5G Base Station Growth: How Many Are Active? | PatentPC

Aug 4, 2025 · With over 2.4 million base stations, the country accounts for more than 60% of all 5G infrastructure globally. The Chinese government, in partnership with major telecom

China to build 1 million new 5G stations in 2021

Aug 2, 2025 · Chinese telecom carriers are likely to build more than 1 million new 5G base stations next year, as the cost of 5G base stations is expected to go

China home to 4.25 million 5G base stations

Jan 22, 2025 · The number of 5G base stations in China has hit 4.25 million, with the number of gigabit broadband users surpassing 200 million, official data showed Tuesday. More than

5G Base Station Market Size to Surpass USD 832.42 Billion by

Mar 6, 2025 · The global 5G base station market size is accounted to hit around USD 832.42 billion by 2034 increasing from USD 44.86 billion in 2024, with a CAGR of 33.92%.

China''s Total 5G Base Stations Reach 4.486 Million

Jul 7, 2025 · 5G network construction continues to deepen. By the end of May, the total number of 5G base stations reached 4.486 million, a net increase of 235,000 since the beginning of the

5G Base Station Market Analysis, Industry Trends

Jan 2, 2025 · Smart Cities to Witness Major Growth 5G technology is an enabling technology for IoT, and as smart cities essentially rely on IoT, the demand for

Top 10 countries with the most extensive 5G in 2022

Mar 22, 2022 · Telstra, Australia''s largest telecommunications company, has installed over 2000 5G base stations, covering 41% of the country''s population. To provide 5G services across

mobile communication base stations

Apr 21, 2021 · China''s mobile communication base station market is poised for significant growth, driven by the rapid expansion of 5G technology and the increasing demand for high-speed

China: market share of 5G base stations by

Jun 25, 2025 · With strong government support, the three big companies invested heavily in the construction of the country''s 5G network. As a result, China had

China Telecom and China Unicom jointly build and share 5G

Sep 10, 2019 · Territories each will cover is divided roughly based on the number of 4G base stations. For example, in Beijing, China Telecom will build 40% of the 5G base stations, while

SoftBank Corp. and KDDI Corporation Expand Scope of

May 8, 2024 · Through 5G JAPAN, SoftBank and KDDI have jointly built out over 5G 38,000 base stations each, resulting in capital expenditure cost reductions of 45.0 billion yen for each

China Tower had ~2.1M telecom towers installed with 3.36M

Mar 6, 2023 · China Tower ended 2022 with 2.05 million telecom towers installed, representing a net increase of 17,000 sites from the end of 2021. The company installed approximately

5g Base Station Market Size & Share Analysis

Jul 8, 2025 · The 5G Base Station Market size is estimated at USD 37.44 billion in 2025, and is expected to reach USD 132.06 billion by 2030, at a CAGR of 28.67% during the forecast

6 FAQs about [Number of 5G base stations of each telecommunications company]

How many 5G base stations does China have?

China has deployed over 2.4 million 5G base stations as of 2023, accounting for over 60% of the global total China is leading the 5G revolution. With over 2.4 million base stations, the country accounts for more than 60% of all 5G infrastructure globally.

How big is the 5G base station market?

The 5G Base Station Market is expected to reach USD 37.44 billion in 2025 and grow at a CAGR of 28.67% to reach USD 132.06 billion by 2030. Huawei Technologies Co., Ltd., ZTE Corporation, Nokia Corporation, CommScope Holding Company, Inc. and QUALCOMM Incorporated are the major companies operating in this market.

Does China have a 5G network?

With over 2.4 million base stations, the country accounts for more than 60% of all 5G infrastructure globally. The Chinese government, in partnership with major telecom providers like Huawei and China Mobile, has aggressively built this network to support industries, consumers, and digital transformation. Why does China have such a head start?

How many base stations will 5G have in 2025?

The U.S. has ambitious plans for 5G expansion, aiming to have more than 300,000 active base stations by 2025. This goal is being driven by investment from private telecom providers and government initiatives like the Rural 5G Fund. For businesses in the U.S., this means increasing access to high-speed connectivity.

Which segment dominates the 5G base station market in 2024?

The industrial segment maintains its dominance in the global 5G base station market, commanding approximately 27% market share in 2024. This significant market position is driven by the accelerating adoption of Industry 4.0 initiatives and the growing integration of IoT devices in manufacturing facilities.

What is the future of 5G?

The future of 5G is clear: more base stations, wider coverage, and improved connectivity. Industry forecasts suggest that by 2025, the total number of 5G base stations worldwide will surpass 5 million. This expansion will be driven by ongoing urbanization, demand for high-speed connectivity, and technological advancements.

Learn More

- Number of 5G base stations of Palestinian telecommunications operators

- Naypyidaw Power Supply Company assists in the construction of 5G base stations

- Romania has 5g communication base stations

- How many base stations does Somalia s 5G network have

- Iran 5G communication base stations are far away

- How to make 5G base stations self-sufficient in electricity

- Does Ghana currently have 5G base stations for communication

- Europe s 5G communication base stations

- Standardized batteries for 5G base stations

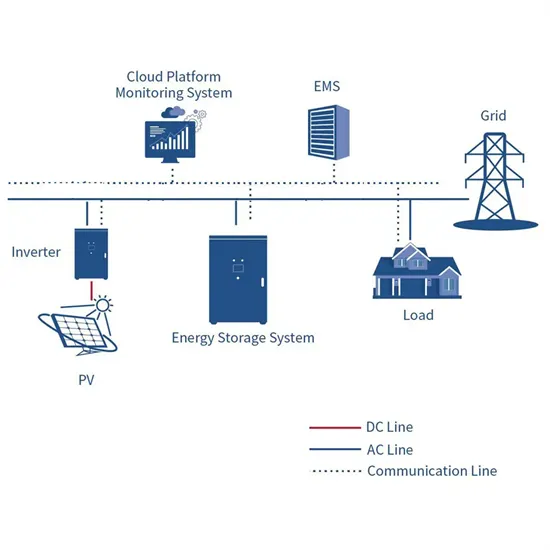

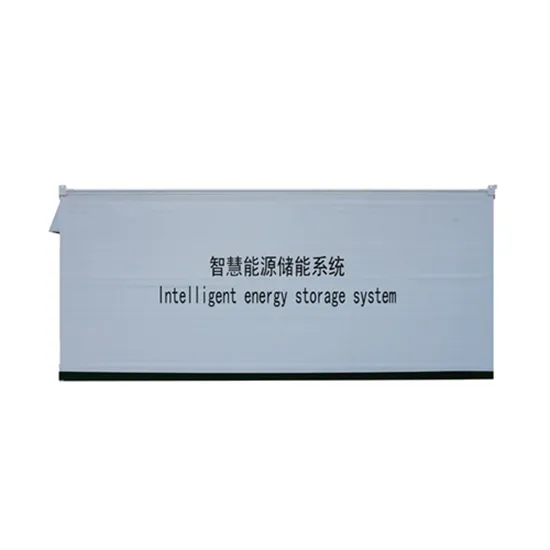

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.