Solar Panel Costs in Cambodia: 2025 Insights

Why Are Solar Panels Still Expensive in Cambodia? Let''s face it: Cambodia''s solar panel price remains 20-30% higher than in neighboring Vietnam or Thailand. But why? Well, three factors

Cambodia home solar system price

The design and installation of Solar Home Systems The price of electricity in Cambodia is the highest in the region and with [Show full abstract] the cost of solar panels decreasing, solar

Cambodia Solar Panel Manufacturing | Market

Jan 14, 2025 · Explore Cambodia solar panel manufacturing with market analysis, production statistics, and insights on capacity, costs, and industry growth trends.

Home solar system price in Cambodia

Our mission is to assist in the development of Cambodia by providing customers with reliable, high quality solar electric systems at a reasonable price with excellent customer and technical

Price of rooftop photovoltaic modules in Phnom Penh

The objective of this report is to analyze the most cost-effective public derisking measures to support private sector investment in on-grid and off-grid solar photovoltaic (PV) energy in

Cambodia solar system for home price in

How Much Does Solar Energy Cost in Cambodia? One of the promising traits of solar energy in Cambodia is its cost. The average electricity price for solar power is around USD 0.03 per kW,

United States Energy Association Request for Proposals

Feb 17, 2023 · United States Energy Association Clean EDGE (Enhancing Development and Growth through Energy) Asia Indo-Pacific Energy Market Investment and Modernization

ROOFTOP SOLAR POWER USERS IN CAMBODIA REQUIRED

Rooftop solar photovoltaic power generation room A rooftop solar power system, or rooftop PV system, is a photovoltaic (PV) system that has its electricity-generating solar panels mounted

Rooftop solar power generation and selling electricity

The "Rooftop Solar PV Power Generation Project" provides electricity consumers with long-term debt financing for installation of rooftop solar photovoltaic power generation systems in Sri

Cost–benefit analysis of photovoltaic-storage investment in

Aug 1, 2022 · With the promotion of renewable energy utilization and the trend of a low-carbon society, the real-life application of photovoltaic (PV) combined with battery energy storage

Cost of a solar generator Cambodia

How Much Does Solar Energy Cost in Cambodia? One of the promising traits of solar energy in Cambodia is its cost. The average electricity price for solar power is around USD 0.03 per kW,

Cambodia Solar PV Panels Market (2025-2031) | Trends

In the Cambodia Solar PV Panels Market, some of the key challenges include limited awareness and understanding of solar energy among consumers, lack of supportive government policies

6 FAQs about [BESS price of photovoltaic panels for villas in Cambodia]

How many solar PV projects are there in Cambodia?

Scores of seven solar photovoltaic (PV) projects are in the pipeline for construction and planned for operation by 2023. The Cambodian government aims to generate 20 percent of energy from renewable energy. This is our guide to Solar Energy in Cambodia.

Are solar panels imported or re-exported in Cambodia?

During the same period, the country’s solar panel imports rose rapidly and doubled to USD272 million but the volume was significantly lower than solar panel exports (Figure 1). This trade pattern suggests that a substantial portion of Cambodia’s solar panel exports may have been assembled domestically rather than imported and re-exported.

How can Cambodia benefit from the solar panel industry?

In recent years, Cambodia has been able to benefit from the emerging solar panel industry by establishing factories, training workers, and developing trade partners. By continuing to improve both hard and soft infrastructure and to strategically explore more trade opportunities, Cambodia’s solar panel exports have more room to grow.

Are Cambodia's solar panel exports facing a critical juncture in 2024?

After a short-lived boom in 2022-2023, Cambodia’s solar panel exports entered a critical juncture in 2024, facing significant challenges.

How much does a floating solar project cost in Cambodia?

The cost of a floating solar project in Cambodia is estimated to be approximately $0.045 per kilowatt-hour (kWh). This is significantly cheaper than the cost per kWh for electricity from a new dam or coal plant.

How many Cambodian households use solar energy?

Approximately one third of a million households, or 8.4% of overall Cambodian households, are currently using off-grid or micro-grid solar (Cambodia Socio-Economic Survey). In 2016, there wasn’t a single solar plant in the country.

Learn More

- BESS price of photovoltaic panels in Haiti shopping malls

- BESS price of photovoltaic panels for Indian factories

- BESS price of photovoltaic panels in Sao Tome and Principe

- How much is the price of multicrystalline photovoltaic panels in Angola

- Price of photovoltaic panels with high current rating

- BESS photovoltaic panel installation price

- Price of photovoltaic panels in Dubai UAE

- Price of secondary transportation of photovoltaic panels

- Prague new photovoltaic panels for sale price

Industrial & Commercial Energy Storage Market Growth

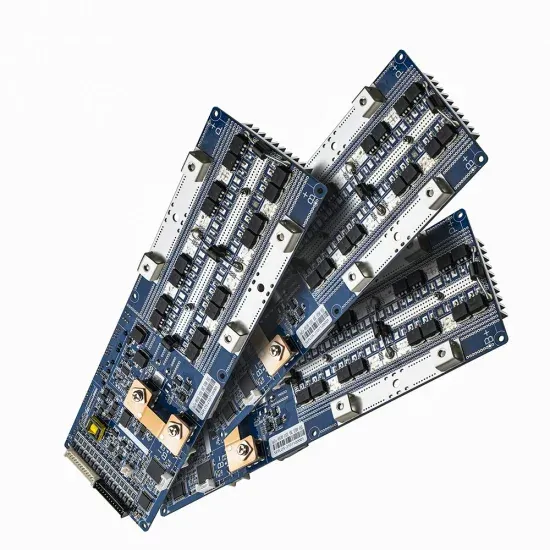

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.