Middle East and Africa Battery Market 2025-2034

1 day ago · Market Overview The Middle East and Africa (MEA) battery market is witnessing significant growth, driven by the increasing demand for reliable power sources in various

Energy Series Advancing Energy Storage in the MENA

Dec 11, 2024 · To date, the most popular way to store excess energy has been pumped storage hydropower plants, but battery energy storage systems (BESS) and thermal storage in the

Middle East Energy | Product Sector | Battery

Aug 18, 2025 · Battery storage technology has become the cornerstone of the Middle East''s ambitious energy transformation, providing essential support for grid resilience, seamless

Middle East Energy | Global Energy Event | 7

1 day ago · For 50 years, Middle East Energy has been a cornerstone of the region''s energy sector growth and innovation. This golden milestone is more than a celebration — it''s a

Middle East Battery Energy Storage Systems Market Size and

Aug 7, 2025 · What is the market size and expected growth rate of battery energy storage systems in Middle East through 2031? Which battery chemistries are gaining traction beyond

Why battery storage investment is vital to the

Sep 28, 2023 · Investing in battery storage is crucial for a successful energy transition in the Middle East, as it enables the realisation of the full benefits of

Middle East Energy | Product Sector | Battery & Energy Storage

Aug 18, 2025 · The Battery & Energy Storage sector at Middle East Energy will be your gateway to the region''s fastest-growing energy technology market. This dynamic sector represents one

Scaling Energy Storage in the MENA Region Amidst

Jan 6, 2025 · Until recently, large-scale energy storage was barely a consideration in the Middle East, where fossil fuels have long dominated power generation. With renewable energy

Battery Storage in the Middle East: Powering the Energy Shift

Jul 16, 2025 · According to The Future of Battery Market in the Middle East & Africa, Saudi Arabia plans to expand its battery storage capacity from 22 GWh to 48 GWh by 2030. The Saudi

Navigating Renewable Energy Challenges

Oct 7, 2024 · Conclusion As renewable energy gains traction in countries like KSA and UAE, the demand for grid flexibility technologies such as battery storage, HVDC, and FACTS will soar.

6 FAQs about [Battery Energy Storage Solutions in the Middle East]

Why are batteries becoming a preferred energy storage solution in the Middle East?

In the Middle East and African region, the demand for batteries has increased in the Middle East as a preferred energy storage solution primarily due to technological innovation and the reduction of battery costs.

Are lithium-ion batteries in demand in the Middle East & Africa?

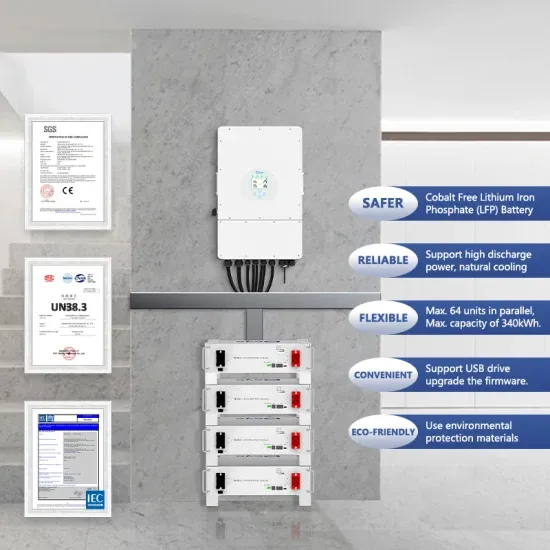

In terms of technology, lithium-ion batteries are in huge demand in the Middle East and Africa Advance Energy Storage Market. These batteries are also being used for the storage of energy from renewable energy sources such as solar and wind in the region.

What is battery energy storage system?

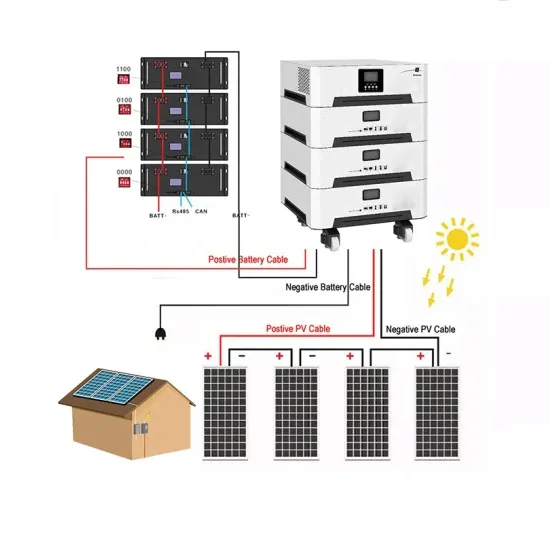

Energy storage is the technique of storing energy in specific equipment or systems so that it can be used when needed later. This enables businesses and sectors to save energy and use it when demand rises, or grid failures occur. The Middle-East and Africa Battery Energy Storage System Market is segmented by Technology, Application, and Geography.

Which energy storage solutions will be the leading energy storage solution in MENA?

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

What is energy storage?

MARKET OPPORTUNITIES AND FUTURE TRENDS Energy storage is the technique of storing energy in specific equipment or systems so that it can be used when needed later. This enables businesses and sectors to save energy and use it when demand rises, or grid failures occur.

Which country has the most battery storage capacity in MENA?

Currently, NaS battery technology dominates the battery storage capacity in operation in MENA, particularly in the UAE, with a total of 108 MW/648 MWh projects developed by the Abu Dhabi Water and Electricity Authority (ADWEA).

Learn More

- Energy storage battery prices in the Middle East

- Middle East Electric New Energy Storage Battery

- Middle East Power Grid Energy Storage Design

- Existing non-electrochemical energy storage stations in the Middle East

- Large energy storage cabinet wholesaler in the Middle East

- Middle East Energy Storage Photovoltaic Engineering Enterprise

- Middle East Large Energy Storage Cabinet

- Liquid Cooling Energy Storage Costs in the Middle East

- Middle East Industrial Energy Storage Products

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.