Low-Carbon Sustainable Development of 5G Base Stations in

May 4, 2024 · For instance, Guo et al. (2022b) utilized LMDI decomposition analysis to estimate carbon emissions from 5G base stations in China, while Ding et al. (2022) conducted the life

Simulation and Classification of Mobile Communication Base Station

Dec 16, 2020 · In recent years, with the rapid deployment of fifth-generation base stations, mobile communication signals are becoming more and more complex. How to identify and classify

A series of 5G micro base stations jointly developed by E

Hangzhou, China, March 2023 - Picocom, a provider of 5G small base station baseband chips and carrier-grade software, recently announced that Yikoqi Communication Technology

应用于移动通信微基站的宽带Doherty功率放大器

Mar 27, 2020 · 第 42 卷 第 5 期2019 年 10 月电 子 器 件Chinese Journal of Electron DevicesVol 42 No 5Oct. 2019项目来源:重庆市重点产业关键技术创新专项项目

ZTE And China Telecom Deploy The Industry''s First 4G5G Dual-Band Micro

ZTE Corporation, a major international provider of telecommunications, enterprise and consumer technology solutions for the Mobile Internet, today announced that ZTE and the Hangzhou

Simulating 4G/5G base stations and terminals based on

System principle: Using LW-USRP/SDR-LW software radio hardware, combined with srsRAN, OpenAirInterface5g and other software platforms, to achieve the construction of 4G/5G analog

The Applicability of Macro and Micro Base Stations for 5G Base Station

Oct 14, 2022 · The construction of the 5G network in the communication system can potentially change future life and is one of the most cutting-edge engineering fields today. The 5G base

mobile communication base stations

Apr 21, 2021 · China''s mobile communication base station market is poised for significant growth, driven by the rapid expansion of 5G technology and the increasing demand for high-speed

Modular Communications Transceiver for 4G/5G

Apr 1, 2023 · This application report describes the methodology to construct modular 4G/5G distributed antenna systems (DAS) and base stations (BTS). It provides an example of an

Optimal Slicing of mmWave Micro Base Stations for 5G

Oct 11, 2023 · Micro base station are small and lightweight base stations that enhance the capacity and coverage of wireless networks. They are typically used in dense urban areas,

Mobile Communication Network Base Station Deployment

Apr 13, 2025 · This paper discusses the site optimization technology of mobile communication network, especially in the aspects of enhancing coverage and optimizing base station layout.

Murata-Base-station-app-guide

Sep 30, 2022 · Due to the higher-band frequency spectrum required by 5G, network infrastructure must make use of multiple small-cell antennas that can pick up these mmWave frequencies

What Is Base Station In Mobile Communication?

Jan 11, 2025 · The primary function of a base station is to transmit and receive radio signals to and from mobile devices, enabling voice and data services. Base stations are typically

6 FAQs about [Mobile communication micro base station 4G5G]

Why should you choose a 4G 5G micro base station?

In addition, the 4G/5G dual-band micro base station is small in size, light in weight and quick to deploy, thus effectively solving the challenge of insufficient site resources and realizing fast 5G signal coverage extension.

What are the differences between 5g and 4G base stations?

There are great differences between 5G and 4G base stations in a number of areas, which together empower 5G to offer better speeds, lower latency, and higher connection density. The differences are reflected in the following areas: 5G base stations adopt a more flexible architecture that supports network slicing and virtualization technologies.

What is a 5G O-ran micro-cell base station?

Unlike the small cell product development currently predominant in Taiwan’s network communication industry, this 5G O-RAN micro-cell base station system overcomes challenges including heat dissipation, signal distortion, and beamforming.

What is ZTE 4G 5G micro base station?

ZTE Corporation announced that ZTE and the Hangzhou branch of China Telecom have deployed the industry’s first 4G/5G dual-band micro base station supporting 3.5 GHz frequency band in Hangzhou, China. With the downlink rate reaching 1.1 Gbps, it can provide users with excellent 4G/5G network experiences.

How can a 5G base station be truly global?

To develop truly global 5G coverage, base stations will need to be installed across the world in some extremely inhospitable environments. This means that the new generation of base stations needs to be designed with environmental challenges and extreme weather in mind, such as the efects of humidity, heat and wind.

What are the differences between a 5G base station and virtualization?

The differences are reflected in the following areas: 5G base stations adopt a more flexible architecture that supports network slicing and virtualization technologies. Network slicing can make the network dynamically adjust resource allocation according to the demands of different services, improving the flexibility and efficiency of the network.

Learn More

- Communication security mobile base station

- Mobile base station communication principle

- How much power does mobile base station communication generate

- Andorra City Mobile suspends communication base station inverter

- Cape Verde Mobile Company 5G communication signal tower base station

- Mobile communication base station outdoor type

- Mobile LTE base station communication principle

- St John s Mobile Communication Base Station

- Mobile communication base station rectifier power supply

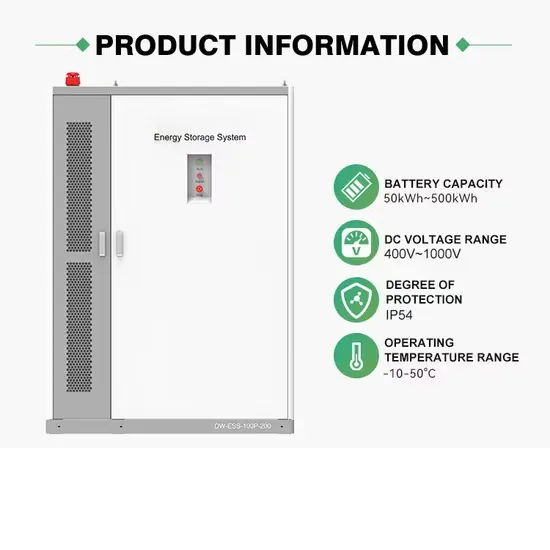

Industrial & Commercial Energy Storage Market Growth

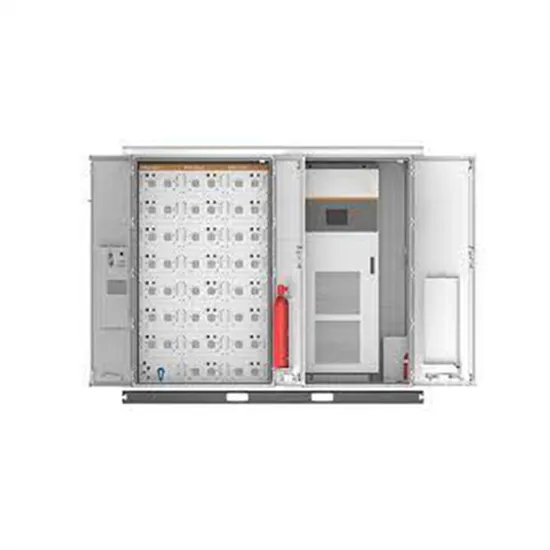

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

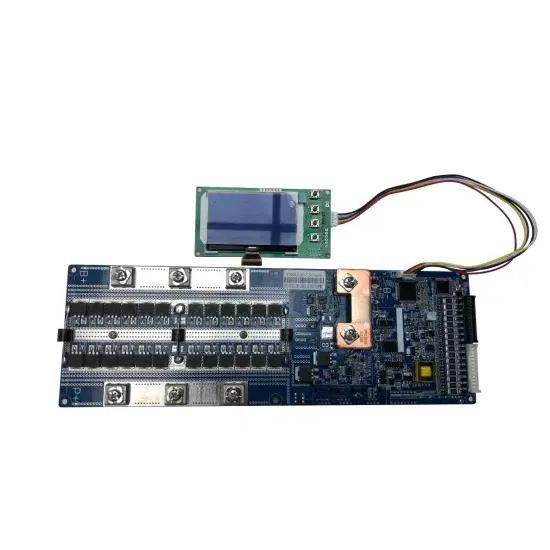

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.