Trina Solar Reports Strong Q1 Gross Margin and

May 27, 2025 · The net profit attributable to shareholders was -1.32 billion yuan, with an adjusted net profit of -1.323 billion yuan, representing a reduction in

Is the net profit of photovoltaic cells high

Compared with other electricity sources,solar PV has one of the lowest life-cycle GHG emission levels per kilowatt hour generated. Nevertheless,PV presents great variability in terms of its

Half of 60 Chinese PV Companies Listed Forecast

Feb 18, 2024 · Trina Solar (688599.SH), a global provider of solar PV and smart energy solutions, forecasts a net profit attributable to parent of 5.27 billion

Revenues redistributed across solar value chain-Industry

Nov 22, 2022 · In the second half of 2022, upstream price hikes slowed down, but cell prices decoupled from upstream price trend and surge, as supply ran short for large-format cells and

2023 Annual Report: LONGi Maintains Robust Financial

Apr 29, 2024 · According to PV InfoLink data, in 2023, the price of multicrystalline silicon materials dropped by about 70%, the price of silicon wafers and cells (PERC 182) decreased by about

Chinese PV Industry Brief: Financials for Longi,

Aug 31, 2021 · Chinese PV Industry Brief: Financials for Longi, Xinte, Solargiga, Irico, Golden Solar Longi posted a net profit of $773 million in the first half of

2021 Financial statements of vertically integrated companies

May 16, 2022 · Cell and module segments contributed RMB 58.5 billion, together accounting for 72% of total revenue, with 17.1% of gross margin. Module business saw 61.3% of growth YoY,

PV cells and modules – State of the art, limits and trends

Dec 1, 2020 · Over the past 15 years a categorisation of generations of PV cell and module technology groups has been frequently used. The main features of individual technology

Financial statements of leading vertically integrated companies

Apr 26, 2021 · For turnover by products, the revenue of solar modules accounted for 93% of the total, with 16.1% gross margin. For turnover by region, the domestic market accounted for

Crystalline Silicon Photovoltaic Cells, Whether or Not

Feb 6, 2024 · Crystalline Silicon Photovoltaic Cells, Whether or Not Partially or Fully Assembled Into Other Products: Monitoring Developments in the Domestic Industry Investigation No. TA

Leading Photovoltaic Company Longi Green Energy''s Net Profit

Aug 31, 2024 · China''s leading silicon wafer and component company, Longi Green Energy, released its semi-annual report for the first half of 2024 on June 30th, revealing a net loss of

Key PV Terms from Mid-Report: Overseas Expansion,

May 31, 2024 · As for photovoltaic modules, Array Technologies emphasized in the report that the company balances between price and shipment volume, actively reducing shipment volume,

Hanwha reaps benefit of Q Cells takeover with Q3 net profit,

Nov 19, 2015 · Hanwha s takeover of Q Cells is bearing fruit, with Q3 recording significantly improved earnings results. In addition to a return to net profitability, Hanwha Q Cells Co. Ltd

JinkoSolar''s Unrivaled Growth and Profit Margins – pv

May 27, 2024 · First-quarter results show that JinkoSolar is still way ahead of the competition in multiple aspects, its sales growth and margin beat the competitors.

Empirical analysis and strategy suggestions on the

Aug 1, 2019 · The results indicate that only 6 variables have significant effects on the gross profit margin of the PV industry value chain, and there are big diversities in the main influencing

Quick understanding of JA Solar''s 2023 annual report

May 4, 2024 · Its financial prowess shines through with impressive indicators: EPS at 2.14 yuan per share, up by 25.15%, net profit margin at 8.82% (up by 1.23 percentage points), and gross

GCL SI H1 net profit jumps by 220% YOY, targets

Jul 14, 2023 · Chinese module manufacturer GCL System Integration (GCL SI) has estimated its preliminary net profit for the first half of 2023 to be around

The six major listed PV module manufacturers achieved

Oct 31, 2024 · Net profit of the six major listed PV module companies in the third quarter Data source: announcement, Wind The top module manufacturers are strong in shipments, but their

Latest net profit margin of photovoltaic cells

A Review of Photovoltaic Cell Generations and Simplified The bifacial photovoltaic technology has been briefly reviewed in the review, including the substrates used, cell texturing,

Under the cloud of PV price war and overcapacity, JinkoSolar''s net

Apr 23, 2024 · PV module leader JinkoSolar (688223. SH) disclosed on April 22 that the operating income last year was 118.682 billion yuan, a year-on-year increase of 43.55%, and the net

DMEGC releases 2024 annual report showing slight profit

Mar 13, 2025 · DMEGC has released its 2024 annual report, revealing that the company achieved annual revenue of €2.4 billion, with a net profit attributable to the parent company of €238

Hanwha Qcells Reports Fourth Quarter and Full Year 2017

Nov 4, 2018 · Hanwha Q CELLS Co., Ltd. ("Hanwha Qcells" or the "Company") (NASDAQ: HQCL), a global leading photovoltaic manufacturer of high-performance, high-quality solar

Chinese PV Industry Brief: DMEGC posts gains as

Apr 29, 2025 · Photovoltaic and lithium battery products made up 72.66% of total revenue, with magnetic materials contributing 20.54% and other businesses

ReNew reports 13-fold jump in Q1 net profit – pv magazine

Aug 14, 2025 · ReNew Energy Global has reported a net profit of INR 5,131 million for the first quarter of fiscal year 2026 (Q1 FY26), marking a 13-fold increase from INR 394 million in Q1

JinkoSolar posts $1 billion net profit for 2023

Apr 24, 2024 · Chinese module manufacturer JinkoSolar has recorded roughly $16.4 billion of revenue and a $1.06 billion net profit for 2023, with PV module shipments reaching 78.52 GW.

43.09GW of Modules Shipped! Trina Solar Releases 2022

PVTIME – On 24 April 2023, Trina Solar (688599.SH), a leading global solar PV and smart energy integrated solution provider, released its 2022 annual report. Its revenue was 85.052 billion

Photovoltaic solar panel gross profit

Policy Paper on Solar PV Manufacturing in India: Silicon Ingot Solar PV Manufacturing in India: Silicon Ingot & Wafer PV Cell - PV Module Trends of ASPs, Gross Profit & Net Profit of Tier-1

2021 Financial statements of vertically integrated companies

May 16, 2022 · Manufacturers across the PV supply chain released their financial statements for 2021. Five leading vertically integrated companies all posted significant growths in revenues

Executive summary – Solar PV Global Supply

Aug 13, 2025 · The total value of global PV-related trade – including polysilicon, wafers, cells and modules – exceeded USD 40 billion in 2021, an increase of

Why is it the first leading photovoltaic company to turn a profit

Jul 22, 2025 · This means that Aiko Solar Co., Ltd. has become the first company in the main photovoltaic industry chain to achieve a profit turnaround in a single quarter. Behind this

Nation''s PV firms report stellar H1 performance

Sep 18, 2023 · Longi Green Energy Technology Co, the world''s biggest PV panel maker, saw its first half net profit increase 41.6 percent year-on-year to 64.65

14 Largest Solar Companies In The World [As of

Jan 25, 2025 · We''ve focused on the titans of the industry- the largest solar companies worldwide - and explored their crucial role in shaping the future of

6 FAQs about [Photovoltaic cells and modules gross profit and net profit]

How has global solar PV manufacturing capacity changed over the last decade?

Global solar PV manufacturing capacity has increasingly moved from Europe, Japan and the United States to China over the last decade. China has invested over USD 50 billion in new PV supply capacity – ten times more than Europe − and created more than 300 000 manufacturing jobs across the solar PV value chain since 2011.

How did China's photovoltaic industry perform in the first half?

[WANG ZHENG/FOR CHINA DAILY] Leading photovoltaic companies in China reported sound performances during the first half, with revenue of all 61 A-share PV companies exceeding 580.3 billion yuan ($79.7 billion) and net profit reaching 69.66 billion yuan, thanks to rising market demand and ever-falling costs.

How many jobs will the solar PV industry create?

The solar PV industry could create 1 300 manufacturing jobs for each gigawatt of production capacity. The solar PV sector has the potential to double its number of direct manufacturing jobs to 1 million by 2030. The most job-intensive segments along the PV supply chain are module and cell manufacturing.

How much investment will solar PV make by 2030?

New solar PV manufacturing facilities along the supply chain could attract USD 120 billion investment by 2030. Annual investment levels need to double throughout the supply chain. Critical sectors such as polysilicon, ingots and wafers would attract the majority of investment to support growing demand.

How many dumping and import taxes are imposed on solar PV?

Since 2011, the number of antidumping, countervailing and import duties levied against parts of the solar PV supply chain has increased from just 1 import tax to 16 duties and import taxes, with 8 additional policies under consideration. Altogether, these measures cover 15% of global demand outside of China.

How did PV supply chains perform in 2021?

Manufacturers across the PV supply chain released their financial statements for 2021. Five leading vertically integrated companies all posted significant growths in revenues and net profits. This can be largely attributed to increased shipment volumes.

Learn More

- Photovoltaic n-type modules and n-type cells

- Heterojunction photovoltaic modules and BC cells

- Photovoltaic inverter enterprise profit margin

- Huawei Belgrade double-glass photovoltaic modules

- Double-glass thin-film photovoltaic modules

- Differences between single-sided and double-sided photovoltaic modules

- Subsidy price of photovoltaic modules in Hamburg Germany

- Companies exporting photovoltaic modules from Belize

- Do photovoltaic cells store energy

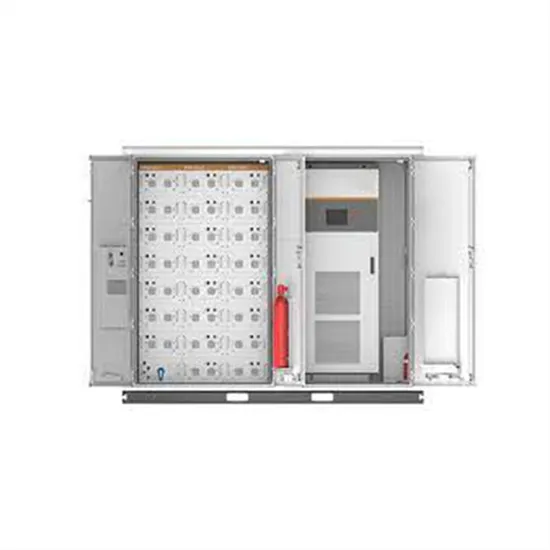

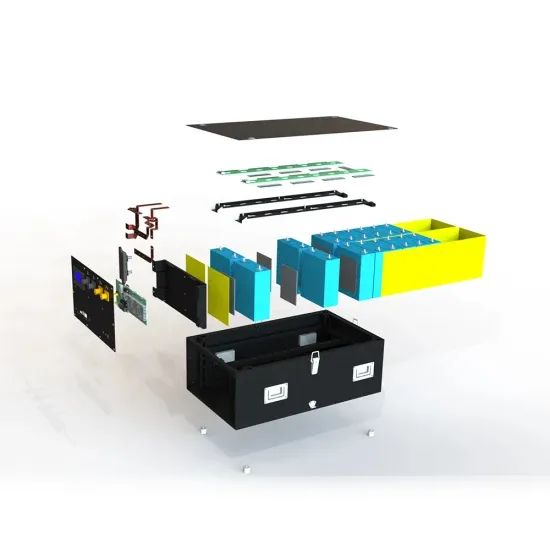

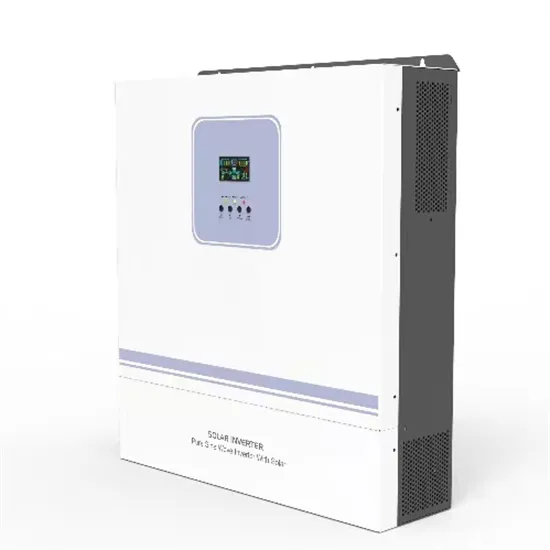

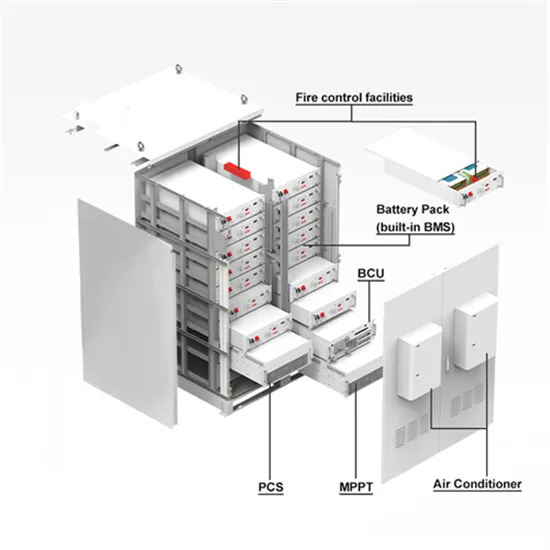

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.