Energy storage subsidies for national development

Government subsidies alleviate the financial constraintsof energy storage enterprises. Government subsidies promote R&D investment in energy storage enterprises. Differentiated

South Africa''s PV subsidy of 4 billion rands: A catalyst for energy

Jul 18, 2023 · As for centralized energy storage projects, as of the first half of 2023, the state-owned power company Eskom has issued tenders for six energy storage projects, collectively

How energy storage can enhance Africa''s smart grid

Jul 11, 2024 · In Africa, the integration of renewable energy and energy storage is critical not only for addressing the continent''s electricity deficits but also for aligning with global sustainability

Accelerating energy access in Africa: 7 key focus

Apr 4, 2025 · The paper highlights findings from a review of the literature on financing of renewable energy and clean cooking interventions. It focuses on

The role of energy subsidies, savings, and transitions in

Apr 1, 2025 · Achieving net-zero emissions through energy transformation necessitates a multifaceted strategy, including removing energy supply chain subsidies, accelerating energy

Energy Storage: The key to energy access in East Africa

Apr 6, 2020 · Pumped hydro dams are prominently used as energy storage in East Africa, but that is changing with the increase in renewable energy and battery energy storage systems. The

The energy storage industry will issue a national subsidy

Are energy storage subsidy policies uncertain? Subsidy policies for energy storage technologies are adjusted according to changes in market competition,technological progress,and other

Subsidies for new energy storage products

Do government subsidies affect the R&D of large-scale energy storage projects? Government subsidies may have a stronger effect on the R&D of large-scale ESEs. Currently, the energy

South Africa s Energy Fiscal Policies: An inventory of

Jan 28, 2022 · Executive Summary Energy fiscal policies (of which fossil fuel subsidies are a subset) in South Africa have historically been framed around distributive aims, particularly in

Are there any government subsidies for energy storage

Do government subsidies increase total factor productivity of energy storage enterprises? Based on panel data of Chinese 101 energy storage enterprises from 2007 to 2022,this paper

Middle East and Africa Outlook Report 2022

Aug 20, 2024 · Power generation across the Middle East and North Africa (Mena) has doubled in the past 15 years, from around 842TWh in 2005 to 1,635TWh by 2020, according to data

Top 5 Largest Energy Storage Projects in Africa

Jul 9, 2022 · With a planned annual net output of 320 GWh, the 100 MW KaXu Solar One CSP plant, located approximately 40 km north-east of the town of Pofadder in the Northern Cape

Sustainable Energy Fund for Africa

Aug 1, 2025 · The Sustainable Energy Fund for Africa (SEFA) is a multi-donor Special Fund managed by the African Development Bank. It provides catalytic finance to unlock private

How Government Subsidies Shape Energy Prices in Africa

Dec 4, 2024 · In East Africa, solar household systems including lithium-ion batteries are facilitating electricity access for rural areas. Although the technology is scalable, obstacles encompass

Battery storage: the tech that could revolutionise

Aug 22, 2024 · The more positive news is that battery storage costs are gradually coming down. The International Energy Agency noted in a recent report that

Are there any government subsidies for energy storage

Based on panel data of Chinese 101 energy storage enterprises from 2007 to 2022, this paper examines the effectiveness of government subsidies in the energy storage industry

Financing energy storage projects in Africa: Challenges and

May 24, 2024 · The partnership between public entities and private sector players can yield tailored solutions that clarify investment pathways while addressing pressing energy needs

Top 5 Largest Energy Storage Projects in Africa

Jul 9, 2022 · Read Next State Mobilises $135M in Subsidies to Help Address Inflation With the energy transition currently underway in Africa, the rapid increase in energy production to meet

East Africa: Regional Energy Outlook | SpringerLink

Apr 4, 2019 · Irrespective of energy resources endowment and RE potential, as of today all EA-7 countries (i.e. with the exception of South Africa) share a

6 FAQs about [East African energy storage projects have subsidies]

Is South Africa a catalyst for energy storage demand?

South Africa's PV subsidy of 4 billion rands: A catalyst for energy storage Demand? In pursuit of its 2050 net-zero carbon emissions vision, South Africa has been making significant strides in promoting renewable energy development.

What is the Africa Energy Fund?

The Fund’s overarching goal is to contribute to universal access to affordable, reliable, sustainable, and modern energy services for all in Africa, in line with the New Deal on Energy for Africa and Sustainable Development Goal 7.

How much money does Africa need for energy projects?

Public and development finance (DFI) funding for energy projects in Africa has fallen by approximately one-third in the last ten years, reaching USD 20 billion in 2024, largely due to a reduction of more than 85% in spending by Chinese DFIs.

What is Africa's energy situation like?

Africa is characterised by strong regional imbalances. South Africa and North Africa account for less than 20% of the population but more than 45% of energy investment and over 65% of installed electrical capacity.

Who funds EEP Africa?

EEP Africa is hosted and managed by the Nordic Development Fund (NDF), with funding from Austria, Denmark, Finland, Iceland, NDF, Norway and Switzerland. Powered by SmartME. All rights reserved. EEP Africa provides clean energy financing to early stage projects in Southern and East Africa.

Does South Africa have more electricity than North Africa?

South Africa and North Africa account for less than 20% of the population but more than 45% of energy investment and over 65% of installed electrical capacity. By contrast, Sub-Saharan Africa, home to most of the region’s population, receives less energy investment and has limited access to reliable electricity.

Learn More

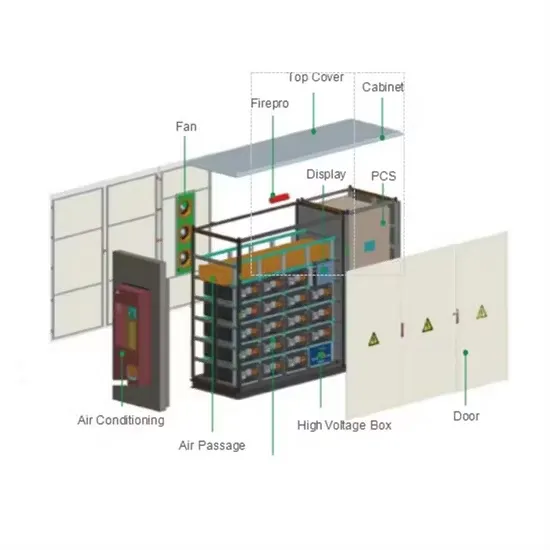

- East African Electric Energy Storage System Base

- New energy storage projects in the Middle East

- Necessity of energy storage projects

- Large-scale battery energy storage projects

- Brunei photovoltaic energy storage subsidies

- Construction of all-new energy and energy storage projects

- Energy storage projects under construction in Thimphu

- What are medium and large energy storage projects

- Prospects for energy storage development in South African industrial parks

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.