, driven by increasing awareness of environmental sustainability, government initiatives to reduce emissions, and

Energy Outlook and Energy Saving Potential in East Asia

Myanmar is endowed with rich natural resources for producing commercial energy. Currently, the available energy sources in Myanmar are crude oil, natural gas, hydropower, biomass, and

What is the price of energy storage vehicles in Liaoning

May 29, 2024 · The current market situation for energy storage vehicles in Liaoning presents a wide range of costs influenced by various factors. 1. The average price ranges from CNY

What is the price of direct-sale energy storage vehicles?

Sep 18, 2024 · The price of direct-sale energy storage vehicles typically ranges from $20,000 to $150,000 depending on various factors, including 1. vehicle specifications, 2. brand reputation,

Expanding EV options, yet to ignite comparable

Aug 8, 2023 · But in reality, it is about K70 million," U Min Nyunt, an auto broker told The Global New Light of Myanmar (GNLM). The EV prices were between

Understanding the Price of Energy Storage Vehicles in Myanmar

Are you curious about the cost of energy storage vehicles in Myanmar? Whether you''re an investor, a logistics manager, or a renewable energy enthusiast, this article breaks down

What are the energy storage charging pile factories in Myanmar

Our range of products is designed to meet the diverse needs of base station energy storage. From high-capacity lithium-ion batteries to advanced energy management systems, each

Review of energy storage systems for electric vehicle

Mar 1, 2017 · The electric vehicle (EV) technology addresses the issue of the reduction of carbon and greenhouse gas emissions. The concept of EVs focuses on the utilization of alternative

Myanmar Energy Storage Market (2024-2030) | Trends,

Market Forecast By Type (Pumped-Hydro Storage, Battery Energy Storage Systems, Others), By Application (Residential, Commercial, Industrial) And Competitive Landscape Report

Barriers to electric vehicle adoption in ASEAN emerging

Jul 29, 2025 · In the ASEAN region, emerging economies such as Cambodia, Myanmar, and the Philippines face persistent barriers, including high upfront costs, limited charging infrastructure,

Naypyidaw Photovoltaic vs Energy Storage Which Solution Powers Myanmar

As Myanmar accelerates its energy transition, Naypyidaw faces a critical choice: invest in large-scale photovoltaic (PV) systems or prioritize energy storage solutions. Both technologies offer

Driving the Future: Strategic Imperatives and Systemic

Jun 23, 2025 · This study critically reflects on Myanmar''s readiness and potential to transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs) amidst escalating climate

6 FAQs about [Myanmar energy storage vehicle price comparison]

Are EV charging stations available in Myanmar?

According to the results of Fig. 7, electricity is reliable more than average in Cambodia and Philippines. However, the reliability of electricity supply is very low in Myanmar. Therefore, Myanmar has more challenges for EV deployment. Survey results on the availability of EV charging stations in Cambodia, Myanmar, and the Philippines.

Why are EV charging problems a problem in Myanmar & the Philippines?

Myanmar and the Philippines, in particular, face persistent electricity reliability issues, while many countries lack integrated plans to expand charging networks in line with EV growth projections .

Are there barriers to electric vehicle adoption in Cambodia and Myanmar?

While this study provides valuable insights into the barriers to electric vehicle (EV) adoption in Cambodia, Myanmar, and the Philippines, several limitations should be acknowledged. First, the sample size, though diverse, was relatively limited in each country.

Why are EV batteries so expensive in ASEAN?

Many ASEAN countries also lack domestic manufacturing capacity for EV batteries and drivetrains, leading to import dependence and higher costs [49, 50]. Limited access to R&D investment further constrains innovation in localized EV technology.

Is transportation a major energy consumer in ASEAN?

The transportation sector in ASEAN is a major energy consumer, accounting for 33.6% of total final energy consumption (TFEC) in 2022 and projected to remain above 33% by 2030 [3, 4]. Energy consumption by sectors in ASEAN, Ref: ASEAN Energy Outlook 8 (Data Source: )

Is Myanmar more aware than the Philippines?

Myanmar shows a significant proportion of respondents as “Moderately Aware” (39.1%), but fewer are “Very Aware” (6.3%), reflecting moderate awareness overall. The Philippines leads in “Very Aware” respondents (27.9%), but overall awareness is lower, with a larger share falling in the “Slightly Aware” (18%) and “Moderately Aware” (23%) categories.

Learn More

- Vaduz Energy Storage Vehicle Price Comparison

- Factory price of electric energy storage vehicle

- Good energy storage vehicle custom price

- Bern Energy Storage Vehicle Product Price

- Ashgabat energy storage vehicle factory price

- Spanish mobile energy storage vehicle wholesale price

- Bandar Seri Begawan Energy Storage Vehicle Price

- Libreville large mobile energy storage vehicle price

- Minsk container energy storage vehicle price

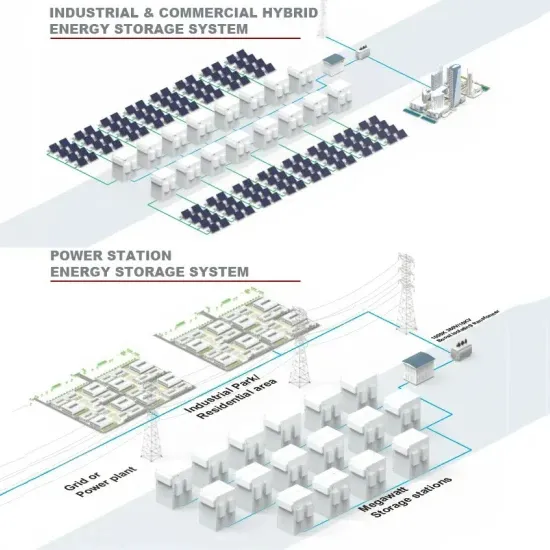

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.