Utility-scale battery energy storage system (BESS)

Mar 21, 2024 · Introduction Reference Architecture for utility-scale battery energy storage system (BESS) This documentation provides a Reference Architecture for power distribution and

What Is BESS? a Comprehensive Overview of Battery Energy

Jun 11, 2025 · BESS, short for Battery Energy Storage System, is an advanced energy storage technology solution widely adopted in the renewable energy sector. Within the industry, it is

Energy Solution for Telecom Base Station – Corey

The energy solution for Telecom Base Station combines renewable energy,energy storage systems and intelligent energy management technology to meet the base station''s demand for

A new player on the BESS market: Entrix launches in Poland

Entrix, a leading German provider of AI-driven battery storage optimization and trading solutions, announces its expansion into Poland. Building on its success in Germany, where it manages a

Lithium battery energy storage power station intelligent

Lithium battery energy storage station inte power throughout a battery energy storage system. By using intelligent, data-driven, and fast-acting software, BESS can be optimized for power

Battery Energy Storage System Integration and

The intelligent operation and maintenance platform of energy storage power station is the information monitoring platform of energy storage power station, which can monitor the

Poland Industrial Park Energy Storage Deployment Case: 80 kWh GSL BESS

May 28, 2025 · GSL ENERGY has recently successfully deployed and commissioned an 80kWh integrated BESS (Business Energy Storage System) with a 50kVA Deye inverter in an

Energy storage system of communication base station

Huijue Base Station Energy Cabinet is a robust, versatile, and intelligent solution that ensures reliable power supply and efficient energy management for critical infrastructure, enabling

Energy management strategy of Battery Energy Storage Station (BESS

Sep 1, 2023 · In recent years, the application of BESS in power system has been increasing. If lithium-ion batteries are used, the greater the number of batteries,

Grid Integration of Industrial Battery Energy Storage Systems (BESS

Learn how to effectively design and connect an industrial energy storage system (BESS) to the grid in Poland. Key technical requirements, engineering challenges, and opportunities for RES

KYOS Presentation ETW Sept 2023

Jan 30, 2025 · Poland BESS forward valuation (pre-reform) The results of the forward valuation are quite low, driven by the low daily spreads and volatility characterizing the Polish market

6 FAQs about [Polish Intelligent Communication BESS Power Station]

Is Poland moving towards battery energy storage systems (Bess)?

As expected, Poland’s latest capacity market auctions have highlighted a significant shift towards the battery energy storage systems (BESS) beside the fact that the de-rating factor has been significantly decreased.

Will PGE build a battery energy storage system in Poland?

State-owned power company PGE Group has obtained regulatory approval to build a 200MW/820MWh battery energy storage system (BESS) in Poland. The project, called CHEST (Commercial Hybrid Energy Storage), will target a capacity of no less than 200MW and a power output of 820MWh, making it one of the largest in Europe, PGE Group said.

What energy storage projects are happening in Poland?

Another notable energy storage project in Poland is gigafactory company Northvolt’s energy storage system (ESS) assembly and production facility, which recently bagged a share of €1.8 billion in EU funding. State-owned power company PGE Group has obtained regulatory approval to build a 200MW/820MWh battery energy storage system (BESS) in Poland.

How many Bess applications have been received in Poland?

The continued interest of BESS developers in the Polish markets was recently highlighted by a staggering number of applications in the 1 billion EUR subsidy scheme. A total of 630 applications were received for 20 GW and 122 GWh of BESS, exceeding the program’s budget sevenfold .

How many MW rated energy storage systems are there in Poland?

The capacity obligations for these projects ranged from 1.2 MW to 153 MW rated power, with an average capacity of around 30 MW. The decision to reduce the de-rating factor for energy storage systems in the last capacity market auction in Poland from 95 percent to 61 percent did not prove detrimental to the market.

Should Bess invest in the Polish capacity market?

Moreover, preferential or market loans could finance up to 100% of eligible costs. This optimism is at the same time being overshadowed by the capacity market developments. Until recently, the Polish capacity market provided a very attractive source of stable revenues for BESS, offering 17-year contracts.

Learn More

- Polish Communication BESS Power Station

- Where is the Somalia Communication BESS Power Station

- Danish generator communication BESS power station

- Doha Communication BESS Power Station

- How much does a portable power communication BESS cost

- Uninterrupted power supply and lightning protection for Bissau communication base station

- Manama communication base station lead-acid battery photovoltaic power generation system bidding

- Vietnam Commercial Outdoor Communication Power Supply BESS

- Tehran Communication Base Station Photovoltaic Power Generation System Solution

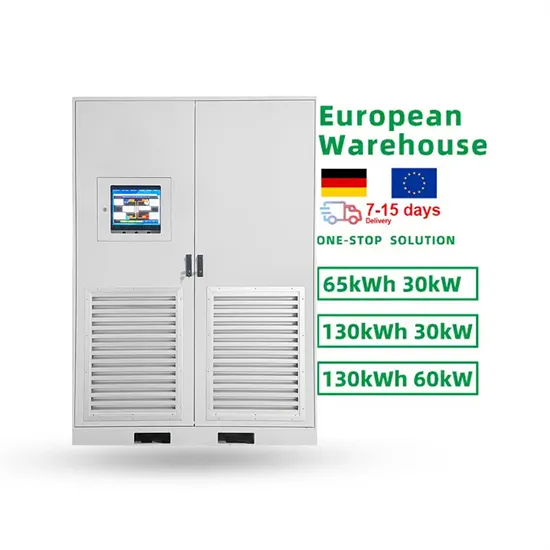

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.