Telecom Battery Backup System | Sunwoda Energy

A telecom battery backup system is a comprehensive portfolio of energy storage batteries used as backup power for base stations to ensure a reliable and stable power supply. As we are

Environmental feasibility of secondary use of electric vehicle

May 1, 2020 · Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles (EVs), yet

Use of Batteries in the Telecommunications Industry

Mar 18, 2025 · The Alliance for Telecommunications Industry Solutions is an organization that develops standards and solutions for the ICT (Information and Communications Technology)

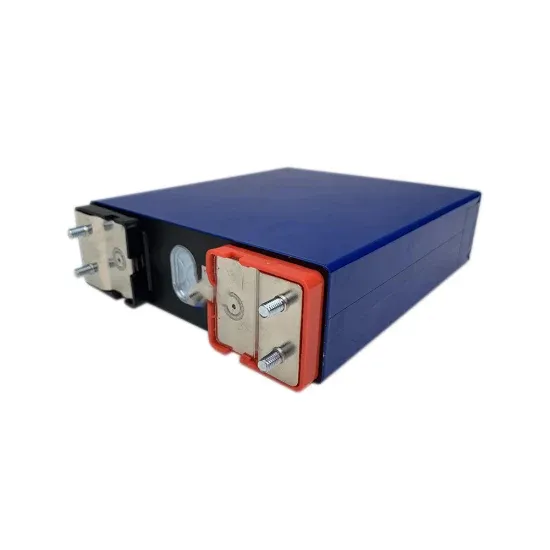

Lithium Iron Batteries for Telecommunications Base Stations

REVOV''s lithium iron phosphate (LiFePO4) batteries are ideal telecom base station batteries. These batteries offer reliable, cost-effective backup power for communication networks. They

Which Batteries Can Be Used as Backup Power Sources for Communication

Several types of batteries can be used as backup power sources for communication base stations. The choice of battery depends on factors such as the power requirements of the base

Carbon emission assessment of lithium iron phosphate batteries

Nov 1, 2024 · This study conducts a comparative assessment of the environmental impact of new and cascaded LFP batteries applied in communication base stations using a life cycle

Pure lead-acid batteries for telecommunication application

Mar 21, 2022 · An area-wide network of base stations is essential in order to integrate the terminals into the radio network.These stations are usually supplied with electrical energy from

Lithium Battery for Communication Base Stations Market

The surge in demand for lithium batteries in communication base stations is primarily attributed to their superior performance characteristics compared to traditional lead-acid batteries.

What is the purpose of batteries at telecom base

Feb 10, 2025 · I believe that in the future, lead-acid batteries will continue to escort the development of the information age, so that we can enjoy more

Application of LiFePO4 Batteries in Mobile and Base Communication Stations

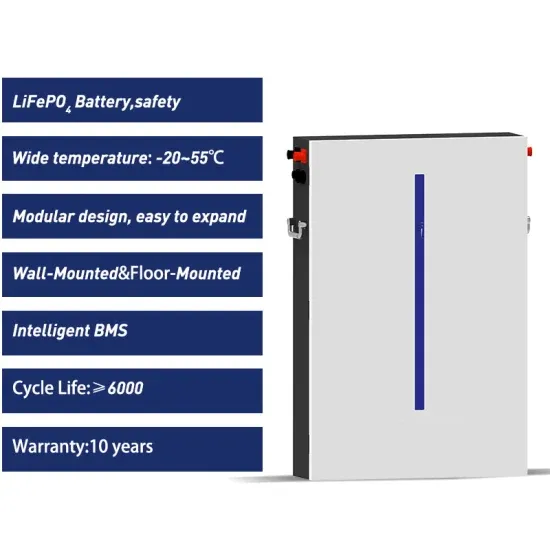

The use of LiFePO4 batteries in mobile and base stations provides a reliable, safe, long-lasting, and efficient energy platform. The ability to configure power through both series and parallel

Lead-Acid Batteries in Telecommunications: Powering...

Telecommunications infrastructure, including cell towers, base stations, and communication hubs, requires a constant and reliable power supply. Lead-acid batteries serve as a dependable

Ukraine has fallen into a power shortage due to Russia''s

Jan 17, 2023 · The mobile communication network laid in Ukraine is not intended for war, and most base stations are equipped with lead-acid batteries as an emergency power supply.

Environmental feasibility of secondary use of electric vehicle

Jan 22, 2020 · Yang et al. [93] conducted an LCA study to compare the environmental impacts of retired LIBs and lead-acid batteries used in communication base stations and found that

Battery technology for communication base stations

The "Battery for Communication Base Stations Market" research report for 2024 offers a thorough and in-depth examination of the industry segmentation based on Types [Lead-acid Battery,

What Powers Telecom Base Stations During Outages?

Feb 20, 2025 · Telecom batteries for base stations are backup power systems using valve-regulated lead-acid (VRLA) or lithium-ion batteries. They ensure uninterrupted connectivity

Solar Powered Cellular Base Stations: Current Scenario,

Dec 17, 2015 · A typical lead-acid battery with a DOD of 60% has an expected lifetime of 1000 charge-discharge cycles (called cycles to failure). In contrast, increasing the DOD to 90%

Battery for Communication Base Stations Market

For a long time, lead-acid batteries have been used in uninterruptible power supplies. But now manufacturers around the world are choosing lithium iron phosphate counterparts, and this is

Environmental feasibility of secondary use of electric vehicle

May 1, 2020 · Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles (EVs), yet

Lithium Battery for 5G Base Stations Market

Feb 9, 2025 · With over 3.3 million 5G base stations installed by late 2023—accounting for 60% of global installations—China''s demand stems from its need for energy-dense, lightweight

Environmental feasibility of secondary use of electric vehicle

Jan 22, 2020 · 摘要: Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles

Communication Base Station Lead-Acid Battery: Powering

In an era where lithium-ion dominates headlines, communication base station lead-acid batteries still power 68% of global telecom towers. But how long can this 150-year-old technology

Battery for Communication Base Stations Market | Size

One of the key trends shaping the communication base station battery market is the shift towards lithium-ion batteries from traditional lead-acid batteries. Lithium-ion batteries offer higher

Lead-acid Battery for Telecom Base Station Market

Asia-Pacific, particularly China and India, dominates lead-acid battery procurement for telecom base stations due to rapid infrastructure expansion and unreliable grid reliability.

Learn More

- Manufacturing lead-acid batteries for communication base stations

- Application for lead-acid batteries for communication base stations

- Lead-acid batteries and optical fibers for communication base stations

- What are the lead-acid batteries for Guinea-Bissau border communication base stations

- Lithium-ion batteries for three communication base stations in Baghdad

- Where China s photovoltaic communication base stations store energy

- Lead-acid battery tower base protection for communication base stations

- Batteries for communication base stations are divided into Class I and Class II

- Secondary overcurrent protection for flow batteries in communication base stations

Industrial & Commercial Energy Storage Market Growth

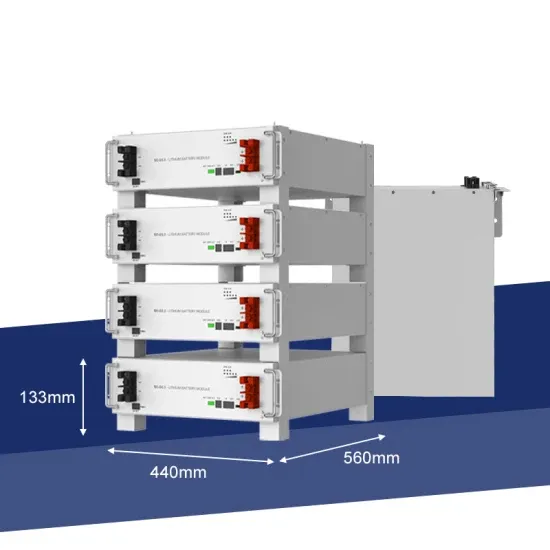

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

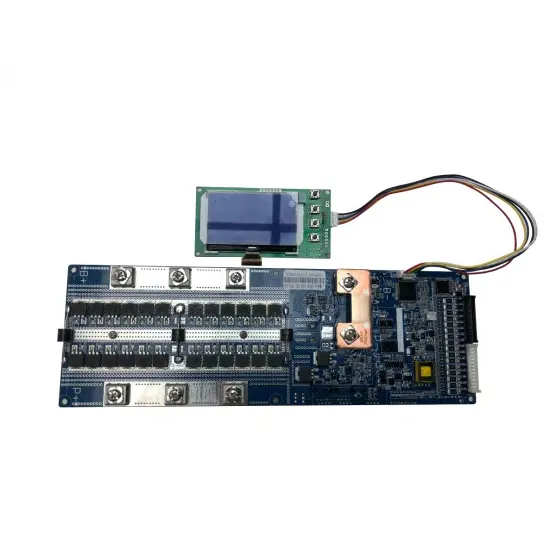

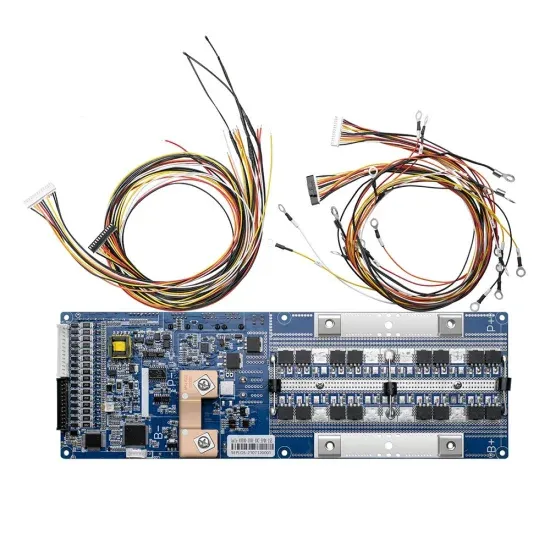

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.