Us Naval Units In Bahrain: Who''s Stationed There?

Nov 14, 2024 · The US Navy''s presence in Bahrain is strong with several units stationed there. Learn about the roles and responsibilities of these units and

U.S. Military Deployments to Bahrain, Escalating

Mar 31, 2025 · 1. Introduction Recent U.S. military movements, particularly the rapid airlift of advanced air defense systems to Isa Air Base in Bahrain, signal

mobile communication base stations

Apr 21, 2021 · The competitive landscape of mobile communication base stations in China is characterized by rapid technological advancements and aggressive market strategies. Major

EWA plans solar power stations in Al Dur

May 11, 2024 · The Electricity and Water Authority (EWA) has received two bids for the planned Solar Power Stations in the Al Dur area of the Southern Governorate in the Kingdom of Bahrain.

Evaluating solar and wind electricity production

Jul 7, 2023 · The present study analyzes the wind energy potential of Qatar, by generating a wind atlas and a Wind Power Density map for the entire country

Airborne Base Stations Bring Back Connectivity

Jan 3, 2025 · When a major typhoon swept through Hainan Province in September 2024, Haikou City and Wenchang City sufered heavy damage, transportation was blocked and power and

Masdar, Bapco Energies to develop 2GW of wind power in Bahrain

May 1, 2024 · At up to 2GW, this clean energy collaboration will support Bahrain to accelerate the decarbonisation of critical industrial sectors and open avenues to develop new markets.

Kingdom of Bahrain Portal for Sustainable Development Goals

5 days ago · The Kingdom of Bahrain has taken several steps towards achieving the Sustainable Development Goals (SDGs) and has aligned its national development agenda with the SDGs.

Largest solar power stations in Bahrain

Here is a list of the largest Bahrain PV stations and solar farms. Get to know the projects'' power generation capacities in MWp or MWAC, annual power output in GWh, state of location and

Masdar and Bapco Energies Forge Groundbreaking 2 GW Wind Power

May 1, 2024 · Masdar, a leading clean energy company based in the UAE, has sealed a significant agreement with Bapco Energies to delve into wind power projects in Bahrain. Under

Renewable Energy in Bahrain: Backgrou nd Paper

Sep 4, 2022 · Bahrain main source of water was the groundwater. The archipelago of Bahrain was famous with the onshore natural springs, submarine freshwater springs1 and the aquifers.

Masdar and Bapco Join Forces to Develop Up to 2 Gigawatts of Wind Power

May 2, 2024 · The collaboration focuses on the exploration and investment in wind energy initiatives in Bahrain, with a potential capacity of up to 2 gigawatts (GW). This strategic

Learn More

- Construction specifications for wind power stations at communication base stations

- The role of wind power in network communication base stations

- Regulations on lightning protection and grounding of wind power in communication base stations

- What are the tasks of wind power in communication base stations

- Wind power design standards for ground-to-air communication base stations

- Principle of wind power signal shielding in communication base stations

- Adjustment scope of wind power construction for communication base stations

- Maintenance plan for wind power and photovoltaic power generation at communication base stations

- Terminal communication base station wind power

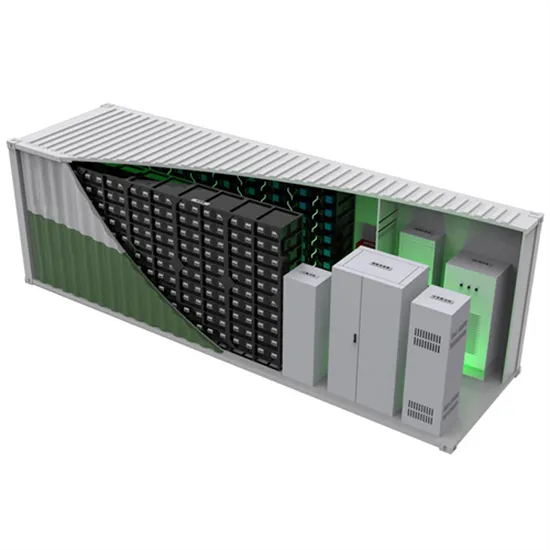

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.