Solar Panel Cost in 2025: How to Estimate The

Jul 4, 2025 · How to calculate solar price per watt Calculating the price per watt for a solar system is very straightforward — it''s simply the system cost divided

Solar module price falling, with no end in sight – pv

Sep 25, 2023 · Solar module prices have never fallen so sharply in such a short period of time. One reason for this is the "PV module glut" in warehouses in Europe, according to

Photovoltaic (PV) Module Technologies: 2020

Nov 2, 2021 · Photovoltaic (PV) module prices are a key metric for PV project development and growth of the PV industry. The general trend of global PV module pricing has been a rapid and

Recent technical approaches for improving energy efficiency

Mar 1, 2023 · Photovoltaic (PV) technology is recognized as a sustainable and environmentally benign solution to today''s energy problems. Recently, PV industry has adopted a constant

PV Price Watch: Prices of China''s PV products stabilise, rebound

Jul 25, 2025 · Prices of products across various segments of China''s PV industry chain—polysilicon, wafers, cells, modules—have begun to rise recently.

Different Types Of Solar Panels In India: Cost,

Jul 22, 2025 · Explore 10 different types of solar panels in India, ranging from first-generation monocrystalline panels to the advanced types of solar panels for

China''s Photovoltaic Module Market Price Differentiation

Mar 31, 2025 · According to the OPIS benchmark assessment, the FOB price of TOPCon modules rose by 1.14% for the fifth consecutive week, closing at US$0.089/W (approximately

China to implement on-grid tariffs, exposing its PV industry

Mar 18, 2025 · This policy promotes the full market-based determination of on-grid electricity prices for new energy sources, including ground-mounted and distributed PV projects, as well

Renewable Power Generation Costs in 2023

The levelised cost of electricity produced from most forms of renewable power continued to fall year-on-year in 2023, with solar PV leading the cost reductions, followed by offshore wind.

Global solar module prices mixed on varying

Jan 17, 2025 · In a new weekly update for <b>pv magazine</b>, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global

APPROVED LIST OF MODELS AND MANUFACTURERS

Jul 28, 2025 · Application Format to apply for inclusion of Solar Photovoltaic (PV) Module Model (s) in the List of "Approved Models and Manufacturers of Solar Photovoltaic Modules (ALMM)"

6 FAQs about [Latest price of photovoltaic module power]

How much does a photovoltaic module cost?

Mainstream Modules: Average price of €0.11/Wp, stable compared to September but 21.4% lower than January 2024. Low-Cost Modules: Average price of €0.065/Wp, a 7.1% decrease from September and 27.8% from January 2024. These trends are exerting mounting pressure on the photovoltaic sector.

How much does a PV module cost in China?

According to price analysis firm InfoLink: “Since March, the spot price of n-type modules in China has soared from RMB0.7/W to RMB0.73/W. Quotes from leading manufacturers are approaching the RMB0.75/W mark.” The results of the China Datang Group’s 2025-2026 PV module framework. Image: Datang.

How much does a photovoltaic panel cost?

Mainstream Photovoltaic Panels: Average price of €0.10/Wp, down 9.1% month-on-month. Low-Cost Photovoltaic Modules: Average price of €0.060/Wp, a decrease of 7.7% compared to the previous month. These figures underscore the significant pressures in the photovoltaic market, as price reductions strain margins to unprecedented levels.

How much will PV modules cost in 2025?

On 11 March 2025, the results of the China Datang Group’s 2025-2026 PV module framework purchase tender were announced, with the spot price of n-type modules increasing from RMB0.7/W (US$0.097/W) to RMB0.73/W (US$0.1/W), and some modules priced as high as RMB0.75/W (US$0.11/W).

How much are Chinese solar modules worth?

Prices for Chinese solar modules have reached record lows, according to the latest data from OPIS. The benchmark assessment for TOPCon modules from China has fallen to $0.100 per watt, a decline of $0.005 per watt compared to the previous week. Similarly, Mono PERC module prices have also dropped by $0.005 per watt, now standing at $0.090 per watt.

How much does a full black solar module cost?

Full black high-efficiency solar modules of up to 22.5% efficiency saw their price increase by 3.7% MoM and 7.7% since January 2025 to €0.14 ($0.15)/W. According to pvXchange, prices for mainstream PV modules with up to 22.5% efficiency improved to €0.115 ($0.12)/W, representing an increase of 4.5% over February and 9.5% over January 2025.

Learn More

- Doha photovoltaic module power generation price

- Price of photovoltaic power station power generation machinery

- Reasons for adjusting the electricity price of photovoltaic power stations

- Chile photovoltaic energy storage power supply price

- Latest price quotes from Botswana photovoltaic panel manufacturers

- 50mw photovoltaic module price

- 280 Photovoltaic module price

- Price of chemical energy storage in photovoltaic power plants

- Price differences among photovoltaic module grades

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

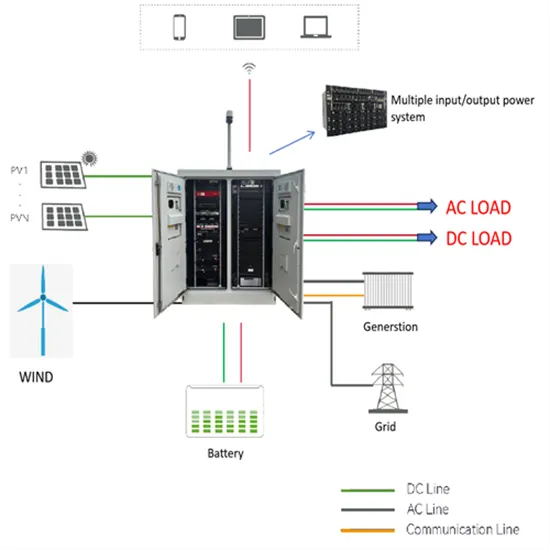

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.