China home to 4.25 million 5G base stations

Jan 22, 2025 · The number of 5G base stations in China has hit 4.25 million, with the number of gigabit broadband users surpassing 200 million, official data showed Tuesday. More than

5G Base Station Construction Market in Italy

5G Base Station Construction in Italy Trends and Forecast The future of the 5G base station construction market in Italy looks promising with opportunities in the smart home, medical &

Tenders for 700MHz Base Stations and Related Antennas

Aug 20, 2021 · The main items of the tenders involve the centralized procurement of 480,000 stations of 5G 700M wireless network main equipment, and the centralized procurement of

China Unicom 5g base station bidding or exceeding the

Jul 12, 2021 · China Telecom and China Unicom recently announced the centralized purchase of 2.1GHz 5g base stations, planning to purchase a total of 242000 stations. The maximum

5G Base Station Construction Market in Italy

Italy''s 5G base station construction market is changing rapidly, catalyzed by technological progress, government initiatives, and rising demand for data services. With substantial

Look Before You Leap: Secure Connection Bootstrapping

Oct 12, 2021 · The communication overheads and computational delays of these signature schemes and authentication protocols will be further aggravated in 5G networks since 5G

Multi-objective cooperative optimization of communication base

Sep 30, 2024 · In the above model, by encouraging 5G communication base stations to engage in Demand Response (DR), the Renewable Energy Sources (RES), and 5G communication base

Italy to spend EUR2bn to ensure full 5G coverage by 2026

Nov 18, 2021 · The Italian government has unveiled plans to invest EUR2 billion (USD2.3 billion) to guarantee mobile data speeds of at least 150Mbps across the entire country by 2026.

The first 10,000-unit 5G small base station bidding opens today: 5G

Today, Monday, May 30, China Mobile announced the results of the first batch of 30,000 5G small base stations after months of bidding tests. Regardless of who wins the bid, the industry is full

The business model of 5G base station energy storage

1 Introduction 5G communication base stations have high requirements on the reliability of power supply of the distribution network. During planning and construction, 5G base stations are

China home to 4.25 million 5G base stations

Jan 21, 2025 · The number of 5G base stations in China has hit 4.25 million, with the number of gigabit broadband users surpassing 200 million, official data showed Tuesday.

TIM wins €725M of Italy''s 5G funding pot

Jun 14, 2022 · Figure 1: The Italian operator is responsible for building the backhaul fiber links for 11,000 5G base stations in Italy. (Source: Arcansel/Alamy Stock Photo)

What is a base station and how are 4G/5G base

Aug 16, 2022 · What is a base station and how are 4G/5G base stations different? Base station is a stationary trans-receiver that serves as the primary hub for

Reconfigurable Antennas for Intelligent In-Door 5G Base

Jun 30, 2022 · This special section encourages submissions focusing on reconfigurable antennas which are designed to enhance our communication experience in in-door and 5G base stations.

Italian government raises $7.5 billion in 5G auction

Italy''s Ministry of Economic Development announced the completion of the national 5G spectrum tender, in which the government raised a total of EUR 6.55 billion ($7.56 billion), more than

China Unicom LTE phase III bidding for 167 thousand base stations

On March 1st, China Unicom LTE phase III wireless main equipment bidding for 167 thousand base stations ended. According to the public results, four major equipment vendors all won the

Italy''s 5G auction is over, but will the €6.5bn spectrum

Oct 3, 2018 · Italy''s auction for 5G spectrum has exceeded everyone''s expectations, netting over €6.5 billion after 14 days of intense bidding. The amount raised is more than double the

Mobile Communication Network Base Station Deployment Under 5G

Apr 13, 2025 · This paper discusses the site optimization technology of mobile communication network, especially in the aspects of enhancing coverage and optimizing base station layout.

Collaborative optimization of distribution network and 5G base stations

Sep 1, 2024 · In this paper, a distributed collaborative optimization approach is proposed for power distribution and communication networks with 5G base stations. Firstly, the model of 5G

TIM wins €725M of Italy''s 5G funding pot

Jun 14, 2022 · Telecom Italia (TIM) has managed to secure a sizable portion of a wider government tender to deploy 5G basestations and fiber backhaul networks in six geographic

6 FAQs about [Italian bidding for 5G communication base stations]

What is a 5G infrastructure project in Italy?

In 2022, the Italian government announced a 5G infrastructure programme funded by the EU Recovery and Resilience Facility (RRF). Under this proposal, INWIT Infrastructure Wireless, a joint venture between Italian mobile operators Vodafone and TIM, has won six lots of funding with a combined value of EUR 345m (USD 359m).

What are Italy's upcoming 5G spectrum tenders?

Italy is actively involved in EU working groups to set common rules for spectrum sharing and usage. Within this framework, provided that the exact timeline has not already been finalized, expected tenders are as follows: Additional Bands for 5G: As noted, the 3.8-4.2 GHz band and the L Band (1.4 GHz) are expected to be auctioned around 2025-2027.

Which cities in Italy have 5G networks in 2023?

As per SA 5G networks, by the end of 2023 a network was realized and switched on in the main cities of Italy, namely Milan, Rome, Turin, Bologna, Naples, Florence, Verona and Catania thanks to the collaboration among the top telecommunications market players (TIM, Vodafone, WindTre and Iliad).

When did 5G start in Italy?

In 2020 TIM and Ericsson launched 5G connected technologies at the Leonardo da Vinci Fiumicino Airport in Rome. In 2021 the government assigned EUR 2.02bn (USD 2.10bn) from the Italian Recovery and Resilience Plan to the application of the 5G Italy Plan.

What is Italy doing in 6G?

At the European level, Italy is involved in several key initiatives funded by the European Commission, under Horizon Europe and other research programs. EU 6G Flagship Programs: Italy is participating in the 6G-IA (6G Infrastructure Association), a public-private partnership aimed at defining and researching 6G technologies.

What percentage of Italy's population is covered by 5G?

According to the latest estimates/data available, Italian operators (TIM, Vodafone, WindTre and Iliad) claimed to have achieved 90-95% population coverage with 5G services.

Learn More

- Does Ghana currently have 5G base stations for communication

- What are the supercapacitors for 5G communication base stations in Algeria

- Europe s 5G communication base stations

- Does the Brazzaville factory have 5G communication base stations

- 5g base stations should be divided into communication

- What are the uninterrupted power supplies for 5G communication base stations in Mozambique

- Are all the communication base stations in Cyprus 5G

- Communication has base stations but no 5G

- How to view 5g communication base stations

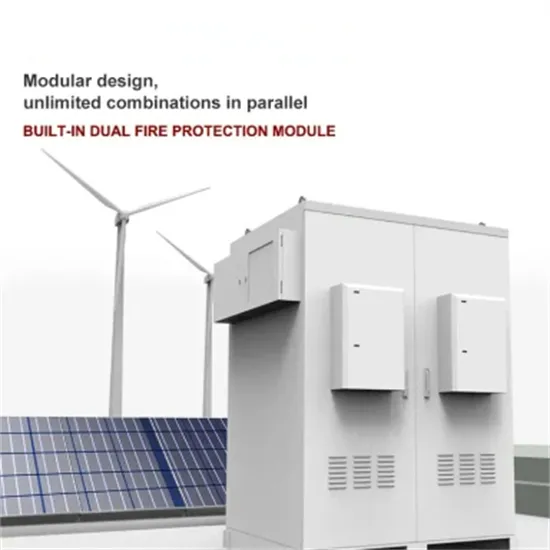

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.