RAFAEL BELLERA RELIABILITY ANALYSIS OF THE FINNISH

Dec 6, 2019 · Wind power is a relatively new mode of electricity generation in Finland and has devel-oped well in the last few years. As with other forms of renewable energy, wind power

Battery Energy Storage System (BESS) as a service in Finland:

Aug 1, 2021 · On the generation side, energy storage can be used to avoid curtailment of wind power in times of network congestion. The authors in [7] find that using battery energy storage

Ren-Gas selects Saipem for post combustion carbon capture at Tampere

Dec 20, 2024 · Ren-Gas is Finland''s leading green hydrogen and e-methane project developer, having secured significant public support for its portfolio from the Finnish Government and the

Technology of distributed power generation in Finland point

Abstract This paper surveyed energy resources technologies related to distributed power generation in Finland. Distributed energy generation was defined as a small-scale energy

Dynamic analysis and control of wind energy conversion

Dec 16, 2024 · As a result of these advantages, wind power generation has grown substantially over the past decade. As illustrated in Figure 1.1, it is evident that the production of electricity

Winda Energy to supply renewable electricity to Ren-Gas in Tampere

Dec 4, 2024 · Winda Energy and Ren-Gas have jointly developed and signed a long-term Hydrogen Power Purchase Agreement (H2PPA) for the Tampere e-methane project. The

EE.EES.480: Wind Power Systems | Tampere University

Impact of large-scale wind power on the power system: Dynamic performance Smoothing phenomenaImpacts on power system frequency control and reserves Wind turbine''s capability

Finnish wind energy shatters records, sets the stage for

4 days ago · Hitachi Energy enables Finland''s energy transition: More than half of the wind power generated in Finland flows through Hitachi Energy''s transformers and grid connection solutions.

Scenarios for future power system development in Finland

Abstract This paper demonstrates how various part-solutions can be combined in different scenarios for a more climate-neutral electric energy system. The case study is the Finnish

HYDROGEN-master | Tampere universities

Jan 4, 2024 · The current energy transition is increasing the pressure for change throughout the energy system. Climate targets and fossil fuel risks will drive the uptake of renewables in the

6 FAQs about [Tampere wind power generation system in Finland]

How much wind power can be built in Finland?

According to Fingrid System Vision, in all 4 scenarios the electricity consumption will rise from current 86 TWh to 128-188 TWh by 2035. How much wind power can and should be built in Finland? Finnish wind conditions do not set a limit to the amount of wind power that can be built in Finland.

How many wind turbines are there in Finland?

However, from 2012 to 2024, wind power construction has gained momentum and national construction and production statistics have been broken year after year. At the end of 2024, there were 1 835 installed wind turbine generators, with a combined capacity of 8 358 MW. They generated 24 % of Finland’s electricity consumption in 2024.

Does Finland have a large share of variable renewable power production?

Recently there has also been an increasingly prominent share of variable renewable power production, i.e., wind and solar. Wind power capacity in the Finnish power system has increased quite rapidly from <1 % to almost 10 % share of electricity demand coverage over approximately a single decade by 2020.

How has wind power changed in Finland?

Wind power capacity in the Finnish power system has increased quite rapidly from <1 % to almost 10 % share of electricity demand coverage over approximately a single decade by 2020. Wind power production has replaced mainly conventional condensing power production, and several fossil fuel-fired condensing power plants have been shut down.

When did wind power construction start in Finland?

In Finland, wind power construction began later than in many other European countries. However, from 2012 to 2024, wind power construction has gained momentum and national construction and production statistics have been broken year after year.

What type of electricity does Finland produce?

The electricity generation fleet in Finland has always been rather uniformly mixed, consisting of hydro power, nuclear power, conventional condensing power, combined heat, and power (both district heating and industrial CHP) – none of the production forms being too predominant.

Learn More

- Montevideo wind and solar power generation complementary system

- Ottawa wind and solar hybrid power generation system

- Reykjavik communication base station wind and solar hybrid power generation installation

- Wind solar diesel and energy storage integrated power generation

- Flywheel energy storage application in wind power generation

- Finland power generation container manufacturer

- RV vertical wind power generation system

- How to set up wind power generation at communication base station

- Solar wind power generation control system

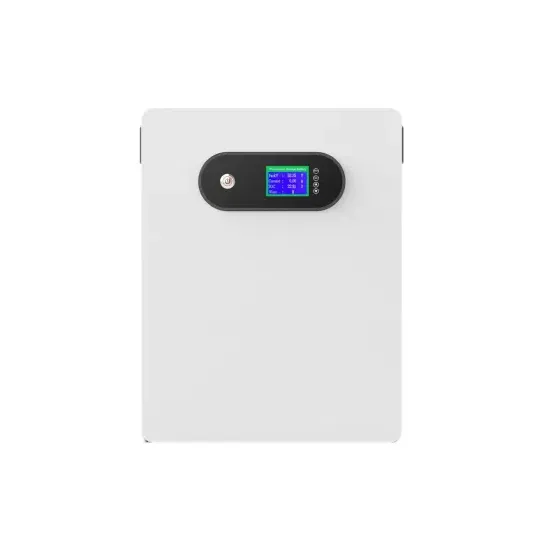

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.