Vanadium flow batteries at variable flow rates

Jan 1, 2022 · Vanadium flow batteries employ all-vanadium electrolytes that are stored in external tanks feeding stack cells through dedicated pumps. These batteries can possess near limitless

Battery and energy management system for vanadium redox flow battery

Feb 1, 2023 · As one of the most promising large-scale energy storage technologies, vanadium redox flow battery (VRFB) has been installed globally and integrated wi

Development status, challenges, and perspectives of key

Dec 1, 2024 · As an important branch of RFBs, all-vanadium RFBs (VRFBs) have become the most commercialized and technologically mature batteries among current RFBs due to their

A comparative study of iron-vanadium and all-vanadium flow battery

Feb 1, 2022 · The flow battery employing soluble redox couples for instance the all-vanadium ions and iron-vanadium ions, is regarded as a promising technology for large scale energy storage,

The Rise of Vanadium Redox Flow Batteries

May 29, 2024 · In recent years, vanadium redox flow batteries (VRFBs) have emerged as a promising solution for large-scale energy storage, particularly in the renewable energy sector.

Long term performance evaluation of a commercial vanadium flow battery

Jun 15, 2024 · The all-vanadium flow battery (VFB) employs V 2 + / V 3 + and V O 2 + / V O 2 + redox couples in dilute sulphuric acid for the negative and positive half-cells respectively. It

Sumitomo Electric Develops Advanced Vanadium Redox Flow Battery

Feb 26, 2025 · Sumitomo Electric is pleased to introduce its advanced vanadium redox flow battery (VRFB) at Energy Storage North America (ESNA), held at the San Diego Convention

Review—Preparation and modification of all-vanadium redox flow battery

Nov 21, 2024 · As a large-scale energy storage battery, the all-vanadium redox flow battery (VRFB) holds great significance for green energy storage. The electrolyte, a crucial

Rubri has successfully exported vanadium flow batteries to

Apr 19, 2024 · Recently, Rubri has successfully exported all-vanadium flow batteries to Bulgarian and hydrogen bicycles to Nigeria. The vanadium redox flow battery project involves

全钒液流电池提高电解液浓度的研究与应用现状

Nov 11, 2022 · The electrolyte of all Vanadium Redox Flow batteries (VRFB) is the solution of a single vanadium element with various valences, which avoids the cross-contamination caused

Vanadium Redox Flow Batteries

Jul 30, 2023 · Vanadium redox flow battery (VRFB) technology is a leading energy storage option. Although lithium-ion (Li-ion) still leads the industry in deployed capacity, VRFBs offer new

Vanadium Flow Batteries: Industry Growth & Potential

4 days ago · Explore the rise of vanadium flow batteries in energy storage, their advantages, and future potential as discussed by Vanitec CEO John Hilbert.

China Sees Surge in 100MWh Vanadium Flow Battery Energy

Aug 30, 2024 · Key projects include the 300MW/1.8GWh storage project in Lijiang, Yunnan; the 200MW/1000MWh vanadium flow battery storage station in Jimusar, Xinjiang by China Three

6 FAQs about [Nigeria s new all-vanadium flow battery]

Will flow battery suppliers compete with metal alloy production to secure vanadium supply?

Traditionally, much of the global vanadium supply has been used to strengthen metal alloys such as steel. Because this vanadium application is still the leading driver for its production, it’s possible that flow battery suppliers will also have to compete with metal alloy production to secure vanadium supply.

How much will flow batteries cost in the next 5 years?

The market for flow batteries—led by vanadium cells and zinc-bromine, another variety—could grow to nearly $1 billion annually over the next 5 years, according to the market research firm MarketsandMarkets. But the price of vanadium has risen in recent years, and experts worry that if vanadium demand skyrockets, prices will, too.

Who invented all-vanadium redox flow batteries?

Skyllas-Kazacos et al. developed the all-vanadium redox flow batteries (VRFBs) concept in the 1980s . Over the years, the team has conducted in-depth research and experiments on the reaction mechanism and electrode materials of VRFB, which contributed significantly to the development of VRFB going forward , , .

Are all-vanadium RFB batteries safe?

As an important branch of RFBs, all-vanadium RFBs (VRFBs) have become the most commercialized and technologically mature batteries among current RFBs due to their intrinsic safety, no pollution, high energy efficiency, excellent charge and discharge performance, long cycle life, and excellent capacity-power decoupling .

How can vanadium redox flow batteries increase their share in energy storage?

Overcoming the barriers related to high capital costs, new supply chains, and limited deployments will allow VRFBs to increase their share in the energy storage market. Guidehouse Insights has prepared this white paper, commissioned by Vanitec, to provide an overview of vanadium redox flow batteries (VRFBs) and their market drivers and barriers.

What are all-vanadium redox flow batteries?

All-vanadium redox flow batteries use V (II), V (III), V (IV), and V (V) species in acidic media. This formulation was pioneered in the late eighties by the research group of Dr Maria Skyllas-Kazacos as an alternative to the Fe/Cr chemistry originally proposed by NASA.

Learn More

- N Djamena New Energy All-vanadium Liquid Flow Energy Storage Battery

- Africa s new all-vanadium liquid flow battery

- 1gw all-vanadium liquid flow battery energy storage

- 1GWh all-vanadium liquid flow battery

- Average voltage of all-vanadium liquid flow battery

- Vientiane All-vanadium Liquid Flow Battery Environment

- Target enterprises of all-vanadium liquid flow battery

- Guatemala s large-capacity all-vanadium flow battery

- 30kw all-vanadium liquid flow energy storage battery

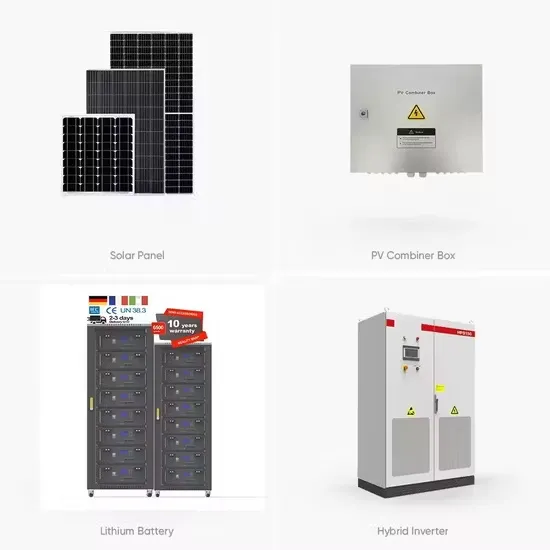

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.