Tiraspol Photovoltaic Power Inverter Price Key Factors and

Meta Description: Explore the factors influencing Tiraspol photovoltaic power inverter prices, including market trends, efficiency ratings, and regional demand. Learn how to choose cost

Cost of Living in Tiraspol. Jul 2025. Prices in Tiraspol

Jul 9, 2025 · Prices in Tiraspol This city had 9 different contributors in the past 18 months. Some data are estimated due to a low number of contributors. If you are living here, please update

Tiraspol Photovoltaic Power and Energy Storage Key

As global demand for renewable energy solutions surges, the combination of photovoltaic power generation and energy storage systems has become a game-changer. In regions like Tiraspol,

Tiraspol Outdoor Solar Security Camera Sustainable

Discover how solar-powered security cameras are transforming property protection in Tiraspol. This guide explores installation best practices, cost-saving benefits, and real-world

Tiraspol Photovoltaic Power Inverter Price Key Factors and

Here''s a snapshot of average prices for 5kW inverters (as of Q2 2024): "Hybrid inverters now account for 40% of Tiraspol''s sales due to rising battery storage adoption." – Solar Energy

Tiraspol Green Inverter Price Table 2023 Market Analysis

Wondering how much a Tiraspol green inverter costs? This comprehensive price analysis reveals current market trends, technical specifications, and cost-saving strategies for commercial and

Solar Panel Installation Philippines for 3kw, 5kw,

Jan 17, 2024 · Solar panel installation cost in the Philippines are influenced by various factors, such as the market situation, supply chain, manufacturer, and

The cost of purchasing solar photovoltaic panels in Poland

How much does a photovoltaic installation cost in Poland? The unit price of a photovoltaic installation in Poland decreases with increasing power. In 2020, the average cost of a 5kW

Tiraspol household roof photovoltaic panel manufacturer

Solar Panel Angles for Tiraspol, Stînga Nistrului, MD — Solarific Tiraspol, Stînga Nistrului is located at a latitude of 46.85°. Here is the most efficient tilt for photovoltaic panels in Tiraspol:

Where can I buy outdoor power supply in Tiraspol

High - Efficiency Photovoltaic Panels Our photovoltaic panels are at the forefront of solar technology. With advanced cell designs and high - quality materials, they offer exceptional

Solar Panel Cost in 2025: How to Estimate The

Jul 4, 2025 · Get multiple binding solar quotes from solar installers in your area. Is the price of solar panels falling? The price of solar panels has declined

Harness Solar Power in Tiraspol Benefits of Rooftop Photovoltaic Panels

As energy costs rise globally, Tiraspol residents and businesses are turning to rooftop photovoltaic panels to slash electricity bills while promoting sustainability. This article explores

The Largest Photovoltaic Panel Manufacturer in Tiraspol

Summary: Discover how Tiraspol''s leading photovoltaic panel manufacturer drives solar innovation for residential, commercial, and industrial markets. Learn about industry trends,

6 FAQs about [What is the retail price of photovoltaic panels in Tiraspol]

How much does a photovoltaic panel cost?

Mainstream Photovoltaic Panels: Average price of €0.10/Wp, down 9.1% month-on-month. Low-Cost Photovoltaic Modules: Average price of €0.060/Wp, a decrease of 7.7% compared to the previous month. These figures underscore the significant pressures in the photovoltaic market, as price reductions strain margins to unprecedented levels.

How much did solar panels cost in October 2024?

Here’s a detailed breakdown: High-Efficiency Solar Panels: The average price was €0.125/Wp, marking a 3.8% decrease compared to October 2024. Mainstream Solar Panels: Prices averaged €0.095/Wp, experiencing a 5% decline from October 2024. Low-Cost Solar Panels: Prices remained stable at €0.060/Wp, unchanged from the previous month.

Which solar panel and polysilicon pricing report adheres to Iosco reporting requirements?

The only solar panel and polysilicon pricing report that adheres to IOSCO reporting requirements. The OPIS Solar Weekly Report is the first and only solar panel and polysilicon pricing report to follow the International Organization of Securities Commissions’ (IOSCO) requirements for fair and transparent pricing.

How much does a photovoltaic module cost?

Mainstream Modules: Average price of €0.11/Wp, stable compared to September but 21.4% lower than January 2024. Low-Cost Modules: Average price of €0.065/Wp, a 7.1% decrease from September and 27.8% from January 2024. These trends are exerting mounting pressure on the photovoltaic sector.

What is Opis solar?

Try OPIS Solar for free. Each Tuesday you will receive an in-depth solar industry analysis report with the week’s polysilicon, wafer, cell and module price assessments, historical price data and expert insight to put it all in context. Each month receive a policy tracker that breaks down the solar policies introduced in the U.S. and Europe.

What is the Opis solar Weekly Report?

The OPIS Solar Weekly Report is the first and only solar panel and polysilicon pricing report to follow the International Organization of Securities Commissions’ (IOSCO) requirements for fair and transparent pricing. This means you can rely on the OPIS price assessments to be unbiased and truly reflective of market activity.

Learn More

- How much is the retail price of photovoltaic panels in Cyprus

- What is the appropriate price for photovoltaic panels in a BESS house

- What do photovoltaic panels use to generate electricity

- Price of secondary transportation of photovoltaic panels

- Price of photovoltaic panels in Dubai UAE

- BESS price of photovoltaic panels for villas in Cambodia

- Banjul new photovoltaic panels for sale price

- Price of installing photovoltaic panels on the ground

- Price of photovoltaic panels entering the grid

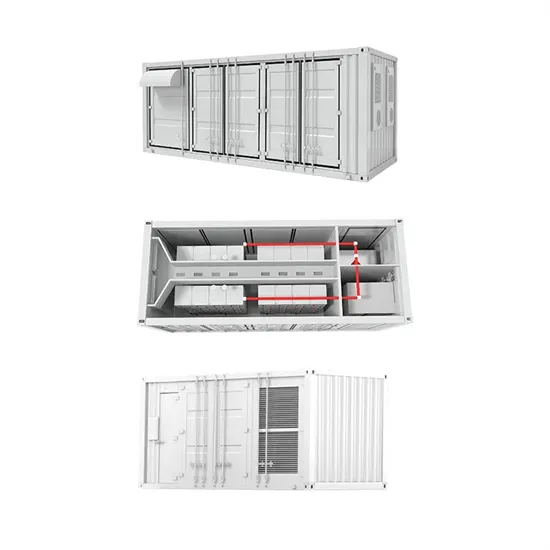

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.