What are the Essential Site Requirements for Battery Energy

Nov 19, 2024 · In recent years, Battery Energy Storage Systems (BESS) have become an essential part of the energy landscape. With a growing emphasis on renewable energy

Potential and challenges of Battery Energy Storage

Jan 5, 2024 · According to the "Draft development plan for meeting the current and future electricity demand for 2023-2032" developed by the Polish Transmission System Operator

On BESS Capacity Optimization of Hybrid Coal-Fired Generator and BESS

Apr 4, 2025 · To obtain a cost-effective BESS investment, this paper develops a new sizing method, which optimizes the BESS capacity by simulating the operation of the hybrid coal

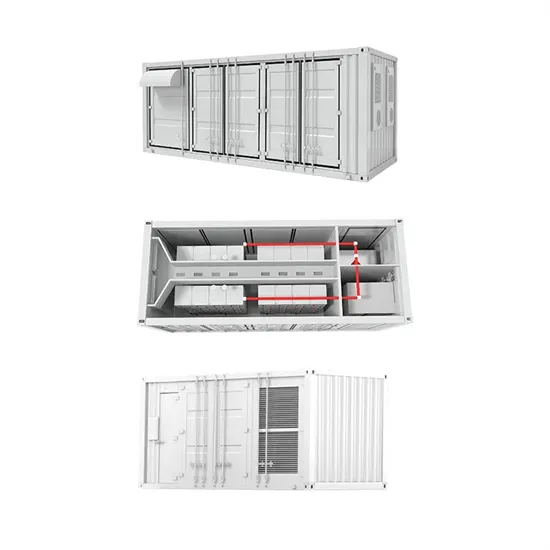

Energy storage system of communication base station

Base station energy cabinet: floor-standing, used in communication base stations, smart cities, smart transportation, power systems, edge sites and other scenarios to provide stable power

EDF Starts Poland''s First 50-MW Grid Battery, Larger Projects

Jun 4, 2025 · EDF Renewables breaks ground on a 50-MW BESS in Opole—Poland''s first high-capacity grid battery—and lines up 120-MW and 200-MW follow-ups for 2027-28.

Greenvolt & BYD to deliver 400MW BESS in Poland

Mar 3, 2025 · Greenvolt has partnered with BYD to deploy 400MW of battery energy storage system (BESS) capacity across two projects in Poland. The agreement covers the design and

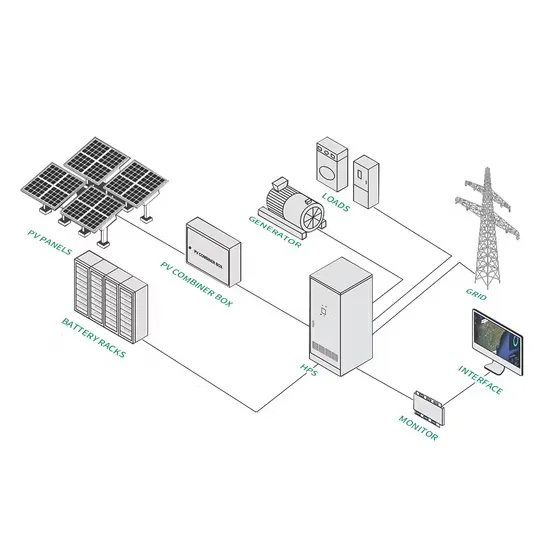

COMMUNICATION SYSTEM COMPOSITION OF ENERGY

In order to test the performance and ensure the operation effect of the energy storage power station, this paper introduces the overall structure of the energy storage power station,

Where Are Poland''s Power Storage Stations Located? Key

Jan 15, 2024 · Ever wondered why Poland is suddenly buzzing with massive battery installations? Let''s unpack the geography and ambition behind Europe''s newest energy storage hotspot –

Polish energy market changes: Key insights for BESS

Jul 28, 2025 · Recent announcements from the Ministry of Climate and Environment and the TSO hint at a possible three-pillar approach: continuation of the capacity market, decarbonisation

BYD to supply 1.6 GWh of battery storage for Greenvolt in

Mar 4, 2025 · Greenvolt Power, a subsidiary of Portugal''s Greenvolt Group, signed an agreement on March 3 with China''s BYD Energy Storage to develop two battery energy storage system

Polish utility plans to add 10 GWh of energy

Mar 25, 2025 · Polish utility PGE Group is planning to add more than 80 energy storage facilities through to 2035 to the tune of PLN 18 billion ($4.7 billion).

Energy Storage Market in Poland: Key Insights from Enex 2025

Feb 25, 2025 · Poland''s energy storage market is growing fast. Discover key insights from Enex 2025 on BESS adoption, investment trends, and grid challenges.

1.6GWh! BYD wins two energy storage projects in Poland!

Mar 13, 2025 · On March 3rd, BYD Energy Storage, a subsidiary of BYD, and Greenvolt Power, a subsidiary of Portugal''s Greenvolt Group, signed an agreement to jointly develop two Battery

Lyten Acquires Northvolt''s Poland BESS Facility

Jul 1, 2025 · Lyten, the supermaterial applications company and global leader in lithium-sulfur batteries, announced the acquisition of Northvolt''s Dwa ESS operations in Gdansk, Poland, a

Polish energy market changes: Key insights for BESS

Jul 28, 2025 · Meanwhile, the works are underway for selecting the location of the second nuclear power plant. In terms of BESS development, the past months have been dominated by two

POLAND: Greenvolt initiates sale of 700 MW battery storage

Portugal-based Greenvolt Power has put up for sale a 700 MW portfolio of Polish BESS assets, it is understood. The group has in recent weeks started construction on its two most mature

6 FAQs about [Polish Communication BESS Power Station]

Is Poland moving towards battery energy storage systems (Bess)?

As expected, Poland’s latest capacity market auctions have highlighted a significant shift towards the battery energy storage systems (BESS) beside the fact that the de-rating factor has been significantly decreased.

Why is Poland launching a grid-scale battery system?

The introduction of this storage support program marks a key milestone in Poland’s energy transformation. By enabling the deployment of grid-scale battery systems, the country is strengthening its ability to integrate larger volumes of clean energy, reduce dependence on fossil fuels, and enhance power system stability.

How can energy storage support Poland's electricity system?

By addressing challenges such as peak load balancing and frequency regulation, energy storage enhances the resilience and flexibility of Poland’s electricity system. The storage support program is expected to begin accepting applications in the second quarter of 2025. Full details and deadlines will be published by the NFOŚiGW.

Will Poland lead Eastern Europe's battery storage market?

Poland is set to lead Eastern Europe's battery storage market, with 9GW offered grid connections and 16GW in the capacity auctions.

How many MW rated energy storage systems are there in Poland?

The capacity obligations for these projects ranged from 1.2 MW to 153 MW rated power, with an average capacity of around 30 MW. The decision to reduce the de-rating factor for energy storage systems in the last capacity market auction in Poland from 95 percent to 61 percent did not prove detrimental to the market.

How many Bess applications have been received in Poland?

The continued interest of BESS developers in the Polish markets was recently highlighted by a staggering number of applications in the 1 billion EUR subsidy scheme. A total of 630 applications were received for 20 GW and 122 GWh of BESS, exceeding the program’s budget sevenfold .

Learn More

- Polish Communication BESS Power Station

- Chad Communication BESS Power Station Load Cabinet BESS

- Doha Communication BESS Power Station

- Energy Communication Base Station Wind Power Technology Company

- Morocco communication base station inverter grid-connected photovoltaic power generation quotation

- Tokyo communication base station battery energy storage system hybrid power supply

- 10kw mobile energy storage power communication BESS

- BESS a British energy storage power communication company

- How is the outdoor communication power supply BESS business doing

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.