FusionSolar Smart PV Management System Connection User

Purpose This document describes how to connect inverters to the FusionSolar Smart PV Management System through the Smart Dongle (SDongleA or SDongleB, also referred to as

5G Base Station Market Size, Share & Growth Report, 2030

5G Base Station Market Summary The global 5G base station market size was estimated at USD 33,472.5 million in 2023 and is projected to reach USD 253,624.3 million by 2030, growing at a

String Inverters Market Size to reach USD 6,380.14 Mn by 2031

The utility segment, which includes large-scale solar farms and grid-connected power plants, accounts for a significant share of the string inverter market. Utility-scale installations require

Huawei leads global inverter market as shipments hit 589

Jul 11, 2025 · Chinese conglomerate Huawei was the world''s largest inverter supplier in 2024, followed by Sungrow, Ginlong Solis, Growatt, and Sineng. New figures from Wood Mackenzie

Huawe''s 3000 Inverters Power Successful Grid Connection of

In addition, Huawei''s inverter is equipped with a L5 MBUS power carrier communication function, which enables the inverter to transmit communication data through AC cables, reducing the

String Inverters Market Size, Share & Forecast Report, 2033

Mar 17, 2025 · String Inverters Market Size, Share, Growth, and Industry Analysis, By Type (1.5-6KW, 6-30KW, 30-40KW, 40-60KW, 60-200KW, Above 200KW), And By Application

Huawei Maintains the Top Position in the Global Passive Antenna Market

Dec 17, 2024 · As a leading market intelligence firm in the global information and communications technology (ICT) sector, ABI Research conducted a comprehensive assessment of 15 base

2024 Annual Report

Dec 31, 2024 · In 2024, the entire team at Huawei banded together to tackle a wide range of external challenges, while further improving product quality, operations quality, and operational

Huawei Maintains the Top Position in the Global Passive Antenna Market

Dec 17, 2024 · According to the report, Huawei''s scored 87.8 points for its implementation capability, which is 8.5% ahead of the second place and fully reflects Huawei''s strong

Huawei and CommScope are the Market Leaders in ABI

Aug 12, 2025 · Despite a challenging year for the passive base station antenna market in 2020, Huawei retained its title as leader and increased its market share to 35.1%. The updated

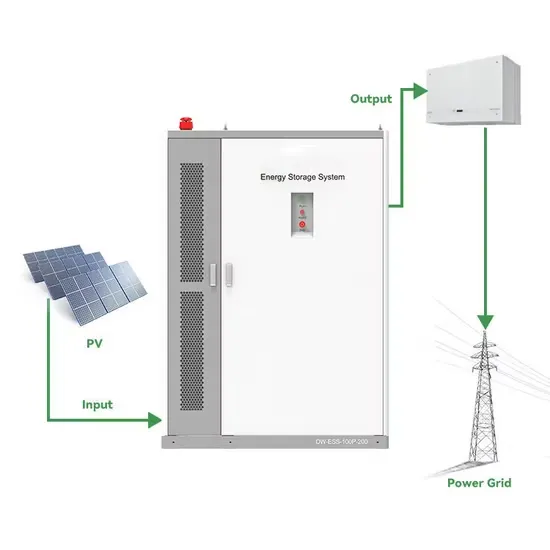

Grid-tied and Off-grid ESS Networking

The grid-tied and off-grid ESS consists of the PV strings, LUNA2000 batteries, inverter, AC switch, load, Backup Box, PDU, Smart Power Sensor and grid. The grid connection status of the

Huawei and CommScope are the Market Leaders in ABI

SINGAPORE, Aug. 3, 2021 /PRNewswire/ -- Despite a challenging year for the passive base station antenna market in 2020, Huawei retained its title as leader and increased its market

6 FAQs about [Huawei communication base station inverter grid-connected market share]

Does Huawei have a mobile base station?

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access. In 2021, Huawei accounted for 30 percent of the global mobile base station market, with Ericsson ranking second occupying 23.5 percent of the market.

Does Huawei have a strong market share?

According to the report, Huawei continues to lead the global market for the ninth consecutive year with a market share of 38.93%, making Huawei the only equipment manufacturer to maintain positive market share growth during this period.

What is the global base station antenna market research report 2023?

[Shenzhen, China, December 17, 2024] In their latest report, the global technology market intelligence firm ABI Research released its 2023 global base station antenna market research report titled "Passive Cellular Antenna Competitive Analysis".

Who owns the base station equipment market?

The report discloses that more than 70% of the market is covered by Chinese and European suppliers. The top three base station equipment providers are China-based Huawei with the share accounting for 30%, Sweden-based Ericsson with 23% shared and the third one is Finland-based Nokia with 20% market shares.

What is the market share of base station equipment suppliers?

A world-leading market intelligence provider – TrendForce released the global market share analysis report of suppliers of base station equipment. The report discloses that more than 70% of the market is covered by Chinese and European suppliers.

Which segment dominates the 5G base station market in 2024?

The industrial segment maintains its dominance in the global 5G base station market, commanding approximately 27% market share in 2024. This significant market position is driven by the accelerating adoption of Industry 4.0 initiatives and the growing integration of IoT devices in manufacturing facilities.

Learn More

- Huawei communication base station inverter grid-connected revenue

- Communication base station inverter grid-connected battery detection principle

- The grid-connected inverter of a communication base station should be 7MWh

- Communication base station inverter grid-connected behavior example

- Communication base station inverter grid-connectedCommunication base station inverter grid-connected distribution

- Communication base station inverter grid-connected supply

- Brad Communication Base Station Inverter Grid-Connected

- Eritrea communication base station inverter grid-connected photovoltaic power generation capacity

- Big data communication base station inverter grid-connected construction project

Industrial & Commercial Energy Storage Market Growth

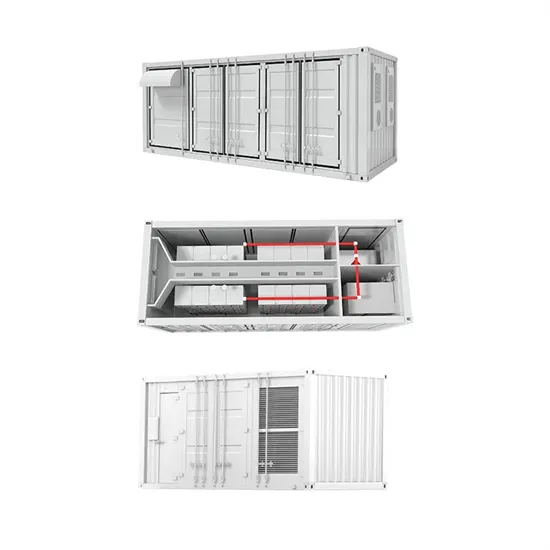

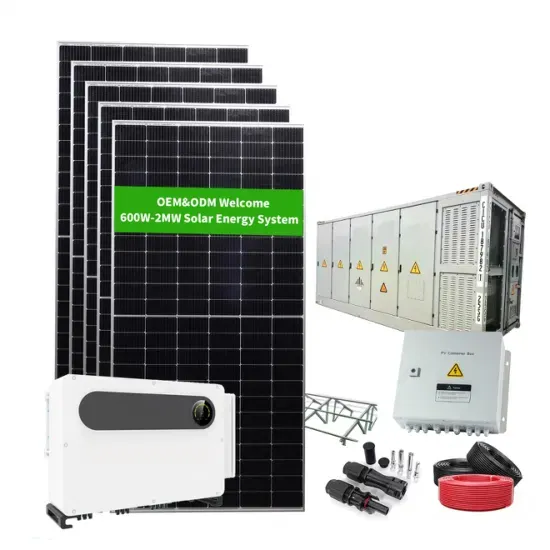

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.