Doha Pulan Energy Storage Technology: Powering the Middle East

Jul 19, 2020 · Why the Middle East''s Energy Storage Market Is Booming Like a Desert Mirage oil-rich nations betting big on battery storage instead of crude oil. That''s exactly what''s happening

Energy Storage Startups in Middle East

Jul 11, 2025 · Discover the top emerging companies in the Energy Storage Startups in Middle East, their funding activity, key investors, company highlights, and growth stages

Jinko ESS to deliver 66MWh storage system for Middle East

Jun 8, 2025 · Jinko ESS has announced that it has secured a 66MWh energy storage order covering four project sites in the Middle East region. The sites will utilize the company''s G2

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Feb 4, 2022 · The pace of integration of energy storage systems in MENA is driven by three main factors: 1) the technical need associated with the accelerated deployment of renewables, 2)

HyperStrong accelerates Middle East market expansion at

Jan 26, 2025 · HyperStrong has participated at the World Future Energy Summit (WFES) in Abu Dhabi for the first time, showcasing its cutting-edge energy storage technologies tailored to the

Middle East Energy | Energy series Energy Storage in MENA

5 days ago · Download the Energy Series - Energy Storage in MENA Report to uncover the pivotal role of energy storage in mitigating the intermittency challenges posed by renewable

Middle East and North Africa

Jan 24, 2025 · The region''s energy mix Natural gas overtook oil as the biggest single-source of electricity generation in the Middle East in 1989 and, since then, it has only grown in

Lebanese large energy storage cabinet manufacturer

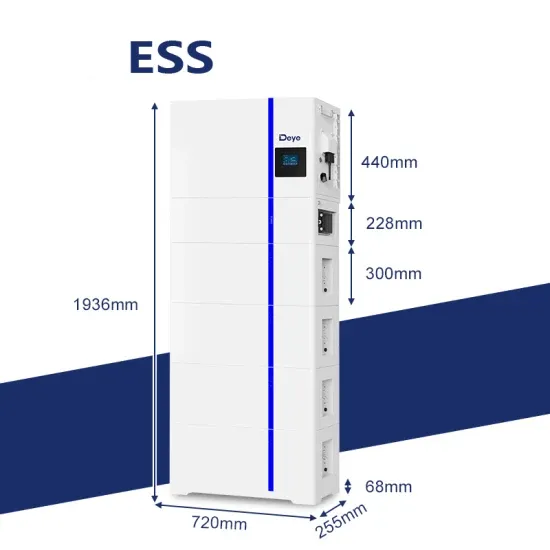

Wincle is a company committed to providing quality and safe energy storage products, such as Cabinet ESS, Energy Storage Cabinet,20kWh Residential Energy Storage System, etc

Middle East interest in energy storage ''ramping

Jul 27, 2017 · There is increasing high-level interest in the potential for energy storage in the Middle East, with grid-connected systems forecast to reach

Desay Battery announces Latest Energy Storage Solutions at

Apr 8, 2025 · Desay Battery, a trailblazer in energy storage solutions, unveiled its latest self-developed products and innovations at Middle East Energy Dubai 2025, the region''s premier

Middle East & North Africa Energy Storage Alliance

Sep 25, 2022 · MENA Energy Storage Alliance is a membership based consortium formed to support the region in its decarbonization initiatives. It encourages cooperation and participation

6 FAQs about [Large energy storage cabinet wholesaler in the Middle East]

Which energy storage solutions will be the leading energy storage solution in MENA?

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

Which energy storage technology has the most installed capacity in MENA?

Pumped hydro storage (PHS) has the largest share of installed capacity in MENA at 55%, as compared to a global share of 90%. Pumped hydro storage is one of the oldest energy storage technologies, which explains its dominance in the global ESS market.

What is energy storage Alliance in MENA?

Create an Energy Storage Alliance in MENA supported by governments and the private sector to foster the development of ESS in the region, by enhancing public-private partnerships. A key objective of this alliance is to foster the development of ESS in the region through experience sharing and standardization.

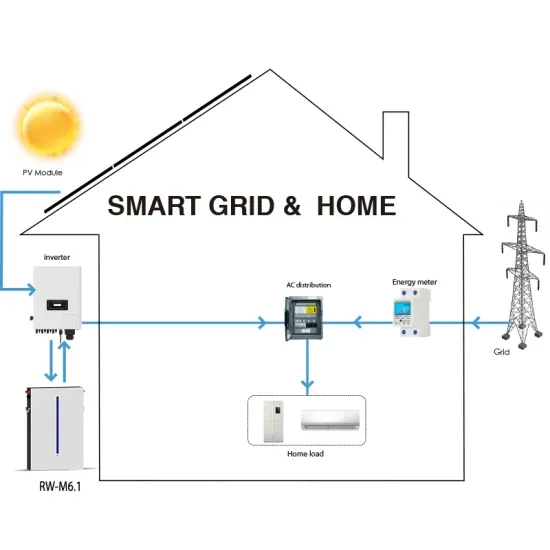

What is an energy storage system?

An energy storage system is charged from the grid or by on-site generation to be used at a later time to take advantage of price diferentials. Energy storage is used instead of upgrading the transmission network infrastructure. The storage system provides the grid with the necessary output to ensure the voltage level on the network remains steady.

Which country has the most battery storage capacity in MENA?

Currently, NaS battery technology dominates the battery storage capacity in operation in MENA, particularly in the UAE, with a total of 108 MW/648 MWh projects developed by the Abu Dhabi Water and Electricity Authority (ADWEA).

Can energy storage be integrated in MENA?

Although the energy storage market in MENA is bound to grow, several barriers exist that hinder the integration of ESS and the ramping up of investments. Financial, regulatory, and market barriers need to be addressed via policy tools that lay the foundations for an evolved power market to integrate the deployed ESS.

Learn More

- Middle East Large Energy Storage Cabinet

- Middle East cabinet energy storage cabin price

- Middle East factory high power energy storage power supply

- Middle East photovoltaic energy storage 15kw inverter price

- Huawei Sofia Large Energy Storage Cabinet Manufacturer

- Apia Large Energy Storage Cabinet Manufacturer

- Middle East Energy Storage System Supply

- What brands are there in large energy storage cabinet manufacturers

- Russian large energy storage cabinet fee standard

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.