A Milestone in Grid-Forming ESS: First Projects

Jul 22, 2024 · The world''s first batch of grid-forming energy storage plants has passed grid-connection tests in China, a crucial step in integrating renewables

How String Inverters Are Changing Solar Management

Jan 18, 2023 · Huawei''s combination of resilient string inverters with data loggers, advanced communication technology and cloud-based data analytics represents an early step toward

Grid-tied ESS Networking

Aug 1, 2025 · Grid-tied ESS Networking Networking 1: Single Inverter The grid-tied ESS consists of PV strings, LUNA2000 batteries, inverter, AC switch, loads, power distribution unit (PDU),

How State Grid Jiangsu Developed a Private Wireless Network

May 22, 2025 · Until recently, State Grid Jiangsu''s power communication networks primarily utilised optical fibres in offices, power supply stations, and 35 kV or higher-voltage substations.

2024 Annual Report

Dec 31, 2024 · Every year, Huawei invests over 10% of its sales revenue into R&D. In 2024, our total R&D spending reached CNY179.7 billion, representing 20.8% of our total revenue. Our

Grid-tied and Off-grid ESS Networking

The grid-tied and off-grid ESS consists of the PV strings, LUNA2000 batteries, inverter, AC switch, load, Backup Box, PDU, Smart Power Sensor and grid. The grid connection status of the

Huawe''s 3000 Inverters Power Successful Grid Connection of

Huawei''s inverter has shown great advantages in the project with its excellent performance and higher conversion efficiency. Compared with similar products, Huawei''s inverter power

Huawei Maintains the Top Position in the Global Passive

Dec 17, 2024 · As a leading market intelligence firm in the global information and communications technology (ICT) sector, ABI Research conducted a comprehensive assessment of 15 base

FusionSolar App and SUN2000 App User Manual

Jun 25, 2020 · Only professionals are allowed to set the grid parameters, protection parameters, feature parameters, power adjustment parameters, and grid-tied point control parameters of

Communication Base Station Renewable Integration

The $86 Billion Question: Can We Power Connectivity Sustainably? As global mobile data traffic surges 46% annually (Ericsson Mobility Report 2023), communication base stations now

2024年十大趋势白皮书-英文版 dd

Grid Connection Challenges PV systems, from utility-scale to commercial and industrial (C&I) and residential scenarios, are growing fast. However, stable grid connection and longer-term

6 FAQs about [Huawei communication base station inverter grid-connected revenue]

How much does Huawei invest in R&D?

Every year, Huawei invests over 10% of its sales revenue into R&D. In 2024, our total R&D spending reached CNY179.7 billion, representing 20.8% of our total revenue. Our total R&D investment over the last decade now exceeds CNY1.249 trillion. On December 31, 2024, 113,000 employees (about 54.1% of our workforce) worked in R&D.

Does Huawei's global telecom equipment market share improve in China?

While both Ericsson and Nokia improved their radio access network positions outside of China, initial estimates suggest Huawei's global telecom equipment market share, including in Chinese mainland, improved by two to three percentage points for the year.

How much money does Huawei spend on R&D in 2024?

Note: During 2024, our revenue derived from the cloud computing business, including revenue from other Huawei segments, amounted to CNY68,801 million. Every year, Huawei invests over 10% of its sales revenue into R&D. In 2024, our total R&D spending reached CNY179.7 billion, representing 20.8% of our total revenue.

How much energy does Huawei use in 2024?

The average energy efficiency of Huawei's main products in 2024 was 3 times as high as in 2019 (base year). Huawei used more than 3 billion kWh of clean energy in its own operations. Nearly 1 million devices have extended their lifespan through our trade-in program.

Does Huawei have a role in China's rapid 5G rollout?

Although Huawei was affected in the 5G segment due to microchips supply cut due to a US government discriminative ban, its advanced 5G technologies still lead other suppliers by one or two years, and it has played an irreplaceable role in China's rapid rollout of 5G base stations to date, telecom industry observers said.

How did Huawei perform in 2024?

In 2024, the entire team at Huawei banded together to tackle a wide range of external challenges, while further improving product quality, operations quality, and operational efficiency. Our performance was in line with forecast. We'd like to thank our customers around the world for your ongoing trust.

Learn More

- Huawei communication base station inverter grid-connected market share

- USA communication base station inverter grid-connected equipment processing

- What is the quota for adding panels to the grid-connected inverter of a communication base station

- Old communication base station inverter grid-connected equipment

- Integrated communication base station inverter grid-connected technical specifications

- Baghdad Communication Base Station Inverter Huawei

- Construction of inverter grid-connected power supply for China-Africa communication base station

- Big data communication base station inverter grid-connected construction project

- Prague communication base station inverter grid-connected price

Industrial & Commercial Energy Storage Market Growth

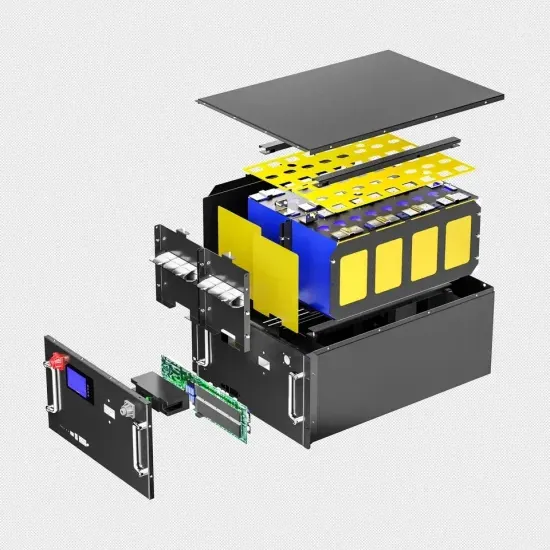

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.