What is a base station and how are 4G/5G base

Aug 16, 2022 · What is a base station and how are 4G/5G base stations different? Base station is a stationary trans-receiver that serves as the primary hub for

Technical Requirements and Market Prospects of 5G Base

Jan 17, 2025 · With the rapid development of 5G communication technology, global telecom operators are actively advancing 5G network construction. As a core component supporting

Europe 5G Base Station Duplexer Market Size, Segments

Apr 8, 2025 · The Europe 5G Base Station Duplexer Market has witnessed remarkable growth in recent years, fueled by the rapid adoption of 5G networks across the region. Duplexers are

5G Coverage in Europe: Progress Toward Goals Amid

Jul 17, 2025 · Europe''s 5G rollout has produced a "two-speed" competitiveness landscape, with some countries surging ahead in deployment while others fall behind. In Q2 2025, Nordic and

Europe 5G Base Station Market Scenario: Key Drivers and

Aug 5, 2025 · Analyzing the market across key regions reveals diverse growth patterns influenced by regulatory environments, technological adoption rates, and investment capacities. Each

Types of 5G NR Base Stations and Their Roles in

May 7, 2025 · As 5G continues to evolve, understanding these base stations will be essential for optimizing network design and achieving the full potential of

Compact 5G base station validated on embedded x86 platform

Jul 24, 2025 · For eeNews Europe readers designing private networks, tactical communications systems, or embedded telecom infrastructure, this development could offer a practical

5G Base station | ThreeBond Europe

A 5G base station is a critical component of modern wireless communication networks, enabling ultra-fast data transmission, low latency, and high connectivity. These stations serve as the

China has more than 3.8 million 5G base stations

Jun 28, 2024 · China''s 5G base stations account for 60 percent of the global total, Zhao added. In China, more than half of all mobile phone users are 5G users, Zhao told MWC Shanghai.

Europe 5G Base Station Market Forecast 2025 & 2032:

Aug 9, 2025 · What are the most popular 5G Base Station market types? Femtocell and Pico Cell are the popular types of 5G base stations currently seeing widespread adoption. About Us:

Battery technology for communication base stations

Feasibility study of power demand response for 5G base station In order to ensure the reliability of communication, 5G base stations are usually equipped with lithium iron phosphate cascade

Latest analysis of 5G roll-out in Europe reveals

Sep 18, 2020 · Europe fares equally poorly in upgrading 4G base stations to 5G as well, with just one percent having been enhanced this way, compared with

State of 5G in EU: 66% population coverage achieved in EU27

2 days ago · Only the total number of 5G base stations is known for some EU countries. This means the true total number of base stations in the EU in 700 MHz, 3.6 GHz or DSS bands

EU: 5G base stations as share of existing 4G

Jul 1, 2025 · Data collected in 2024 placed the number of 5G base stations in the European Union at around ** percent of the number of existing 4G base stations.

Assessment of 5G Deployment Status in Europe

Feb 20, 2024 · Europe''s sophisticated research base, industrial sector and consumer markets should underpin rapid deployment of 5G and development of an innovative 5G and IoT sector.

5G in Europe – status and next steps

Nov 8, 2023 · Source: 5G coverage of populated areas and spectrum assignment data is sourced from the DESI index; Base station data is from the European Commission, via the Digital

6 FAQs about [Europe s 5G communication base stations]

What is the European 5G Observatory?

The European 5G Observatory covers the 27 EU Member States, and 20 additional non-EU countries, offering a comprehensive view of 5G developments across Europe and beyond. Why use the European 5G Observatory? Fifth generation mobile communications (5G) is a key technology for digital communication and thus socio-economic development.

What is the European Commission's 5G strategy?

From a policy perspective, the European Commission has placed 5G at the core of its competitiveness strategy, closely linking coverage availability, timely spectrum assignment, and vendor diversity to productivity gains and strategic autonomy.

Is 5G available in Europe?

By contrast, 5G Availability in Central and Western European laggards such as Belgium, the United Kingdom, and Hungary remains less than half that of the leaders. On average, EU mobile subscribers spent 44.5% of their time connected to 5G networks in Q2 2025, up from 32.8% a year earlier.

What is Europe's 5G Revolution?

Europe’s 5G revolution is well underway. From artificial intelligence (AI) to the internet of things (IoT), the high bandwidth and low latency offered by 5G is powering a range of exciting technological developments across the continent.

Which countries have the best 5G coverage?

The report considers publicly available data on 5G coverage, connection speeds, and the extent of developments in private networks in the countries that disclose the respective data. The report also presents a tool for scoring network coverage and speeds, highlighting countries such as Italy, the Netherlands, and Denmark with almost 100% coverage.

Will the EU achieve 100% outdoor 5G population coverage?

This research, which leverages Speedtest Intelligence® data, aims to independently benchmark progress toward the EU’s flagship 5G deployment objectives, including the Digital Decade 2030 goal of achieving 100% outdoor 5G population coverage, using the world’s largest consumer-initiated dataset.

Learn More

- Italian bidding for 5G communication base stations

- Are there the most 5G base stations in communication

- What are the uninterrupted power supplies for 5G communication base stations in Mozambique

- Are there many 5G communication base stations in Castries

- Should 5G base stations be divided into communication and communication

- Are all the communication base stations in Cyprus 5G

- How many 5g communication base stations are there in London

- Can Nicaragua s communication base stations use 5G

- Romania has 5g communication base stations

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

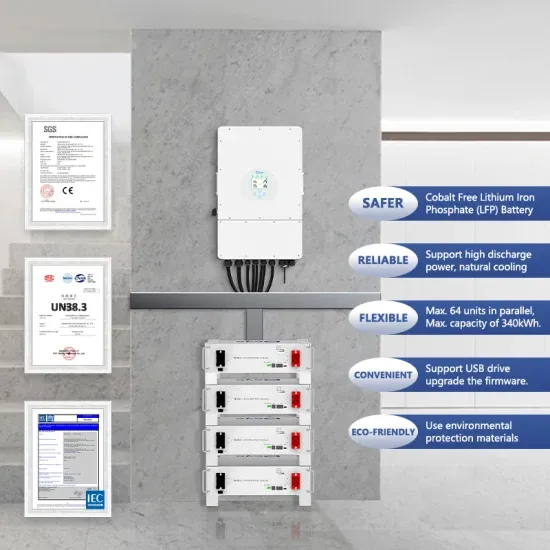

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.