Battery Storage in the Middle East: Powering the Energy Shift

Jul 16, 2025 · According to The Future of Battery Market in the Middle East & Africa, Saudi Arabia plans to expand its battery storage capacity from 22 GWh to 48 GWh by 2030. The Saudi

Navigating Renewable Energy Challenges

Oct 7, 2024 · Introduction As countries transition from centralized to decentralized grid networks, the necessity for investments in new energy technologies becomes imperative. The trend of

Middle East Investments Surge as Global Energy Storage

May 1, 2025 · In the Middle East, the market is also expanding rapidly, with significant new projects underway. For instance, Sungrow secured a contract for a 7.8 GWh energy storage

Biggest renewable energy projects in the Middle

Dec 23, 2024 · Showcasing the Middle East''s steadfast commitment to cleaning up its power, here are the region''s most significant renewable energy projects

Battery Storage in the Middle East: Powering the Energy Shift

Jul 16, 2025 · As the Middle East intensifies its shift to renewable energy, battery storage is becoming a vital part of its infrastructure. Countries like Saudi Arabia and the United Arab

Anticipating a Surge: Global New Installations in

Dec 18, 2023 · As the primary drivers of global growth, China, the United States, and Europe are expected to commandeer 84% of new installations in 2024,

Renewables, Hydrogen and Energy Storage Insights 2030

Feb 4, 2025 · With its comprehensive Renewable Energy (RE) Database and the MENA Hydrogen Tracker, Dii Desert Energy monitors renewable projects greater than 5 MW and

The Future of Battery Market in the Middle East & Africa

Jun 24, 2025 · From megaprojects to microgrids, the battery revolution is gaining serious ground across the Middle East and Africa. No longer just a supporting technology, battery storage is

Middle East and North Africa

Jan 24, 2025 · Instead of bringing the oil era to a halt, Middle East producers would prefer to see greater emphasis on carbon capture and storage, to create a ''circular carbon economy''. At the

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Feb 4, 2022 · Meeting the national renewable energy targets requires scaling up and systematic integration of variable renewable energy (VRE) systems into the power grid, which in turn

Storage Projects in MENA Region | Synergy Consulting

The Middle East''s largest solar-plus storage project, Philadelphia Solar, reached financial close on a 12MWh lithium-ion battery based energy storage project in Jordan in 2018.

MENA Energy Recap, Q2 2025: Markets Soften

Jul 17, 2025 · The MENA Energy Recap is a quarterly review of key energy developments that took place in the region from April through June of 2025 and what they signal in the months

The Middle East''s Solar Shift: From Oil to Energy

Mar 17, 2025 · The Middle East, long defined by its oil wealth, is now emerging as a global leader in solar power. Once considered an afterthought in a region

Middle East: Energy Transition Unlocks Huge Market

Dec 6, 2024 · According to CES''s "Energy Transformation Outlook for the Middle East and North Africa", it is expected that by 2030, the MENA region will deploy 40-50GWh of energy storage

5 FAQs about [New energy storage projects in the Middle East]

What is Al Shuaibah solar project?

One of the most essential renewable energy projects it helps build is the Al Shuaibah solar project. It comprises the Al Shuaibah PV 1 and Al Shuaibah PV 2, which can produce 600 MW and 2,031 MW, respectively. Combined, they can supply energy to an impressive 450,000 households.

Where is Abu Dhabi's new power plant located?

Located in Al Dhafra, Abu Dhabi, it commenced construction in 2012. Units 1 to 3 are already operational. It’s pivotal in the UAE’s energy diversification, supplying 25 percent of its electricity.

What is Neom Green Hydrogen Project?

One of the sustainable projects in this development is the NEOM Green Hydrogen Project. A collaboration of NEOM, ACWA Power and Air Products, it combines onshore solar, wind and energy storage, targeting 600 tons of daily green hydrogen output by 2026.

Is Mohammed bin Rashid Al Maktoum the world's largest solar park?

This is equivalent to emissions produced by 4.8 million cars. Sitting on a total area of 77 square kilometers, the Mohammed bin Rashid Al Maktoum Solar Park touts itself as the world’s largest single-site solar park. Project completion could be in 2030, and by then, it could reach a 5,000 MW capacity.

What is Barakah nuclear power plant?

The Barakah Nuclear Power Plant is a landmark project, serving not only as the UAE’s inaugural nuclear power station but also as the Arab world’s first commercial facility of its kind. Located in Al Dhafra, Abu Dhabi, it commenced construction in 2012. Units 1 to 3 are already operational.

Learn More

- Middle East Electric New Energy Storage Battery

- Middle East factory high power energy storage power supply

- Middle East cabinet energy storage cabin price

- Energy Storage Prices in the Middle East

- Existing non-electrochemical energy storage stations in the Middle East

- Energy storage battery prices in the Middle East

- New energy storage projects include

- Middle East Power Grid Energy Storage Design

- Middle East Large Energy Storage Cabinet

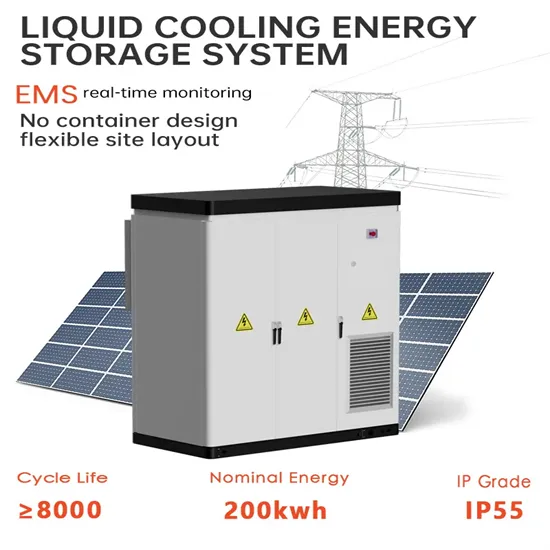

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

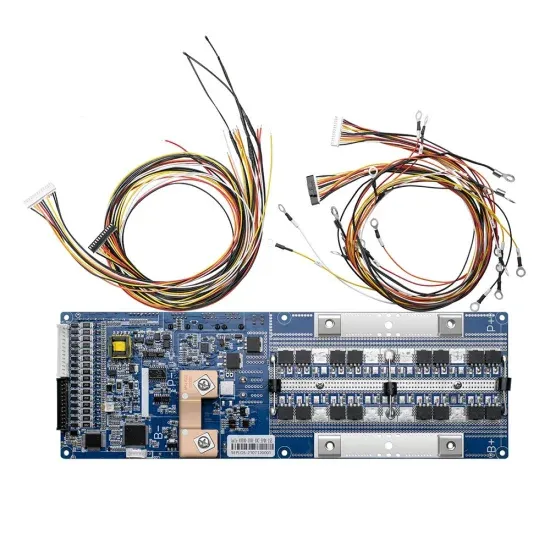

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.